Table of contents

- Stocks vs shares vs equities

- How does a stock work?

- How many shares can a company have?

- Types of stocks

- What is a dividend?

- What exchanges can a company list its stock on?

Most people are familiar with the term stock market – it’s a market where you can buy or sell stocks, but there is much more to it than just that.

Almost every country in the world has its own stock exchange or even multiple exchanges where people can buy and sell stocks, among other financial instruments.

These exchanges are a regulated environment. In certain countries, the same regulatory bodies that licence online brokers oversee transactions on their respective stock exchanges to ensure transparency and prevent fraud. For example, the United Kingdom’s largest stock exchange, the London Stock Exchange (LSE), is regulated by the Financial Conduct Authority (FCA). Every time a stock is traded (bought or sold), it is monitored by this regulator for discrepancies, ensuring compliance with its policies.

What are stocks, and how are they different from shares and equities? In this article, we’ll dive deep into all these details and explain everything a trader needs to know about stocks.

Stocks vs shares vs equities

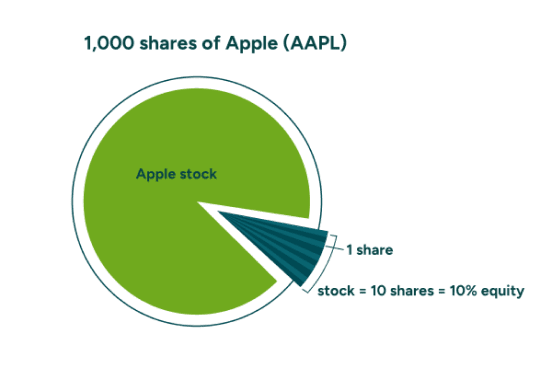

A stock is a representation of a company’s ownership. The term stock is often used interchangeably with the term share. However, there is a difference. Stock implies ownership in general, regardless of its size, while a share is a unit of measurement of this ownership. Equity is another term commonly used, and it refers to the total ownership stake in a company without any debt involved.

For example, you may often see your balance being called equity on trading platforms. In this case, it’s the total amount of funds you own after deducting any loss you may incur if you have open trades.

To sum up all three terms – if Apple Inc. were to have 1,000 shares only and you owned 100 of them, you would also own Apple’s stock or a part of its equity.

How does a stock work?

Most companies start as privately held. It can be either an individually owned business, where all assets and hence all the stock belong to one person, or a partnership with two or more owners, where stock is divided between them. In both cases, a company may seek to raise capital and attract investors to expand its coverage and services. To make an investment opportunity appealing, the business raising capital will offer partial company ownership in exchange for funding. In simple words, third-party investors receive some ownership of a company for providing their capital to it.

For example, let’s say your friend opens a startup, and you provide USD 10,000 to help it grow, and receive partial ownership in this startup on pre-defined terms and conditions in return. As you now are a shareholder, you will receive your share of the profits, and have the right to vote on decisions. If a startup does grow into an established company, more capital might be needed to allow the firm to grow. At this stage, a company can go public and sell shares on the stock market to raise more capital.

This is when a company gets listed on a stock exchange and goes through an Initial Public Offering (IPO) – the process of devising an investment plan, setting share prices, their total number and making them available to the public.

How many shares can a company have?

An individually owned business can have as little as one share representing 100% of a company’s value and belongs to the owner – that’s the minimum possible. Once a company goes public, there is no limit to the number of shares it can issue. Apple, for example, has billions of shares. However, the law of supply and demand works in this case, too, and the more shares there are available on the market, the lower they are usually priced. That’s why large corporations issue shares gradually, carefully evaluating demand to prevent a significant price drop. Apple added new shares to the market only five times in over 40 years, every time making sure that investors anticipated it.

Types of stocks

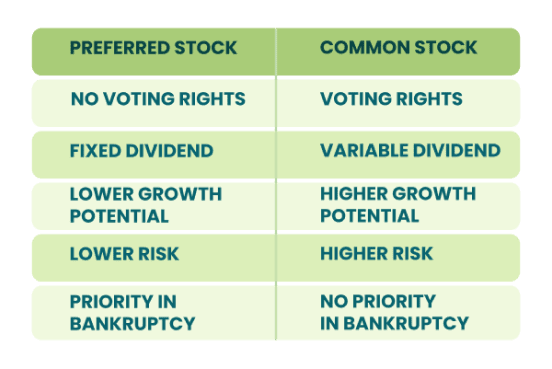

Besides private and public stocks we discussed above, the two main types of stocks are common and preferred.

Common stocks

Common stocks are the most popular type of issued stocks. In most cases, shares available to the public belong to this category. Common stocks tend to be more volatile than preferred stocks, offering higher potential reward but also higher risk to traders. The holders of common stock have voting rights and the right to receive dividend payments, although the latter is not guaranteed.

Preferred stocks

On the other hand, preferred shareholders tend to offer more predictable income, with higher and fixed dividend payouts. However, they usually always come with no voting rights and limited growth. In case a company goes bankrupt, the holders of preferred stock are also prioritised in being repaid compared to common stock owners.

What is a dividend?

A dividend means a distribution of a company’s earnings or profit to shareholders as a reward for their investment. It is usually paid quarterly in cash or in the form of additional shares. However, not all companies pay dividends and some reserve the right to reinvest their profit into the company’s growth instead of sharing it with investors. For example, high-growth companies usually choose to reinvest instead of paying dividends. Even some of the giants that are profitable, like Amazon, Meta and Google (Alphabet), follow the same policy to ensure continuous growth.

When a company announces a dividend distribution, investors are only deemed eligible if they have bought shares before a set date, called the ex-dividend date. The average dividend payouts vary but typically fluctuate between 2% and 5% of a share price depending on the company’s industry. For example, in the energy sector, dividends average 5%, while healthcare companies often pay a little over 2%.

What exchanges can a company list its stock on?

Most companies can be listed on any exchange in the world as long as they meet the minimum requirements set by the exchange. The main defining factor in choosing an exchange often depends on where the target audience (potential investors) are located. Hence, most companies get listed on an exchange in the same country where their headquarters are. That’s why Apple is listed in the US, Mercedes-Benz in Germany and Xiaomi in China.

Some companies list their stocks on more than one exchange in pursuit of a larger exposure. For example, the two major US stock exchanges – New York Stock Exchange (NYSE) and Nasdaq – have hundreds of non-American companies listed on them.

These exchanges are the largest in the world by market capitalisation, meaning they have a lot of companies listed on them, including the largest corporations. This, in turn, leads to high liquidity and market movement that presents many trading opportunities, attracting potential traders and investors.

Not sure what’s the difference between stock trading and investing? Head to our next article where we explain it in detail and show how to trade stocks with CFDs.