Over the long term, the stock market tends to appreciate in value. This is because as the economy grows, companies' earnings increase, which helps drive stock prices up. If you look at the chart of a popular index like the S&P500, which tracks the 500 largest US companies, you'll see that its value is higher today than it was 10, 20 or 30 years ago, even when you take into account stock market crashes, like the ones we saw in 2000, 2008, and 2020.These crashes can be hard to stomach for long-term investors as the capital gains they have generated over the years take a hit. The good news is over the long term, the stock market tends to bounce back, which means investors can recoup these losses.

On the other hand, CFD traders value a market crash as much as a rally because both present trading opportunities for them. In this article, we’ll explain how to identify these opportunities as we go through the main factors affecting stock prices.

Main factors influencing stock prices

All the factors that may indicate an upcoming price change of a stock can be divided into three groups: macroeconomic, microeconomic and human.

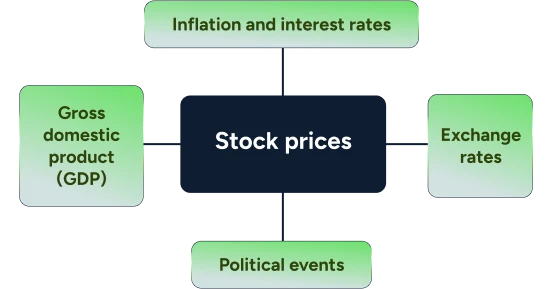

Macroeconomic factors

All the factors that may indicate an upcoming price change of a stock can be divided into three groups: macroeconomic, microeconomic and human.

As the COVID-19 pandemic proved, the global and local state of the economy can significantly influence stock prices. This influence can be both positive and negative, depending on the nature of the crisis. For example, tech companies like Amazon or Apple were thriving while the borders were shut and people were stuck at home, while their non-tech counterparts were tanking one after another.

With a crisis like that, it’s quite hard to predict where exactly it’s going to hit. Although big market crashes are an exception, not the common stock market’s nature, and hence have to be analysed individually.

The day-to-day stock market performance is much easier to analyse. Over the years, traders and analysts identified price movement patterns and established macroeconomic factors that can indicate an upcoming price change. Here are some of them:

Inflation and interest rates

These two factors are usually linked together as they are correlated. Increasing inflation usually leads to increasing interest rates and vice versa. In a nutshell, the lower these rates are compared to their previous data, the better it is for stocks as it becomes cheaper for consumers and businesses to access credit. Traders usually keep an eye on the economic calendar to follow these announcements and place their trades accordingly.

Gross domestic product (GDP)

A growing GDP rate usually signals a strong economy and is reflected in the higher price of stocks. However, if the growth is too steep, it can indicate the opposite as, in the long term, it can lead to higher inflation, which tends to have a negative impact on the value of stocks. It is important to note that stocks tend to move just after the release of economic data as they discount the future. This means that major stock indices will move lower when the economy is at its worst as investors and traders position themselves for better times ahead.

Exchange rates

Foreign exchange rates are usually the product of the previously mentioned factors – a country’s low inflation and GDP growth lead to the strengthening of its currency compared to foreign currencies. Thus, a strong currency as an isolated factor of analysis can also indicate a potential increase in the prices of stocks that originate in the same country.

Political events

The political climate in the form of either local events, such as presidential elections or geo-political tensions, like armed conflicts and wars, usually has a strong effect not only on stocks of participating countries but on global stock prices too. In the case of elections, it can be both positive and negative, depending on market sentiment. Wars, however, tend to bring distress and falling prices to the stock market.

All the macroeconomic factors are usually very intertwined and need to be studied as an aggregate – both on the local and global levels. It is also important to keep in mind the economic, political and trading relations of a country where the stock you analyse originates with other countries, as their economies may influence each other. Moreover, it’s always good to keep an eye on the American economy as it usually has a strong global influence, with the US dollar being a globally accepted reserve currency.

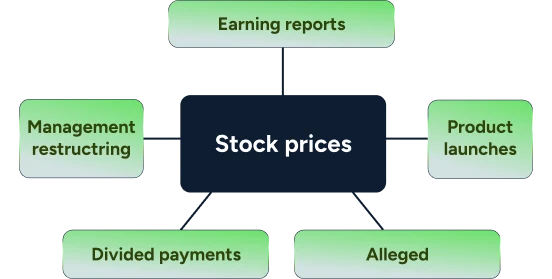

Microeconomic factors

In addition to global drivers, there are also factors on a smaller scale that may affect share prices, such as the company's performance.

Any positive news, such as higher-than-anticipated reported earnings, new advanced product launches or efficient management restructuring, tends to drive a company's stock up.

Negative events such as lower-than-expected profits, lawsuits, and any controversy or drops of confidence in company leaders can have the opposite effect and trigger price drops.

One factor that stands out is the dividend announcement, which usually causes a short-lived price spike caused by dividend hunters. A consequential price drop often follows as a result of a sellout of the shares that were bought with the sole purpose of receiving dividends.

Microeconomic factors are often reinforced and sometimes even triggered by market sentiment – the way traders perceive the event and the level of investor confidence, which brings us to the last group of factors affecting stock prices.

Human factors

These are the factors that influence the stock market due to public activity. For example, a new product launch can positively or negatively affect a company's stock price, depending on how traders and investors feel about it. If they believe a product has potential and will gain popularity, it will attract more buyers and traders to the company stock. On the other hand, if they believe it will be a failure, they might start pulling their investments out and sell the stock, causing its price to decline.

Increased demand for certain products or stocks, leading to their increasing prices, can also be caused solely by public activity. The infamous GameStop saga, for example, at one point brought a whopping 2,000% increase to the company's stock price, followed by an almost equal a large price drop and another surge in just a little over two months. The entire series of events was caused by public activity and sentiment.

Factors like market sentiment are nearly impossible to predict with a fundamental analysis of a company or economy. That’s where technical analysis steps in, but it is usually considered an advanced technique. If you are just starting out your stock trading journey, it is advisable to study the basics first and practice trading on a risk-free demo account. For example, ThinkMarkets’ proprietary platform ThinkTrader offers CFD trading on over 3,000 global stocks and USD 10,000 virtual funds to test and improve your trading skills.