US Crude Oil

West Texas Intermediate, known as Texas light sweet or WTI, is one of the two major oil benchmarks of the world, the other being BRENT. Together, they make up most of the world’s oil supply. Similar to Brent, WTI has a light density and low sulphur content, which makes it easier to refine to diesel or gasoline.

The US used to hold the spot market for WTI before abandoning control in 1981. After a subsequent market collapse, oil production shrank and moved to Cushing, Oklahoma.

This grade of oil is extracted from oil fields in Texas, North Dakota, Oklahoma, and Louisiana.

If you’re looking to open a position in WTI, here are some factors to look out for:

- Similar to BRENT, the price of WTI depends heavily on global sentiment and the expected supply and demand. When investors anticipate an increase in demand, prices tend to rise, and vice versa.

- Events that disrupt the supply chain or economic troubles can cause oil prices to tank. The global recession of 2008 saw oil trade at its lowest price in recent history.

- Oil prices are highly sensitive to geopolitics. Civil unrest in OPEC countries and other major players in the oil markets, like Russia, tend to move the price significantly.

Market news

CommoditiesFundamental/Technicallid Date

Gold surges again: Will it break the $3,000 barrier?

CommoditiesFundamental/TechnicalNov 02 2025

Will gold hit $3K? Traders go long as markets react to Trump & wage inflation

CommoditiesFundamental/Technicallid Date

Gold prices look primed for a fresh all-time high

CommoditiesSpecial reportsSep 12 2022

How to trade gold with leverage

CommoditiesDaily briefinglid Date

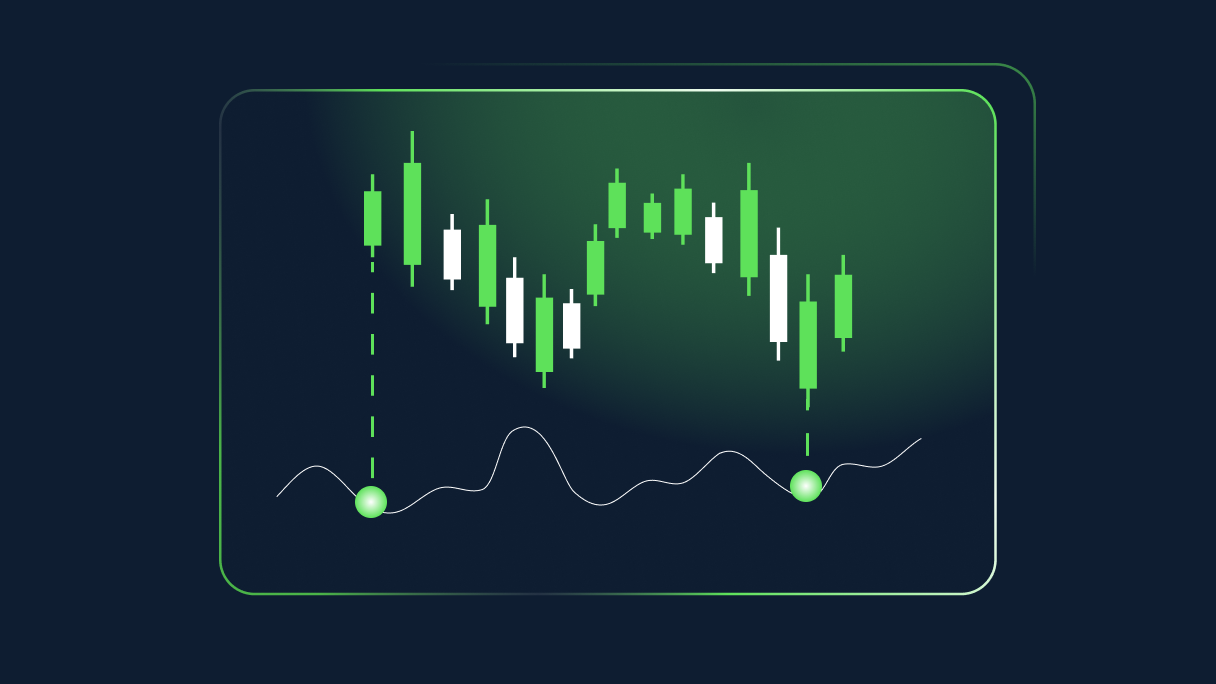

-indicator-work.png?width=1216&height=684&ext=.png)