Articles (7)

What are stocks, and how does stock trading work?

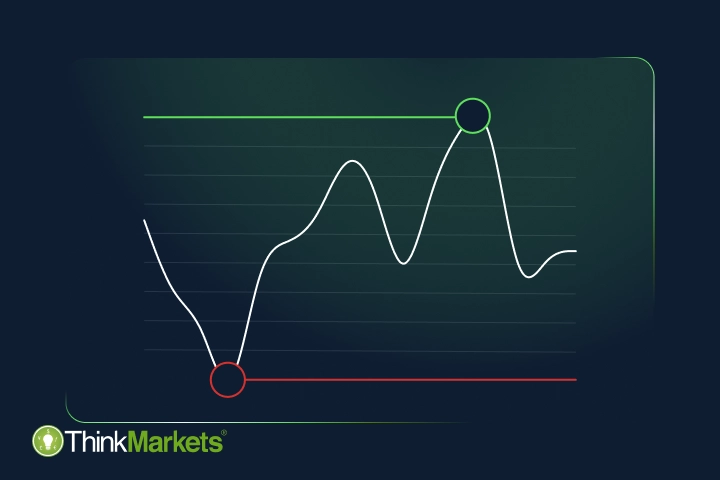

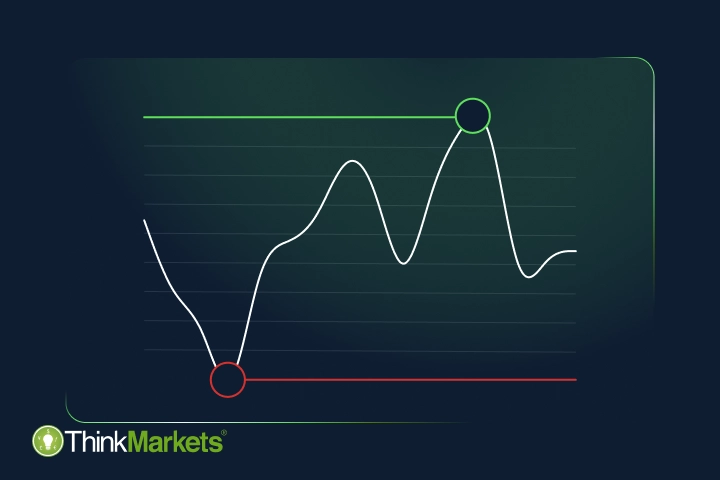

<p paraeid="{3905333e-d6ad-49f8-b2a7-46ee067cf7da}{244}" paraid="1767617311">Most people are familiar with the term stock market – it’s a market where you can buy or sell stocks, but there is much more to it than just that. <br /> </p> <p paraeid="{d02067f4-da4e-4032-b7cc-a7294b695deb}{17}" paraid="112530676">Almost every country in the world has its own stock exchange or even multiple exchanges where people can buy and sell stocks, among other financial instruments. <br /> </p> <p paraeid="{d02067f4-da4e-4032-b7cc-a7294b695deb}{33}" paraid="241417236">These exchanges are a regulated environment. In certain countries, the same regulatory bodies that licence online brokers oversee transactions on their respective stock exchanges to ensure transparency and prevent fraud. For example, the United Kingdom’s largest stock exchange, the London Stock Exchange (LSE), is regulated by the Financial Conduct Authority (FCA). Every time a stock is traded (bought or sold), it is monitored by this regulator for discrepancies, ensuring compliance with its policies. <br /> <br /> <br /> What are stocks, and how are they different from shares and equities? In this article, we’ll dive deep into all these details and explain everything a trader needs to know about stocks.</p> <h2>Stocks vs shares vs equities</h2> <p paraeid="{d02067f4-da4e-4032-b7cc-a7294b695deb}{109}" paraid="787304823">A stock is a representation of a company’s ownership. The term stock is often used interchangeably with the term share. However, there is a difference. Stock implies ownership in general, regardless of its size, while a share is a unit of measurement of this ownership. Equity is another term commonly used, and it refers to the total ownership stake in a company without any debt involved. <br /> </p> <p paraeid="{d02067f4-da4e-4032-b7cc-a7294b695deb}{143}" paraid="37962362">For example, you may often see your balance being called equity on trading platforms. In this case, it’s the total amount of funds you own after deducting any loss you may incur if you have open trades. <br /> </p> <p paraeid="{d02067f4-da4e-4032-b7cc-a7294b695deb}{159}" paraid="2087999960">To sum up all three terms – if Apple Inc. were to have 1,000 shares only and you owned 100 of them, you would also own Apple’s stock or a part of its equity. </p> <p><br /> <br /> <img alt="TFMKT-4086-Image1-1.png" src="/getmedia/ec1a6c59-0298-47bd-a30c-d9c992e3979e/TFMKT-4086-Image1-1.png" style="display: flex; margin: 20px auto;" title="TFMKT-4086-Image1-1.png" /></p> <h2>How does a stock work?</h2> <p paraeid="{d02067f4-da4e-4032-b7cc-a7294b695deb}{186}" paraid="772652413">Most companies start as privately held. It can be either an individually owned business, where all assets and hence all the stock belong to one person, or a partnership with two or more owners, where stock is divided between them. In both cases, a company may seek to raise capital and attract investors to expand its coverage and services. To make an investment opportunity appealing, the business raising capital will offer partial company ownership in exchange for funding. In simple words, third-party investors receive some ownership of a company for providing their capital to it. <br /> </p> <p paraeid="{1199522b-70e2-4b7d-9954-8024da34ca44}{5}" paraid="1105466596">For example, let’s say your friend opens a startup, and you provide USD 10,000 to help it grow, and receive partial ownership in this startup on pre-defined terms and conditions in return. As you now are a shareholder, you will receive your share of the profits, and have the right to vote on decisions. If a startup does grow into an established company, more capital might be needed to allow the firm to grow. At this stage, a company can go public and sell shares on the stock market to raise more capital. <br /> </p> <p paraeid="{1199522b-70e2-4b7d-9954-8024da34ca44}{81}" paraid="2146976948">This is when a company gets listed on a stock exchange and goes through an Initial Public Offering (IPO) – the process of devising an investment plan, setting share prices, their total number and making them available to the public. </p> <h2>How many shares can a company have?</h2> <p>An individually owned business can have as little as one share representing 100% of a company’s value and belongs to the owner – that’s the minimum possible. Once a company goes public, there is no limit to the number of shares it can issue. Apple, for example, has billions of shares. However, the law of supply and demand works in this case, too, and the more shares there are available on the market, the lower they are usually priced. That’s why large corporations issue shares gradually, carefully evaluating demand to prevent a significant price drop. Apple added new shares to the market only five times in over 40 years, every time making sure that investors anticipated it.</p> <h2>Types of stocks</h2> <p>Besides private and public stocks we discussed above, the two main types of stocks are common and preferred.</p> <h3>Common stocks</h3> <p>Common stocks are the most popular type of issued stocks. In most cases, shares available to the public belong to this category. Common stocks tend to be more volatile than preferred stocks, offering higher potential reward but also higher risk to traders. The holders of common stock have voting rights and the right to receive dividend payments, although the latter is not guaranteed.</p> <h3>Preferred stocks</h3> <p>On the other hand, preferred shareholders tend to offer more predictable income, with higher and fixed dividend payouts. However, they usually always come with no voting rights and limited growth. In case a company goes bankrupt, the holders of preferred stock are also prioritised in being repaid compared to common stock owners. <br /> <br /> <img alt="TFMKT-4086-Image2-1.png" src="/getmedia/44b32dcd-b4d6-4ceb-936b-de9c739a910b/TFMKT-4086-Image2-1.png" style="display: flex; margin: 20px auto;" title="TFMKT-4086-Image2-1.png" /></p> <h2>What is a dividend?</h2> <p paraeid="{1199522b-70e2-4b7d-9954-8024da34ca44}{232}" paraid="1690159432">A dividend means a distribution of a company’s earnings or profit to shareholders as a reward for their investment. It is usually paid quarterly in cash or in the form of additional shares. However, not all companies pay dividends and some reserve the right to reinvest their profit into the company’s growth instead of sharing it with investors. For example, high-growth companies usually choose to reinvest instead of paying dividends. Even some of the giants that are profitable, like Amazon, Meta and Google (Alphabet), follow the same policy to ensure continuous growth. <br /> </p> <p paraeid="{acb2c30d-64dd-4b07-82ea-8b974d18a721}{47}" paraid="1759198674">When a company announces a dividend distribution, investors are only deemed eligible if they have bought shares before a set date, called the ex-dividend date. The average dividend payouts vary but typically fluctuate between 2% and 5% of a share price depending on the company’s industry. For example, in the energy sector, dividends average 5%, while healthcare companies often pay a little over 2%. <br /> <br /> <img alt="Group-63232.png" src="/getmedia/6c3e696d-2936-48b7-a3e7-cd0a5821df92/Group-63232.png" style="display: flex; margin: 20px auto;" title="Group-63232.png" /></p> <h2>What exchanges can a company list its stock on?</h2> <p>Most companies can be listed on any exchange in the world as long as they meet the minimum requirements set by the exchange. The main defining factor in choosing an exchange often depends on where the target audience (potential investors) are located. Hence, most companies get listed on an exchange in the same country where their headquarters are. That’s why Apple is listed in the US, Mercedes-Benz in Germany and Xiaomi in China.<br /> <br /> Some companies list their stocks on more than one exchange in pursuit of a larger exposure. For example, the two major US stock exchanges – New York Stock Exchange (NYSE) and Nasdaq – have hundreds of non-American companies listed on them.<br /> <br /> These exchanges are the largest in the world by market capitalisation, meaning they have a lot of companies listed on them, including the largest corporations. This, in turn, leads to high liquidity and market movement that presents many trading opportunities, attracting potential traders and investors.<br /> <br /> Not sure what’s the difference between stock trading and investing? Head to our next article where we explain it in detail and show <a href="/za/trading-academy/stocks/how-to-trade-stocks">how to trade stocks with CFDs</a>.</p>

How to trade stocks

<p>Stock trading has always been a popular activity to generate passive income, and the COVID-19 pandemic only brought more demand to it. According to various research, stuck at home or laid off from their jobs, people started actively looking for other ways of entertainment and income.<br /> <br /> The user count of stock trading apps has almost tripled since 2019, and websites with educational content on financial markets have seen a four-times surge in the number of visits. However, not many websites offer a beginner-friendly explanation of the concept.<br /> <br /> In our article, we aim to help inexperienced traders understand how to trade stocks as we explore the basics of it and focus on one of the most popular ways of doing it – stock trading with CFDs.</p> <h2>What is the difference between stock trading and investing in stocks?</h2> <p>First of all, let's establish the difference between stock trading and investing in stocks, as both versions are widely spread.<br /> <br /> Many traders use these terms interchangeably or call any stock-related activity trading. It makes sense because whether it's day trading with a quick turnaround or a long-term investment portfolio, the end goal is the same – to make a profit once the price grows.<br /> <br /> However, there are significant differences. For example, you can trade stocks without buying them. Moreover, it is also possible to benefit when a stock price goes down, not only when it's gaining value. That's what sets trading and investing apart.<br /> <br /> At ThinkMarkets, we use the term investing when a trader physically buys an instrument. Investing in stocks means buying a company’s shares and acquiring its ownership along with the right to receive shared profit if their stocks pay <a href="/za/trading-academy/indices/stock-market-indices">dividends</a>. It usually implies having a long-term plan – most investors hold their shares for an extended period of time, from several days to years or even decades, selling them for profit when their price grows significantly. Some buy and sell their shares regularly to get smaller but regular profits.<br /> <br /> On the other hand, other traders speculate solely on short-term price movements of stocks without buying them. We call this activity trading, and one good example of it is CFD trading.</p> <h2>Why trade stocks with CFDs?</h2> <p>CFD trading is very popular among traders because it offers multiple benefits, such as:<br /> </p> <ul> <li>Opportunity to capitalise on both rising and falling prices by going long or short;</li> </ul> <ul> <li>Accessing the underlying stock at a lower cost than buying it outright via leaverage;</li> </ul> <ul> <li>There are no ownership requirements, providing cost-effective and flexible access. </li> </ul> <p><br /> In addition, CFD trading is available on all global markets, making it an attractive way to trade multiple instruments at once.</p> <h2>How to trade stocks with CFDs</h2> <p>If you are not familiar with the concept of CFD trading, we discuss it in detail in our <a href="/za/trading-academy/cfds/what-are-cfds">CFD trading: a beginner’s guide.</a><br /> <br /> To give a brief example, let’s say you decided to trade Apple shares. The current market price is USD 152.00.</p> <h3>Going long</h3> <p>If your research suggests that the price is going to increase, you open a long CFD position (buy). Keep in mind that when you trade stocks with CFDs, one contract usually equals one share.<br /> <br /> The price does go up to USD 162.00. The difference – USD 10, is your profit. If your prediction turns out incorrect and the price drops to USD 142.00, you lose USD 10.<br /> <br /> <img alt="" src="/getmedia/b1f80809-53c2-4530-a173-0bc72696d9fa/article-how-to-trade-stocks-long.webp" style="width: 552px; height: 441px;" /><br /> <br /> In the news reports, you may often hear such an event described as the price moved by ten points, not dollars. It’s because price movements on the stock market are measured by points, where each point equals USD 1:<br /> <br /> <img alt="" src="/getmedia/d7650b39-5092-497a-acf8-48b96a9e7cf7/article-how-to-trade-stocks-long-formula.webp" style="width: 550px; height: 25px;" /></p> <h3>Going short</h3> <p>In the opposite scenario, you can place a short CFD trade (sell) if you think the price is going to go down. If it does – you get profit, and if it moves in the opposite direction, you incur a loss.<br /> <br /> <img alt="" src="/getmedia/76d9c0a5-929f-41d7-af3a-d1d05dc1b2a6/article-how-to-trade-stocks-short.webp" style="width: 552px; height: 444px;" /><br /> <br /> As you can see, no matter whether the stock price appreciates or depreciates, you have an opportunity to capitalise on its price movements because you can trade in either direction with CFDs.<br /> <br /> In this example, the AAPL abbreviation is Apple’s stock ticker you’ll see across all trading platforms. It’s a unique code used by companies for easier identification, the same as USD stands for the United States Dollar in forex.</p> <h3>Spreads</h3> <p>It is also important to note that depending on whether you open a long or short position, the initial price will slightly differentiate. It happens because every financial instrument has two prices in trading: buy (bid) and sell (ask).<br /> <br /> A sell price indicates how much money you would receive if you were to sell a stock, should you own it. On the other hand, the buy price means how much you'd need to pay to buy a stock. In CFD trading, both numbers mean the price of a contract you can open. The difference between these two prices is called the spread, and it is the fee a broker charges for facilitating the transaction.<br /> <br /> The image below shows a spread of the Apple stock – 9.0 or 90 cents.<br /> <br /> <img alt="" src="/getmedia/0d85eb30-6f54-4138-9d19-79d65f072b7d/article-how-to-trade-stocks-spreads.webp" style="width: 552px; height: 151px;" /><br /> <br /> Keep in mind that the placement of a decimal point is different in index trading and trading stocks. The same 9-cent spread in stock trading would be marked as 0.9.</p> <h3>Leverage in stock CFD trading</h3> <p>CFD traders usually trade stocks with leverage. Leverage means funds borrowed from a broker to open a larger position. To place a trade with leverage, you only need to cover a small deposit called a margin. The bigger the leverage, the smaller the margin.<br /> <br /> For example, if you trade with 30:1 leverage in our previous example, you will only need to pay one 30th of USD 152.00, or USD 4.56, to trade a share of Apple worth over a hundred dollars.<br /> <br /> <img alt="" src="/getmedia/9f8ea23b-31bb-4185-bb37-33774d89a927/article-how-to-trade-stocks-leverage.webp" style="width: 552px; height: 308px;" /><br /> <br /> Your profit doesn’t get smaller. It’s still the same USD 10, which is more than your initial deposit. It’s important to understand that if your trade is unsuccessful, the loss will also remain the same and exceed your initial deposit. That’s why using <a href="/za/trading-academy/cfds/risk-management-tools-in-cfd-trading">risk management tools</a> like stop loss and take profit is crucial in CFD trading.<br /> <br /> However, before you start trading stocks with real money, it's advisable to practice your skills and learn how to use risk management tools on a risk-free demo account pre-loaded with virtual funds. ThinkMarkets' proprietary trading platform, <a href="/za/thinktrader">ThinkTrader</a>, offers over 3,000 global stocks and favourable trading conditions for beginners and experienced traders.<br /> <br /> If you are looking for tips on identifying trading opportunities on stocks, check out our <a href="/za/trading-academy/stocks/what-affects-stock-prices">What affects stock prices?</a> article, where we explain factors affecting their prices.</p>

What affects stock prices?

<p paraeid="{45bdec93-b9d8-4864-bd9d-c0a3f0631972}{159}" paraid="679473590">Over the long term, the stock market tends to appreciate in value. This is because as the economy grows, companies' earnings increase, which helps drive stock prices up. If you look at the chart of a popular index like the S&P500, which tracks the 500 largest US companies, you'll see that its value is higher today than it was 10, 20 or 30 years ago, even when you take into account stock market crashes, like the ones we saw in 2000, 2008, and 2020.These crashes can be hard to stomach for long-term investors as the capital gains they have generated over the years take a hit. The good news is over the long term, the stock market tends to bounce back, which means investors can recoup these losses. </p> <p paraeid="{af858a94-1cd1-433e-a49b-06c9a8d210b5}{36}" paraid="1056185374">On the other hand, <a href="/en/trading-academy/cfds/what-are-cfds">CFD traders</a><a href="/en/trading-academy/cfds/what-are-cfds"> </a>value a market crash as much as a rally because both present trading opportunities for them. In this article, we’ll explain how to identify these opportunities as we go through the main factors affecting stock prices. </p> <h2>Main factors influencing stock prices</h2> <p>All the factors that may indicate an upcoming price change of a stock can be divided into three groups: macroeconomic, microeconomic and human.</p> <h3>Macroeconomic factors</h3> <p>All the factors that may indicate an upcoming price change of a stock can be divided into three groups: macroeconomic, microeconomic and human.</p> <img alt="" src="/getmedia/5a527f95-9404-4bc3-96a5-ab43534f97ff/article-what-affects-stock-prices-macro.webp" style="width: 552px; height: 289px;" /> <p><br /> As the COVID-19 pandemic proved, the global and local state of the economy can significantly influence stock prices. This influence can be both positive and negative, depending on the nature of the crisis. For example, tech companies like Amazon or Apple were thriving while the borders were shut and people were stuck at home, while their non-tech counterparts were tanking one after another.<br /> <br /> With a crisis like that, it’s quite hard to predict where exactly it’s going to hit. Although big market crashes are an exception, not the common stock market’s nature, and hence have to be analysed individually.<br /> <br /> The day-to-day stock market performance is much easier to analyse. Over the years, traders and analysts identified price movement patterns and established macroeconomic factors that can indicate an upcoming price change. Here are some of them:</p> <p><strong>Inflation and interest rates</strong></p> <p>These two factors are usually linked together as they are correlated. Increasing inflation usually leads to increasing interest rates and vice versa. In a nutshell, the lower these rates are compared to their previous data, the better it is for stocks as it becomes cheaper for consumers and businesses to access credit. Traders usually keep an eye on the <a href="/en/economic-calendar">economic calendar</a> to follow these announcements and place their trades accordingly. <br /> </p> <p><strong>Gross domestic product (GDP)</strong></p> <p>A growing GDP rate usually signals a strong economy and is reflected in the higher price of stocks. However, if the growth is too steep, it can indicate the opposite as, in the long term, it can lead to higher inflation, which tends to have a negative impact on the value of stocks. It is important to note that stocks tend to move just after the release of economic data as they discount the future. This means that major stock indices will move lower when the economy is at its worst as investors and traders position themselves for better times ahead.</p> <p><strong>Exchange rates</strong></p> <p><a href="/en/trading-academy/forex/what-affects-forex-exchange-rates">Foreign exchange rates</a> are usually the product of the previously mentioned factors – a country’s low inflation and GDP growth lead to the strengthening of its currency compared to foreign currencies. Thus, a strong currency as an isolated factor of analysis can also indicate a potential increase in the prices of stocks that originate in the same country.</p> <p><strong>Political events</strong></p> <p>The political climate in the form of either local events, such as presidential elections or geo-political tensions, like armed conflicts and wars, usually has a strong effect not only on stocks of participating countries but on global stock prices too. In the case of elections, it can be both positive and negative, depending on market sentiment. Wars, however, tend to bring distress and falling prices to the stock market.<br /> <br /> All the macroeconomic factors are usually very intertwined and need to be studied as an aggregate – both on the local and global levels. It is also important to keep in mind the economic, political and trading relations of a country where the stock you analyse originates with other countries, as their economies may influence each other. Moreover, it’s always good to keep an eye on the American economy as it usually has a strong global influence, with the US dollar being a globally accepted reserve currency.</p> <h3>Microeconomic factors</h3> <img alt="" src="/getmedia/597c1913-938b-4722-b9f3-8f65d07a17e7/article-what-affects-stock-prices-micro.webp" style="width: 552px; height: 279px;" /> <p><br /> In addition to global drivers, there are also factors on a smaller scale that may affect share prices, such as the company's performance.<br /> <br /> Any positive news, such as higher-than-anticipated reported earnings, new advanced product launches or efficient management restructuring, tends to drive a company's stock up.<br /> <br /> Negative events such as lower-than-expected profits, lawsuits, and any controversy or drops of confidence in company leaders can have the opposite effect and trigger price drops.<br /> <br /> One factor that stands out is the dividend announcement, which usually causes a short-lived price spike caused by dividend hunters. A consequential price drop often follows as a result of a sellout of the shares that were bought with the sole purpose of receiving dividends.<br /> <br /> Microeconomic factors are often reinforced and sometimes even triggered by market sentiment – the way traders perceive the event and the level of investor confidence, which brings us to the last group of factors affecting stock prices.</p> <h3>Human factors</h3> <img alt="" src="/getmedia/70ce09e9-5764-4a22-9ee1-01aa97b52284/article-what-affects-stock-prices-human.webp" style="width: 552px; height: 98px;" /> <p><br /> These are the factors that influence the stock market due to public activity. For example, a new product launch can positively or negatively affect a company's stock price, depending on how traders and investors feel about it. If they believe a product has potential and will gain popularity, it will attract more buyers and traders to the company stock. On the other hand, if they believe it will be a failure, they might start pulling their investments out and sell the stock, causing its price to decline.<br /> <br /> Increased demand for certain products or stocks, leading to their increasing prices, can also be caused solely by public activity. The infamous GameStop saga, for example, at one point brought a whopping 2,000% increase to the company's stock price, followed by an almost equal a large price drop and another surge in just a little over two months. The entire series of events was caused by public activity and sentiment.<br /> <br /> Factors like market sentiment are nearly impossible to predict with a fundamental analysis of a company or economy. That’s where <a href="/en/trading-academy/what-is-technical-analysis-in-trading">technical analysis</a> steps in, but it is usually considered an advanced technique. If you are just starting out your stock trading journey, it is advisable to study the basics first and practice trading on a <a href="/en/demo-account">risk-free demo account</a>. For example, ThinkMarkets’ proprietary platform <a href="/en/platform/download-thinktrader">ThinkTrader</a> offers CFD trading on over 3,000 global stocks and USD 10,000 virtual funds to test and improve your trading skills.</p>

What are Earnings Reports and How It Affects Stock Prices?

<p>Understanding earnings reports provides traders with invaluable information about the financial health and prospects of companies. By deciphering earnings reports, traders can make more informed decisions on buying, selling, or holding stocks, all while minimising risks and potentially maximising rewards.</p> <p>These reports are the financial lifeblood of publicly traded companies, and comprehending their significance is the first step towards making informed trading decisions.</p> <h2>What Are Earnings Reports?</h2> <p>Earnings reports, often referred to as quarterly earnings or corporate earnings reports, are periodic financial updates provided by publicly traded companies. They serve as a comprehensive snapshot of a company's financial performance during a specific quarter. Companies release earnings reports to fulfill regulatory requirements, maintain transparency, and keep shareholders and the broader market informed about their financial health.</p> <h2>Key Components of Earnings Reports:</h2> <p>Here are the fundamental elements that make up an earnings report:</p> <p><strong>Revenue</strong></p> <p>Revenue, also known as sales or turnover, represents the total income generated by the company. It is a critical indicator of a company's ability to generate income and sustain growth.</p> <p><strong>Earnings Per Share (EPS)</strong></p> <p>EPS is a measure of a company's profitability and is calculated by dividing the net income (profit) by the total number of outstanding shares.</p> <p><strong>Guidance </strong></p> <p>Guidance, also known as forward guidance, offers a glimpse into a company's expectations and projections for future performance. This forward-looking information can significantly impact investor sentiment and stock prices.</p> <h2>The Impact on Stock Prices</h2> <p>The release of earnings reports is often followed by market volatility. When a company releases its earnings report, it provides a comprehensive view of its financial performance over a specific period. This transparency allows investors and traders to gauge the company's health, profitability, and growth potential.</p> <p>Positive results, such as revenue growth and higher-than-expected earnings per share (EPS), often lead to a surge in investor confidence, resulting in an increase in the company's stock price. Conversely, disappointing earnings can trigger a sell-off, causing stock prices to plummet.</p> <h2>Earnings surprises</h2> <p>One of the key concepts during earnings season is the notion of earnings surprises. An earnings surprise occurs when a company's actual earnings or revenue differ from analysts' expectations. These surprises can be either positive (beating expectations) or negative (falling short of expectations). Earnings surprises often lead to sharp price movements in the stock market.</p> <p>When a company reports better-than-expected earnings, it tends to boost investor confidence. This positive sentiment may result in a surge in demand for the company's stock, driving up its price.</p> <p>On the other hand, if a company fails to meet earnings expectations, it can lead to a rapid decline in stock prices as investors may sell their shares in disappointment.</p> <p>The dates leading to and following the release of Earnings reports present traders with potential market opportunities. They can either go long or short depending on their analysis of the situation.</p> <p>Ready to trade? Log in to <a href="http://portal.thinkmarkets.com/" target="_blank">ThinkPortal</a> to access your trading platform now!</p>

How to Trade Shares in South Africa?

<p>South Africa is one of the primary financial hubs in Africa. The country is renowned for a solid banking system and it boasts stringently regulated, sophisticated financial markets. The Johannesburg Stock Exchange (JSE), the country’s national stock exchange, ranks 19th among the world’s bourses by market capitalization, which tops US$ 1 trillion.</p> <p>The JSE is Africa’s oldest and largest stock exchange, and home to a wide range of financial instruments. The JSE’s market depth and liquidity, supported by a strong system of regulation, makes it an attractive destination for local and international investors who want to gain exposure to companies and assets in South Africa or the African continent.</p> <h2>Why Should You Trade Stocks as CFDs?</h2> <p><strong>Five advantages</strong> of trading share CFDs:</p> <ol> <li>You have the opportunity of trading with leverage. <a href="/za/stocks-trading/">ThinkMarkets</a> is one of such brokers that offer CFD leveraged trading on share CFDs.</li> <li>You can profit from rising and falling prices. Use buy orders to benefit from prices that are climbing, and use short orders to profit from falling prices.</li> <li>You can trade thousands of stocks from different exchanges across the world all from a single platform <a href="/za/account-types/">such as the MT4/MT5</a>, and the ThinkTrader platforms offered by ThinkMarkets.</li> <li>You can use the tools on the charts to perform analysis of the stock you intend to trade.</li> <li>Share CFD trading is commission-free and tax-free as well. You only pay the spread when trading and you keep all your profits too.</li> </ol> <h2>The Regulatory Background to Trading Share CFDs in South Africa</h2> <p><strong>European Securities and Markets Authority (ESMA)</strong> made some changes as to how much leverage brokers in the United Kingdom and European Union offer their traders. Leverage for CFD share trading was capped at 1:10, meaning that margin requirements were raised to 10%. Given that most stock trading had been allowed to go on at a leverage of 1:500 on most EU/UK brokerages before this ruling, this change represented a major stumbling block on the trading of shares.</p> <p>The ESMA ruling meant that it was now significantly more expensive to open and operate a CFD share trading account with any of the UK or EU-based brokerages, used by many traders in South Africa.</p> <p>As a result, many South African traders and traders from across Africa found themselves locked out of CFD share trading, with some of the flocking to offshore locations with shady regulation and virtually zero protection for traders.</p> <p>To counter the adverse effects of such migration to unregulated jurisdictions, brokers such as ThinkMarkets made a move to South Africa to open a new location for African traders. The Financial Sector Conduct Authority oversees trading in South Africa, and this agency offers world-class regulation and trader protection comparable with what the ESMA offers in Europe. There is also an added advantage of generous leverage being made available to traders, similar to what they previously enjoyed before 2018 in the EU/UK jurisdictions.</p> <p>The opening of the South African division of ThinkMarkets has opened a whole new vista of opportunity for traders in South Africa and in Africa as a whole to trade shares as CFDs. With ThinkMarkets South Africa, you enjoy the best of both worlds. Not only do you enjoy top-notch regulation and trader protection, but you also trade share CFDs using significant leverage.</p> <p>Trading shares with ThinkMarkets South Africa is very easy. Once you have an account that is verified and funded, you can go to the asset index of your <a href="https://www.thinkmarkets.com/za/metatrader4/">MT4</a>/<a href="/za/metatrader5/">MT5 platform</a> and ThinkMarkets platforms.</p> <p>In MT4/MT5, select the stock you want to trade by clicking on the "Show" button, and then use the various order buttons to buy or sell the stock using any of the instant or pending orders.</p> <p>Making the stock available for trading is done using the Symbol tab. Click View -> Symbol, or use the Ctrl + U button to call this function up.</p> <p><img alt="" src="/getmedia/47c0a9f2-e038-4332-b591-0065ea4c2fc9/South-African-CFDs-image-1.jpg" /></p> <p>What you see the asset classes, click on <a href="/za/stocks-trading/">Equities</a> to view the complete listing of the stocks that you can trade on the ThinkMarkets MT4 platform.</p> <p><img alt="" src="/getmedia/a2636e2c-4e3b-4157-bffe-eb29ca5465e2/South-African-CFDs-image-2.jpg" /></p> <p>If the dollar icon beside the stock is grey, it means the stock is not yet available for trading. You can make these stocks available for trading by either clicking once on the stock name and then clicking on the SHOW tab. Alternatively, you can double-click on the stock name. The dollar icon will change from grey to a gold colour, as shown below.</p> <p><img alt="" src="/getmedia/e2733849-f793-4dd3-bde5-6fce1868cf9a/South-African-CFDs-image-3.jpg" /></p> <p>Once the colour of the icon beside the stock has changed from grey to gold, it means that that stock is now available for trading. If you want all the stocks to become available for trading, click the SHOW tab once.</p> <h2>How to Perform Some Key Stock Trading Functions</h2> <p>Here are some key facts about how to perform some critical stock trading functions.</p> <ol> <li><strong>Opening a Stock Chart & Adding an Indicator</strong></li> </ol> <p>Scroll down the asset list on the Market Watch window. Right-click on the stock of your choice and click on CHART WINDOW in the dropdown menu. This opens the chart of the stock you are interested in. You can now add indicators on the chart. Assuming you want to add a moving average indicator to the chart, you can do this by clicking Insert -> Indicators -> Trend -> Moving Average.</p> <ol start="2"> <li><strong>Order Placement/Executing a Trade</strong></li> </ol> <p>Click on the New Order tab, or press the F9 button and scroll down the list of stocks to select the stock to trade. You can also open the chart of the stock in question as described above, then right-click on the chart and press the New Order tab in the dropdown menu.</p> <p><img alt="" src="/getmedia/fcabbacd-ba6b-4a5f-850c-88f55b7dbf9c/South-African-CFDs-image-4.jpg" /></p> <p>The New Order function opens the dialogue box that allows the trader to set up the parameters for the trade:</p> <p><img alt="" src="/getmedia/2a9f1fde-5d51-411e-b82b-69d16ff26b3b/South-African-CFDs-image-5.jpg" /></p> <p>You can:</p> <ul> <li>Choose between market execution (Buy by Market or Sell by Market) and Pending Orders (Buy Stop, Sell Stop, Buy Limit, Sell Limit).</li> <li>Select the trade size (minimum is 0.1 lots or 10 shares on many stocks)</li> <li>Set the Stop Loss and Take Profit price targets</li> <li>When all is ready, you click the Order Execution button.</li> </ul> <p>There are a host of other functions. </p> <ul> <li>You can change the time frame of each chart.</li> <li>Check for news updates using the News tab in the Terminal Window.</li> <li>View your account exposure, order history and alerts.</li> <li>Add and remove indicators.</li> <li>Rescan your servers.</li> <li>Use a variety of chart tools such as the trend line tool Fibonacci tools and Gann tools.</li> <li>Zoom in and zoom out of charts.</li> </ul> <p>All these functions can be replicated in the ThinkMarkets mobile application, downloadable from the App Store (iPhone and iPad) or the Google Play Store (Android devices).</p> <p>Assets listed on the JSE can be traded directly on the exchange, using local stock brokers, or on online trading platforms as <strong>contracts-for-difference (CFD) assets</strong>. There are significant advantages of trading stocks as CFD assets as opposed to trading them on the exchanges.</p>

10 Tips to Successful Trading

<p>A solid plan for your online trading activities will provide a blueprint for your trading activities and define your goals.<br /> <br /> This, in turn, will help you stay on track and potentially avoid an undesirable outcome. Creating a trading plan involves a lot of moving parts.<br /> <br /> Creating a successful trading plan takes a little more than that. In this day trading guide, we’ve outlined ten essential steps every trading plan needs to have.</p> <h2>1. Understand the market <br /> before you start trading</h2> <p>A solid understanding of the financial market you are going to trade on is crucial for building a good trading plan. Having a strong knowledge base will help you navigate a large volume of information in a trading world confidently and make educated trading decisions.<br /> <br /> No matter what financial instruments you choose for your trading journey – forex, indices, commodities or others – there are three main points any day trader needs to focus on:</p> <ul> <li>Market terminology</li> <li>Unique traits of the market</li> <li>Factors influencing price movements</li> </ul> <img src="/TMXWebsite/media/TMXWebsite/circle.jpg" /> <p>For example, in forex, price movements are measured in pips, while in all the other markets, they are measured in ticks or points. This unique trait of each market requires an understanding of the market terminology.<<br /> <br /> Factors influencing price movements in each market will also vary. Forex, for instance, is heavily influenced by economic reports from the home countries of the traded currency pairs, while the prices of commodities are highly dependent on supply and demand. As a result, forex will move in large swings when economic reports are released, (especially reports from the US, Eurozone, or Japan), and commodities will see a lot of movement after the announcements of shortages in supply. To identify trading opportunities presented by such events, you need a clear understanding of what exactly influences each market.</p> <p>A good starting point to learn the basics of trading for beginners can be the trading guides on our website. Keep your demo account open as you go through any new information, and try to apply it in practice whenever possible.</p> <h2>2. Determine market conditions</h2> <p>Evaluating market conditions, in a nutshell, means identifying strong trading signals that present trading opportunities. To determine it, you need to be able to analyse the market you selected.<br /> <br /> There are two main methods of doing it – fundamental and technical analysis. The main difference between the two is the type of data used to predict future market movements.<br /> <br /> Technical analysis is based on the past price movements of an instrument, while fundamental analysis studies economic and financial factors that may affect the markets in future.</p> <img src="/TMXWebsite/media/TMXWebsite/fundamental_analyse.jpg" /> <p>At first, analysing financial markets may seem complicated and even intimidating. However, like with any other complex topic, you can start with a basic approach and advance little by little once you start getting a better understanding of how financial markets work.<br /> <br /> If you are just getting into day trading for beginners, it may be easier to start with news trading, identifying support and resistance levels and understanding some basic chart patterns. On the other hand, advanced traders can find trading signals in complex economic reports and technical indicators. Regardless of your experience level, you need to have a clear understanding of the analysis process you use before you start relying on it.<br /> <br /> However, whether you choose fundamental analysis, technical analysis or a mix of the two, it’s important to note that neither provides a guaranteed trading outcome. Any market analysis only indicates a potential price movement and could help determine your entry point.</p> <h2>3. Know where to enter the market</h2> <p>In trading, the entry point refers to the price level you are willing to open a trade at. While doing your market analysis, you will often see that sometimes the markets are primed for trading, while at other times it may be best to stand aside. If the trading signal you have identified is strong, you can open a trade right away. However, if you are unsure of the current market conditions or the available information is providing conflicting signals, it could be better to hold on and wait for a trade with a stronger signal.<br /> <br /> There will also be times when the signal seems strong, but your desirable entry point is not available on the market yet. In this case, you can place a pending order that will be executed only once the price reaches your specified level. Pending orders can help you manage risk and ensure that you enter the market according to your predetermined plan.<br /> <br /> To get some insights about the entry points as a trader, you can also keep an eye on the regular <a data-di-id="di-id-788ae628-c73859d3" href="/en/market-news/" rel="noreferrer noopener" target="_blank">market news</a> posted on our website by trading experts. Financial markets are unpredictable, and even experts can't guarantee the next price movement. However, they share valuable tips that may help you adjust and fine-tune your trades.</p> <img src="/TMXWebsite/media/TMXWebsite/laptop.jpg" /> <h2>4. Assess your risk appetite</h2> <p>New traders tend to have a strong aversion to risk and often focus too heavily on losses or, worse, refuse to close a losing position. They increase their risk exposure and believe that the market will return in their favour. Successful traders know there is a potential risk in every trade.<br /> <br /> That’s why setting an appropriate risk level before you start trading and sticking to it is one the most important steps of creating a day trading strategy. A wise day trader won't risk more than they can afford to lose.<br /> <br /> Determining how much of your capital you can risk per trade depends on your total trading account size and experience. Many traders use a 1-3% risk level as their control point, but beginners usually start with 1% to get comfortable with the idea. For example, if your trading capital is USD 10,000, you might decide to risk 1% per trade, which would be USD 100. However, this percentage should be based on your individual risk tolerance and trading strategy.</p> <img src="/TMXWebsite/media/TMXWebsite/risk-appetite_1.JPG" /> <p>It is not uncommon to experience strings of wins and losses, but whether you have a good day or your predictions are incorrect, it should not change your pre-determined risk level.</p> <h2>5. Understand your risk/reward ratio</h2> <p>A risk/reward ratio is a balance between how much you are willing to lose in order to gain a certain reward. Once you know your risk level, the next step is to set a desirable reward level. Just like with a 1-3% risk level, a 1:3 risk/reward ratio is widely considered appropriate among traders.<br /> <br /> It means you should expect no more than three points of return for every point you risk. So with a trading capital of USD 10,000 and a risk level of 1% (USD 100), your target return should not exceed USD 300. However, beginners often prefer to start with a lower reward level as well and set their risk/reward ratio to 1:1, which is USD 100 as a target return for every USD 100 of risk.<br /> <br /> In many cases, a reasonable reward goal will also depend on the instrument and market you are trading on. For example, you shouldn’t expect a 300-point price move from a market with a 100-point average range.</p> <img src="/TMXWebsite/media/TMXWebsite/risk-reward-ratio_1.JPG" /> <h2>6. Control your trading capital</h2> <p>The price movements on any trading market are outside your control as a trader. What you can control is the negative or positive impact any one of them has on your trading account. Risk management tools, such as stop loss and take profit, will help you keep your risk/reward ratio in check and avoid undesirable and unpredicted results.<br /> <br /> Generally speaking, every trade you place has only three possible outcomes:</p> <ul> <li>The market goes in your favour = you gain</li> <li>The market moves against you = you lose</li> <li>The market trades sideways = no gain and no loss</li> </ul> <p>To have control over your trading account, features are available to use such as take profit to lock your gains in successful trades and stop loss to limit your losses if the market moves against you.<br /> <br /> Following our previous example, for the trading account of USD 10,000 with a 1:3 risk/reward ratio, your stop loss could be set to USD 100 and take profit to USD 300. While many trading platforms will automatically calculate and display potential profit and loss for set take profit and stop loss levels, it's important for traders to understand how these levels relate to the price movement of the asset they are trading.<br /> <br /> As we mentioned earlier, following your predetermined risk level without changing it for already running trades is crucial. Many traders have made the unfortunate mistake of adjusting stop-loss orders lower and lower on a losing trade until they hit the point of ruin. Whereas other traders have adjusted take-profit orders higher and higher just to see their profits vanish as a trade quickly reverses against them.<br /> <br /> Sometimes you will find yourself in a third scenario, where the instrument you are trading on moves sideways for an extended period without bringing you the desirable gain and not triggering your stop loss. In such cases, traders often prefer to exit such trade manually, re-evaluate their trading plan and wait for a stronger trading signal.</p> <h2>7. Document your trading plan</h2> <p>The easiest way to re-evaluate your day trading plan is to go through each and every step of it and check whether the information you determined earlier is still relevant. That’s why documenting it is essential.<br /> <br /> Here are some example steps that could be included in any trading plan:</p> <ul> <li>Previous trading session review</li> <li>Existing trading opportunities analysis <ul> <li>Macro-analysis of the current market – news, economic reports, other factors that impact markets</li> <li>Micro-analysis of the current market – review of charts and technical indicators</li> </ul> </li> <li>A defined entry point</li> <li>A defined risk you are comfortable with per trade</li> <li>Defined stop loss and take profit levels</li> </ul> <p>Every trading plan is unique and depends on the personal goal of a trader. You may follow the same steps or create different ones to match your personal trading needs – no matter which option you choose, documenting it could still help you stay on track.</p> <img src="/TMXWebsite/media/TMXWebsite/checklist_1.jpg" /> <h2>8. Put your plan to the test</h2> <p>Going through the motions of your trading plan is as important as documenting it. Use a demo account of your trading platform to test it in a simulated real-world market environment with no risk.<br /> <br /> Making an effort to practise trading on a demo account can help identify weaknesses in your trading plan and allow you to adjust it where necessary. To give your trading plan a real test, keep in mind that when trading with a demo account, it is critical to follow your plan and execute each step as if you were trading in a live environment.<br /> <br /> That means placing trades only if your plan signals it, respecting all stop-loss and take-profit levels and making adjustments or course corrections only after the end of a trading day, not during it.<br /> <br /> Many beginner traders make the mistake of not treating their demo account with the same discipline and mindset they would have for their live account with real money. As a result, when the same trading strategy is applied to a live trading account, the results will differ greatly compared to the demo account. Moreover, not following the predetermined actions will make it much harder to review and analyse your trading session later.<br /> <br /> That’s why it is important to stick to your trading plan to prepare yourself for transitioning from a demo account to live.</p> <h2>9. Remove emotions from the equation</h2> <p>Uncontrolled emotions are one of the key reasons traders abandon their trading plan and fail to achieve the outcome they seek.<br /> <br /> When you begin to trade, it is important to remove any non-related or outside influences from your environment to allow yourself to trade with a clear focus and have a better trading experience.<br /> <br /> Seasoned traders apply various techniques to eliminate emotions from day-to-day trading and follow the structure and discipline provided by a well-thought-out trading plan. Some of them use a daily ritual, such as a short checklist related to their trading plan. Others use a brief physical exercise to help clear their mind and sharpen their focus. It can be anything else that works for you personally as long as it helps to achieve the main goal – developing a process that will help you execute each and every step of your trading plan without deviation. Like any new skill you are learning, your trading process will soon develop a natural flow and become second nature as long as you stay true to it.</p> <img src="/TMXWebsite/media/TMXWebsite/emotions.jpg" /> <h2>10. Find out what type of trader you are</h2> <p>nce you run your trading strategy a few times, you will start noticing that some trades work better for you than others. That’s when you know it’s time to find out your trading personality.<br /> Understanding your own trading personality can help you achieve the most positive experience and results from your trading. Some traders are better suited for high-volume, short-term trading, while others thrive using a slower long-term style.<br /> <br /> Determining what trading style works better for you is just as important as knowing the personality of the market you decide to trade on. There are many assessments available online to help you learn more about yourself in a trading environment, as well as numerous books and articles written on trading psychology and behavioural finance. Explore who you are as an individual and how that can apply to your trading psychology and strategy.</p> <img src="/TMXWebsite/media/TMXWebsite/human_1.JPG" /> <h2>Bonus: 11. Apply discipline and consistency</h2> <p>There is no ultimate success route to trading, but as with many things in life, being disciplined and consistent could be seen as key. It may take more than one try and some patience to find out whether a certain strategy is working.<br /> <br /> Beginner traders often give up on their plans as soon as they face their first loss and move to another strategy hoping it will work better. Stay disciplined and consistent, study the details of your trading sessions and plan your next steps only with a clear understanding of what works well and what doesn’t.<br /> <br /> Ready to get stated with day trading? Start with ThinkTrader. Our award-winning platform gives access to over 4,000 financial instruments, market news and multiple analytical tools to help you define your trading plan.<br /> <br /> Try it now on the <a data-di-id="di-id-8245fa02-6d05b691" href="https://web.thinktrader.com/account/login" rel="noreferrer noopener" target="_blank">web</a> or download the app [QR code]./p></p> <p><img alt="" src="/getmedia/e1074687-a223-4ed5-a7a2-540d16d4b2cd/QR-code_1.png?width=200&height=200" /></p> <p><a data-di-id="di-id-89b33f44-3ddfd855" href="/TMXWebsite/media/TMXWebsite/10-tips-to-successful-trading-pdf.pdf" onclick="DownloadFn()">Download the pdf</a></p>

TSMC vs. Samsung part 2: Exploring the rivalry shaping semiconductor manufacturing

<p>Following up on our previous exploration of the intense rivalry between Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics, this article aims to explore the technologies and business practices that make these two companies the giants they are today.</p> <p>In our last discussion, we compared their revenue, technological advancements, and partnerships. Now, we will examine the foundational aspects of their semiconductor manufacturing processes, their competitive strategies, and the broader impacts they have on the world of technology. But before we dive deeper, let’s briefly touch on the importance of semiconductors in general.</p> <h2>What are semiconductors and why are they important?</h2> <p>Semiconductors are materials that have properties between those of a conductor and an insulator, making them ideal for controlling electrical currents. They are the essential building blocks of microchips, which are at the core of virtually every electronic device.</p> <p>Whether it’s your smartphone, laptop, television, or even your car, semiconductors are what enable these devices to function by controlling the flow of electricity and facilitating complex computational tasks.</p> <p>By allowing for precise control over electrical currents, semiconductors are at the heart of the technologies that power our world and are indispensable to both everyday life and the broader technology industry. They enable advancements in computing, telecommunications, automotive systems, healthcare devices, and countless other applications.</p> <h2>The semiconductor manufacturing process</h2> <p>The semiconductor manufacturing process is one of the most intricate and sophisticated production processes in the world. According to ASML and Hitachi High-Tech, the manufacturing of microchips involves several key stages, each critical in transforming raw silicon into the powerful chips that power our devices.</p> <p>The first stage is lithography, where light is used to print intricate patterns on silicon wafers. These patterns form tiny circuits that will eventually process and store data. Lithography is one of the most challenging steps, as it requires incredible precision to print features that are just a few nanometres wide. Companies like ASML are leading in the production of advanced lithography machines, particularly Extreme Ultraviolet (EUV) lithography, which is crucial for producing the latest generations of chips.</p> <p>Next is etching, a process that removes specific areas of the wafer's surface to create the desired circuit patterns. This step is followed by deposition, where various materials are added to the wafer to form the layers of the chip. These layers are essential for creating the transistors and interconnects that enable chips to perform complex calculations.</p> <p>TSMC and Samsung have developed their own unique approaches to these processes, incorporating specialised technologies to enhance chip performance. TSMC, for instance, has pioneered the use of FinFET (Fin Field-Effect Transistor) technology for its 7nm and 5nm nodes, which provides better control of current flow through transistors, reducing power consumption and improving speed. Additionally, TSMC’s Chip-on-Wafer-on-Substrate (CoWoS) packaging technology allows multiple chips to be integrated into a single package, enhancing performance for high-computing applications.</p> <p>Samsung, meanwhile, has focused heavily on advancing Gate-All-Around (GAA) technology with its 3nm nodes. GAA represents a significant leap beyond FinFET by allowing even more precise control of current, which leads to improvements in both power efficiency and performance. Samsung’s implementation of GAA, known as Multi-Bridge-Channel FET (MBCFET), is designed to overcome the limitations of traditional transistor designs as nodes become even smaller.</p> <p>In addition to GAA, Samsung is also a leader in V-NAND and DRAM memory technologies, which are critical for storage and high-speed data processing. V-NAND involves stacking memory cells vertically, which allows for greater storage density and improved performance compared to traditional planar NAND. These innovations have made Samsung a leader in the memory market, complementing its foundry services.</p> <p>The differences between TSMC’s and Samsung’s approaches to semiconductor manufacturing highlight their distinct strategies: TSMC focuses on maintaining a leadership position in logic chip manufacturing through cutting-edge process nodes and advanced packaging, while Samsung leverages its IDM model to integrate memory and logic capabilities, providing a more comprehensive solution for various technology segments.</p> <p>These processes help explain why TSMC and Samsung remain at the forefront of the semiconductor industry. Their constant pursuit of innovation, whether through TSMC’s advanced lithography and packaging or Samsung’s GAA and memory technologies, ensures that the devices we use every day continue to become faster, more efficient, and more capable.</p> <h2>Same industry – different approach</h2> <p>One of the key differences that have prominently emerged in recent years is how TSMC and Samsung respond to global supply chain disruptions.</p> <p>TSMC’s strategy has been to focus on building new fabs outside Taiwan, particularly in countries like the United States and Japan, to address concerns over geopolitical tensions.</p> <p>Samsung, meanwhile, has doubled down on integrating its semiconductor capabilities with its broader consumer electronics and mobile divisions, allowing it to manage disruptions more effectively by relying on an internal supply chain.</p> <p>These evolving strategies are shaping the next chapter in their rivalry, and understanding these moves helps us gain a clearer picture of where the semiconductor industry is headed.</p> <h3>TSMC’s approach</h3> <p>TSMC continues to lead as the largest pure-play foundry, with its primary advantage being its foundry services. What makes TSMC’s approach unique is its aggressive push towards leading-edge nodes, particularly its focus on the 2nm and upcoming 1.4nm processes by 2025.</p> <p>The 2nm and the upcoming 1.4nm semiconductor processes are pivotal advancements that drive significant improvements in device performance, energy efficiency, and innovation. These nano processes enable higher transistor density, allowing chips to deliver faster computing power while consuming less energy, which is key for extending battery life and supporting sustainability goals. They also facilitate more compact designs and the integration of advanced features like AI accelerators, enhanced connectivity, and improved graphics, which makes them essential for next-generation technologies like 5G, AI, and high-performance computing.</p> <p>These advanced nodes provide a competitive edge in the semiconductor industry, positioning companies to meet growing consumer and enterprise demands for powerful and efficient devices. While they require substantial investment and technological precision, their potential to revolutionise technological sectors is unmatched. By enabling cutting-edge innovations, the 2nm and 1.4nm processes set the stage for transformative developments in electronics and computing.</p> <p>TSMC’s commitment to staying ahead in advanced nodes is showcased in its massive investments in research and development which amounted to $6.281B for the twelve months ending 30 September, 2024, noting a 13.65% increase year-over-year, and its ongoing partnerships with leading technology firms to integrate the latest process nodes in consumer products.</p> <h3>Samsung’s approach</h3> <p>Samsung, on the other hand, is leveraging its Integrated Device Manufacturer (IDM) model to strengthen its market position. Unlike TSMC, Samsung designs, manufactures, and markets its own chips, giving it a unique position to optimise the entire production process from start to finish. Samsung's recent advancements in Gate-All-Around (GAA) technology mark a significant step forward in chip design by addressing the limitations of the traditional FinFET architecture.</p> <p>As transistors, the building blocks of chips, become smaller to fit more into each chip, FinFET designs face challenges in controlling the flow of electricity, leading to inefficiencies such as higher power consumption and heat generation. GAA technology overcomes these issues by surrounding the transistor’s channel on all sides, allowing for more precise control of the current. This innovation improves power efficiency, enabling devices to use less energy, while also enhancing performance, making chips faster and more capable.</p> <p>The implications of GAA technology extend beyond just improved efficiency. It enables the creation of high-density chips that are critical for the next generation of technology. By overcoming the physical limitations of older designs, GAA technology ensures that devices can become more powerful and compact without sacrificing energy efficiency. This positions Samsung as a leader in semiconductor innovation, driving advancements that benefit both consumer electronics and industrial applications.</p> <p>Furthermore, Samsung’s growth in the memory chip segment, particularly in V-NAND and DRAM technologies, highlights its ability to diversify its product portfolio and strengthen its position in the semiconductor industry. V-NAND technology, which stacks memory cells vertically, allows for higher storage capacity and faster performance in a smaller space, making it ideal for modern devices like smartphones, SSDs, and data centres. Similarly, DRAM technology, which provides fast, temporary data storage for active applications, remains essential to everything related. By advancing in these areas, Samsung ensures it can meet the rising demand for high-performance memory solutions.</p> <p>This diversification provides stability against market fluctuations, as demand for memory chips often remains steady even when other segments experience downturns. By investing in innovative memory technologies, Samsung not only solidifies its competitive edge but also ensures it can adapt to evolving market needs. Through this strategy, the company positions itself as a reliable leader in memory solutions while contributing to the development of more efficient and powerful devices worldwide.</p> <h3>The role of major partnerships and clients</h3> <p>The partnerships and collaborations of TSMC and Samsung have played a significant role in their growth and leadership in the semiconductor market.</p> <p>TSMC has established strong relationships with leading technology firms such as Apple, AMD, and Nvidia. These partnerships are essential for TSMC as they ensure a steady demand for advanced nodes and position TSMC as the preferred supplier for some of the world's most innovative companies. For example, Apple relies on TSMC's cutting-edge technologies for its A-series and M-series chips, which power iPhones, iPads, and MacBooks. Similarly, AMD and Nvidia depend on TSMC’s advanced nodes for their high-performance processors and graphics cards.</p> <p>Samsung has also forged significant collaborations, notably with Qualcomm and IBM. Qualcomm, a leader in mobile processors, has partnered with Samsung to manufacture its Snapdragon chips using Samsung’s 4nm and 3nm nodes. This collaboration highlights Samsung’s capability in producing high-performance mobile processors. Additionally, Samsung's partnership with IBM aims to push the boundaries of semiconductor innovation, with a focus on developing next-generation logic and memory technologies.</p> <p>These partnerships profoundly affect the technological development and market positioning of TSMC and Samsung.</p> <h2>Global impact of TSMC and Samsung</h2> <p>The global impact of TSMC and Samsung extends beyond their technological advancements; they are key players in the international semiconductor supply chain.</p> <p>TSMC and Samsung are two of the largest semiconductor manufacturers globally, and their production capabilities influence the availability of advanced chips for a wide range of industries, including consumer electronics, automotive, and telecommunications.</p> <p>The significance of their roles became especially evident during the recent global chip shortage, which affected industries worldwide. Geopolitically, both companies are also at the centre of international trade and technology security. The reliance of major economies on TSMC and Samsung for advanced semiconductors has made these companies strategic assets, with countries like the United States, Japan, and South Korea actively supporting their expansion efforts.</p> <p>TSMC’s decision to build fabs in the US and Japan, and Samsung’s investment in new facilities in Texas, are moves that reflect the geopolitical importance of securing a stable and resilient semiconductor supply chain. FlowCh.ai highlights how TSMC and Samsung are positioning themselves globally to mitigate risks and take advantage of opportunities. By diversifying their manufacturing locations, both companies aim to reduce the impact of regional disruptions and ensure a continuous supply of advanced chips to their clients worldwide.</p> <h2>Challenges facing TSMC and Samsung</h2> <p>Despite their successes, TSMC and Samsung face several challenges that could impact their future growth and market positions. One of the significant challenges is the global chip shortage, which has put immense pressure on semiconductor manufacturers to increase capacity.</p> <p>As we have already examined, both companies are investing heavily in expanding their production capabilities, but the high costs and long timelines associated with building new fabs make it a complex issue to address. Geopolitical tensions also pose a considerable risk. TSMC's heavy reliance on Taiwanese facilities makes it vulnerable to geopolitical instability in the region.</p> <p>Similarly, Samsung is expanding its footprint in the US to reduce its reliance on South Korean facilities. According to Investopedia, Samsung's recent $7.2 billion buyback plan is part of its strategy to navigate financial challenges and reassure investors of its stability amidst market uncertainties.</p> <p>The semiconductor industry is capital-intensive, and maintaining investor confidence is crucial for funding the R&D and expansion projects needed to stay competitive. Supply chain disruptions, rising production costs, and the need for advanced equipment are additional challenges that both companies must address.</p> <p>As they strive to develop smaller, more efficient nodes, the cost of R&D and production continues to rise, requiring significant financial resources and technological expertise.</p> <h2>The future of semiconductor technology</h2> <p>The future of the semiconductor industry will be defined by continued innovation, strategic investments, and the ability to overcome challenges posed by geopolitical and market dynamics. TSMC and Samsung are setting the stage for the next wave of technological advancements.</p> <p>Emerging technologies like quantum computing, neuromorphic computing, and silicon photonics are also reshaping the future of the semiconductor landscape. Both TSMC and Samsung are exploring these frontiers through collaborations with academic institutions and technology firms, investing in the research and development required to bring these technologies to market.</p> <p>From a broader perspective, sustainability is becoming increasingly important. The environmental impact of semiconductor manufacturing is significant, and both companies are focusing on improving energy efficiency and reducing waste. TSMC has set ambitious targets to achieve net-zero emissions by 2050, while Samsung is implementing eco-friendly practices in its fabs to minimise its carbon footprint.</p> <p>The semiconductor industry’s future will also depend on addressing workforce challenges, including the need for skilled engineers and technicians. Both TSMC and Samsung are ramping up training programmes and collaborating with educational institutions to develop the next generation of talent.</p> <h2>Semiconductor innovation driven by competition</h2> <p>The rivalry between TSMC and Samsung is a driving force behind the innovation and progress of the semiconductor industry. Their competitive strategies, technological advancements, and global influence ensure that they remain at the forefront of shaping the future of technology.</p> <p>As the demand for advanced semiconductors continues to grow, TSMC and Samsung are well-positioned to lead the industry into a new era of technological possibilities. Their ongoing competition fuels advancements that benefit not just their clients but the entire ecosystem of industries that rely on semiconductors.</p> <p>The future of the TSMC vs. Samsung rivalry promises to be as dynamic and transformative as the technologies they produce, making it an essential narrative for anyone interested in the evolution of modern technology.</p>