文章 (4)

K線圖初级教学:K線是什麼?K線圖怎麼看?

<p>K線圖,是一種最基本的技術分析工具。它通過顯示開盤價、收盤價、最高價和最低價,提供了市場價格行為的直觀視覺表示,幫助交易者識別市場行爲,瞭解市場的動向。<br /> <br /> 在本文中,我們將深入探討K線是怎麼形成的,怎麼觀察單根K線形態,K線組合,並討論如何根據不同的交易風格選擇合適的時間框架,從而有效地利用K線圖進行市場分析,提高交易決策的精確度。<br /> </p> <h2>K線是什麽?</h2> <p><strong>K線圖</strong>,被稱爲蠟燭圖(Candlestick),也常被比喻為k棒,由一個實體和兩條<a href="/tw/trading-academy/candlesticks/upper-lower-shadow/" target="_blank">影線</a>組成。其起源於18世紀的日本用於追蹤米價波動。隨著時間推移,基於其本身的實用性與簡潔性,逐漸被金融行業的人推崇並運用。</p> <figure style="text-align: center;"><img alt="K線圖與線形圖對比" src="/getmedia/6a66dfed-28e8-49e6-b4ed-b6257ac052de/k-line-chart-vs-line-chart.webp" title="K線圖與線形圖對比" width="100%" /><br /> <br /> <span style="color: #4e5f70;">K線圖與線形圖對比圖</span></figure> <p><br /> 與<strong>線形圖(Line Chart)</strong>相比,K線圖在展示價格變動和市場走勢方面提供了更豐富的細節,使投資者能夠清晰地看到支撐與阻力點,以及其他關鍵的交易信號。<br /> </p> <h2>K線怎麼看?</h2> <p>K線圖,通常被形象地稱為蠟燭圖,是現代的金融市場中常用的一種圖表類型,用於展示金融產品在特定時間的價格變化。<br /> <br /> 每一根K線提供了在一定時段內價格動態的視覺表示,反映了市場的波動性與交易強度。<br /> </p> <h3 style="font-size:22px">1. K線是怎麼形成的?</h3> <p>K線圖的發展從基本的線圖演變而來,提供了一種更為全面和直觀的方式來分析市場。線圖僅顯示每個時段的收盤價,而K線圖則展示開盤價、收盤價、最高價和最低價這四個關鍵數據點,提供了市場價格行為的更全面視圖。</p> <img alt="K線是怎么形成的" src="/getmedia/2f4d3dc9-68ed-4305-8628-5a4263599522/how-k-line-is-formed.webp" title="K線是怎么形成的" width="100%" /> <h3 style="font-size:22px">2. K線的成分</h3> <br /> <style type="text/css">.small-view #article-image{ width: 100%; } .medium-view #article-image{ width: 85%; } .large-view #article-image{ width: 80%; } </style> <img alt="K線的成分" id="article-image" src="/getmedia/51d681da-ee98-4760-838f-0a51b051795d/components-of-candlesticks.webp" title="K線的成分" width="100%" /><br /> <p>首先,每根K線包含<strong>一個實體</strong>和<strong>兩個影線</strong>,當中包含了以下四種關鍵數據點:<br /> </p> <style type="text/css">thead { background-color: #3e4a5a; } thead tr th { color: white; } .header-row { background-color: #3e4a5a; } .header-row th { color: white; } .article__content tr:nth-child(even) td{ border: 1px solid #ddd !important; } table tbody tr:nth-of-type(even){ background-color: #f2f6f6 !important; } </style> <table border="1" cellpadding="1" cellspacing="1" style="width:100%;"> <thead> <tr class="header-row"> <th scope="col">成分</th> <th scope="col">解釋</th> </tr> </thead> <tbody> <tr> <td style="text-align: center;">開盤價</td> <td style="text-align: center;">該時段內第一筆交易的價格</td> </tr> <tr> <td style="text-align: center;">收盤價</td> <td style="text-align: center;">該時段最後一筆交易的價格</td> </tr> <tr> <td style="text-align: center;">最高價</td> <td style="text-align: center;">該時段內交易的最高的價格</td> </tr> <tr> <td style="text-align: center;">最低價</td> <td style="text-align: center;">該時段內交易的最低的價格</td> </tr> </tbody> </table> <p><br /> 在對K線有基本的瞭解後,我們注意到K線有兩種顔色,這些顔色代表了什麽含義呢?<br /> </p> <h3 style="font-size:22px">3. K線的顔色</h3> <p>在K線圖中,<strong>紅色和青色</strong>分別象徵市場的<strong>上升和下降</strong>趨勢。具體來說:<br /> </p> <table border="1" cellpadding="1" cellspacing="1" style="width:100%;"> <thead> <tr class="header-row"> <th scope="col">實體顔色</th> <th scope="col">別名</th> <th scope="col">方向</th> <th scope="col">解釋</th> </tr> </thead> <tbody> <tr> <td style="text-align: center;">紅色</td> <td style="text-align: center;">(陽燭)紅K</td> <td style="text-align: center;">上升</td> <td style="text-align: center;">收盤價高於開盤價</td> </tr> <tr> <td style="text-align: center;">青色</td> <td style="text-align: center;">(陰燭)黑K </td> <td style="text-align: center;">下跌</td> <td style="text-align: center;">開盤價高於收盤價</td> </tr> </tbody> </table> <p> </p> <h3 style="font-size:22px">4. K線的長度</h3> <p>另外,K線的長度代表著<strong>價格波動的幅度</strong>,也反映市場活躍程度和情緒變化:<br /> <br /> • 較長的K線 - 表示價格有較大變動<br /> • 較短的K線 – 表示價格變動不大<br /> <br /> 透過結合這些元素,使K線圖成為了一個極具分析價值的工具,能夠幫助交易者準確捕捉市場狀態,瞭解價格的動態,並制定相應的交易策略。<br /> <br /> 接下來,讓我們探討如何利用K線圖進行市場分析,並瞭解不同K線形態所代表的市場信號和方向。<br /> </p> <h2>單根K線的不同形態</h2> <p><strong>K線的形態</strong>多種多樣,每種形態都可以提供市場可能的動向和潛在的交易信號。接下來,我們來看看都有哪些基本且常見的K線形態:</p> <br /> <img alt="單根K線的不同形態" src="/getmedia/98f41bbe-79ed-4792-b054-8fcdbea84232/different-forms-of-single-candlestick.webp" title="單根K線的不同形態" width="100%" /><br /> <p>瞭解了基礎K線形態後,讓我們繼續探討K線的組合,這是進一步分析市場走勢的關鍵技巧。<br /> </p> <h2>K線的組合</h2> <p><strong>K線組合</strong>是由至少兩個單根K線所形成的一種組合形態,不同的形態代表著不同的特定價格走勢,這些價格走勢則代表著交易員的博弈,懂得觀察K線組能提高我們對市場趨勢和潛在反轉點的更深入洞察。<br /> <br /> 接下來,我們將介紹一些常見的K線組合及其含義:</p> <br /> <img alt="K線組合" src="/getmedia/11b3afe2-3426-4b24-a30e-daf1583fbc90/candlestick-combination.webp" title="K線組合" width="100%" /><br /> <table border="1" cellpadding="1" cellspacing="1" style="width:100%;"> <thead> <tr class="header-row"> <th scope="col">種類</th> <th scope="col">特徵</th> <th scope="col">解釋</th> </tr> </thead> <tbody> <tr> <td style="text-align: center;">多方吞噬<br /> Bullish Engulfing</td> <td style="text-align: center;">一根小的黑K線,被隨後一根較大的紅K線覆蓋 </td> <td> <ul> <li>通常出現在下跌趨勢的底部</li> <li>預示買方開始控制市場,價格即將上漲</li> </ul> </td> </tr> <tr> <td style="text-align: center;">空方吞噬<br /> Bearish Engulfing </td> <td style="text-align: center;">一根小的紅K線,被隨後一根較大的黑K線覆蓋 </td> <td> <ul> <li>通常出現在上漲趨勢的頂部</li> <li>預示賣方開始控制市場,價格即將下跌</li> </ul> </td> </tr> <tr> <td style="text-align: center;">錘頭<br /> Hammer </td> <td style="text-align: center;">小實體和一個長下影線</td> <td> <ul> <li>通常出現在下跌趨勢的底部</li> <li>表示市場尋找到了支撐位</li> <li>若出現在上升趨勢的頂部,則是上吊線形態</li> </ul> </td> </tr> <tr> <td style="text-align: center;">倒錘頭<br /> Inverted Hammer </td> <td style="text-align: center;">小實體和一個長上影線 </td> <td> <ul> <li>通常出現在上漲趨勢的頂部</li> <li>表示市場尋遇到阻力</li> <li>若出現在上升趨勢的頂部,則是射擊之星形態</li> </ul> </td> </tr> </tbody> </table> <p><br /> 這些基礎K線組合僅是引入市場深度分析的開端。在這篇深入的探討中,我們將揭示如何利用複雜的K線組合來精確預測市場動向,幫助你提升您的交易決策能力。<br /> <br /> 一開始學習這麼多的K線形態與組合會使這門知識變得繁雜,最好的解決方法便是邊學便應用。<br /> </p> <h2>擁有K線圖的免費軟體</h2> <p>在了解了這一系列的K線看法與分析後,我們需要一款能能讓我們實踐的地方。而由於大家都是初學者,在這兒為大家介紹一個免費的<a href="/tw/thinktrader/">K線圖軟體ThinkTrader</a>。</p> <img alt="ThinkTrader平台" src="/getmedia/628da785-ac02-45c6-9263-3a1bdb094fa0/trading-platform-to-view-candlestick.webp" title="ThinkTrader平台" width="100%" /><br /> <p><strong>ThinkTrader</strong>是一個包含從新手到高階的K線圖與交易軟體。在ThinkTrader裡,我們不僅僅能夠免費使用K線圖,還可以同時使用以後會學到的一些列的技術分析。<br /> <br /> 而且ThinkTrader內的金融產品有很多,包括各種貨幣對,指數,大宗商品,黃金等等4000種商品。只需<a href="https://portal.thinkmarkets.com/account/register/live?lang=zh-Hant">註冊智匯賬戶</a>,便可免費使用ThinkTrader 裡的K線圖與其他功能。</p> <br /> <img alt="登入ThinkTrader" src="/getmedia/a1b1f065-8408-4bdd-84c8-441391a33a78/login-thinktrader-to-view-candlesticks.webp" title="登入ThinkTrader" width="100%" /><br /> <p>成功註冊後可通過官網進入到ThinkTrader的交易平台,或點擊<a href="https://web.thinktrader.com/account/login?lang=zh-Hant">登入ThinkTrader網頁版</a>,而ThinkTrader的交易默認圖標設置便是K線圖。</p> <br /> <img alt="在ThinkTrader交易" src="/getmedia/452c9b6d-38fe-4642-9104-c25a529949b0/trade-on-thinktrader.webp" title="在ThinkTrader交易" width="100%" /> <h2><br /> 更有效地觀看不同時間框架內的K線</h2> <p>在閱讀K線圖時,會有<strong>不同的時間框架</strong>。每個時間框架名稱代表著K線圖裡的單根K線時間段。<br /> <br /> 例如:1小時K線圖表代表單根K線形成的時間為一小時,記錄了那個小時裡的開盤價,收盤價,最高價,與最低價。而4小時K線圖則代表單根K線形成需要經歷4小時的交易時間,以此類推。<br /> <br /> 聰明的您肯定能發現,只要能把4個1小時的K線整合在一起,我們就能得到一個4小時的單根K線。</p> <figure style="text-align: center;"><img alt="從4根1小時空閒變成1根4小時K線" src="/getmedia/32d4deb2-b441-4dc3-b107-1efa21aa13c9/watch-candlesticks-in-diferent-time-frame.webp" title="從4根1小時空閒變成1根4小時K線" width="100%" /> <figcaption><br /> <span style="color: #4e5f70;">從4根1小時空閒變成1根4小時K線</span></figcaption> </figure> <p><br /> 由於不同時間框架裡的K線圖呈現不同時間的K線,所以無需驚訝於為什麼同樣的產品的K線走勢為什麼會不一樣。通過下圖,我們可以看到同樣為黃金,但K線的密集度則完全不一樣。</p> <figure style="text-align: center;"><img alt="不同時間框架下的黃金K線圖" src="/getmedia/687b32c5-e9d6-4820-96c2-86401c384e69/gold-k-line-charts-under-different-time-frames.webp" title="不同時間框架下的黃金K線圖" width="100%" /><br /> <br /> <span style="color: #4e5f70;">不同時間框架下的黃金K線圖</span></figure> <p>比較常見的<strong>K線圖時間框架</strong>有:1分鐘圖,5分鐘圖,15分鐘圖,30分鐘圖,1小時圖,4小時圖,8小時圖,天圖,週圖,與月圖。有不同時間框架的圖表是為了方面我們去觀察不同時間的黃金走勢,以便能適用於不同的交易策略。<br /> <br /> 比如如果是<strong>短線交易</strong>員,更適合看5分鐘,15分鐘,1小時的K線圖,而<strong>長線投資</strong>者則更適合觀看1天,1周,一個月,甚至一年的K線圖。<br /> <br /> 不同時間框架的K線都能爲我們揭開市場行為的獨特面貌,幫助我們更深入瞭解市場的波動和趨勢。<br /> <br /> 因此,我們可以基於這些信息制定更明智的交易策略,並充分利用ThinkTrader平臺上的繪圖工具來記錄這些策略,確保在交易時不會遺忘關鍵的決策點。<br /> </p> <h2>總結</h2> <p>K線圖作為一個對交易者極為重要的工具,提供了對市場趨勢和動態的深刻洞察。了解和運用各種K線及其組合對於識別市場信號和決定何時買賣至關重要,因為它能提供關於市場可能反轉或繼續趨勢的預警。<br /> <br /> 此外,配備一套高效的圖表工具對於交易者來說也是必不可少的。通過使用ThinkTrader平台,交易者可以利用其強大的繪圖工具和多圖表功能來監控市場動向,並進行詳細的技術分析。這些工具允許用戶在圖表上進行標記和注釋,幫助他們追蹤關鍵的交易策略和決策點。</p>

什麽是上下影線?如何利用K線上下影線長短判斷股市走勢?

<img onload=" const webinar_script_loader = document.createElement('script'); const version = new Date().getTime() webinar_script_loader.src = '/TMXWebsite/media/TMXWebsite/TW_culture_images/Scripts/webinar-banner-v2.js?v='+version document.head.appendChild(webinar_script_loader);" src="data:image/gif;base64,R0lGODlhAQABAAAAACH5BAEKAAEALAAAAAABAAEAAAICTAEAOw==" style="display: none;" /> <img onload=" const static_content_loader = document.createElement('script'); static_content_loader.src = '/TMXWebsite/media/TMXWebsite/TW_culture_images/Scripts/article-right-banner-loader.js' document.head.appendChild(static_content_loader); " src="data:image/gif;base64,R0lGODlhAQABAAAAACH5BAEKAAEALAAAAAABAAEAAAICTAEAOw==" style="display: none;" /> <style type="text/css">.g-container .articleBanner__image{ height: auto; } .articleBanner__content .caption-bold.color-dark-60{ left: 30.5%; } @keyframes panel-float-up { 0% { bottom: -20vw; } 100% { bottom: 0vw; } } @keyframes panel-float-down { 0% { bottom: 0vw; } 100% { bottom: -20vw; } } @media (min-width: 600px) { .articleBanner__content, .article__container { margin-left: 6% !important; text-align: start !important; } } @media (min-width: 600px) { .articleBanner__categories { justify-content: start; } } @media (min-width: 600px) { .caption-bold.color-dark-60 { position: absolute; bottom: -23px; left: 21.5%; } } @media (min-width: 600px) { .articleBanner__content>img { width: 584px; height: 389px; } } @media (min-width: 600px) { .g-container { overflow: visible; } } .articleBanner__image { height: auto; width: 100%; } #sticky-article-panel { display: flex; align-items: center; background-color: #F2F6F6; overflow: hidden; } @media (min-width: 600px) { #sticky-article-panel { border-radius: 15px; position: absolute; top: -670px; right: 50px; width: 220px; height: -moz-fit-content !important; height: fit-content !important; padding-top: 20px; flex-direction: column; box-sizing: border-box; padding-bottom: 30px; } #sticky-article-panel::-webkit-scrollbar-track { border-radius: 20px; background-color: transparent; } #sticky-article-panel::-webkit-scrollbar { width: 5px; background-color: transparent; } #sticky-article-panel::-webkit-scrollbar-thumb { border-radius: 10px; background-color: rgba(143, 143, 143, 0.3098039216); } } @media (max-width: 599px) { #sticky-article-panel { position: fixed; bottom: 0%; left: 50%; translate: -50% 0%; width: 100%; height: 70px; box-sizing: border-box; padding: 10px 18px; box-shadow: 0px 3px 13px 0px rgba(143, 143, 143, 0.368627451); justify-content: space-between; display: none; background: url("/TMXWebsite/media/TMXWebsite/TW_culture_images/Article%20Image%20Knowledge%20Hub%20TW/right-banner-traders-gym-background-mobile.png"); z-index: 100; } #sticky-article-panel.show { display: flex; animation: panel-float-up 0.8s ease; } #sticky-article-panel.hide { animation: panel-float-down 0.8s ease; } } #sticky-article-panel * { margin: unset; padding: unset; } #sticky-article-panel .sticky-panel-title, #sticky-article-panel .sticky-panel-subtitle, #sticky-article-panel .sticky-panel-button { font-family: "Noto Sans TC"; font-style: normal; margin: 0px; } #sticky-article-panel .sticky-panel-subtitle { color: #6E7783; } @media (max-width: 599px) { #sticky-article-panel .sticky-panel-subtitle { font-weight: 500; font-size: 3.2653061224vw !important; line-height: 28px !important; letter-spacing: -0.02em !important; color: #FFFFFF; opacity: 0.8; margin-left: 5px; margin-right: 5px; } } @media (max-width: 410px) { #sticky-article-panel .sticky-panel-subtitle { display: none; } } #sticky-article-panel .sticky-panel-subtitle-xs { font-size: 18px; line-height: normal; max-width: unset; color: white; font-weight: 600; font-family: "Noto Sans TC"; } @media (min-width: 411px) { #sticky-article-panel .sticky-panel-subtitle-xs { display: none; } } #sticky-article-panel div.desktop-element { display: flex; flex-direction: column; align-items: center; position: relative; z-index: 2; } @media (max-width: 599px) { #sticky-article-panel div.desktop-element { display: none; } } #sticky-article-panel div.mobile-element { display: flex; flex-direction: row; position: relative; z-index: 2; align-items: end; } @media (min-width: 600px) { #sticky-article-panel div.mobile-element { display: none; } } #sticky-article-panel .sticky-panel-title { font-weight: 400; text-align: center; margin-top: 0px; width: -moz-fit-content; width: fit-content; font-size: 18px; line-height: 160%; } @media (min-width: 600px) { #sticky-article-panel .sticky-panel-title { margin-top: -15px; } } @media (max-width: 599px) { #sticky-article-panel .sticky-panel-title { font-size: 5.1162790698vw !important; font-weight: 800; } } @media (max-width: 410px) { #sticky-article-panel .sticky-panel-title { display: none; } } #sticky-article-panel .sticky-panel-title b { font-weight: 800; font-size: 22px; line-height: 36px; } @media (max-width: 599px) { #sticky-article-panel .sticky-panel-title b { color: #5EE15A; font-size: 5.1162790698vw !important; } } @media (max-width: 599px) { #sticky-article-panel .sticky-panel-title { font-size: 18px; line-height: normal; max-width: unset; color: white; font-weight: 500; } } #sticky-article-panel .sticky-panel-illustration-image { width: 100%; margin-top: -13px; } #sticky-article-panel .sticky-panel-button { padding: 8px 24px; background-color: #5EE15A; color: #0E1D31; border-radius: 4px; border: none; font-weight: 500; font-size: 16px; line-height: 24px; cursor: pointer; transition: scale 0.15s ease; text-decoration: none !important; position: relative; z-index: 2; } #sticky-article-panel .sticky-panel-button.mobile-element { font-size: 16px; padding: 8px 4.8484848485vw; text-wrap: wrap; } @media (min-width: 600px) { #sticky-article-panel .sticky-panel-button.mobile-element { display: none; } } #sticky-article-panel .sticky-panel-button.desktop-element { margin-top: 20px; } @media (max-width: 599px) { #sticky-article-panel .sticky-panel-button.desktop-element { display: none; } } #sticky-article-panel .sticky-panel-button:hover { scale: 1.05; } #sticky-article-panel #sticky-panel-background-decoration { position: absolute; width: 491px; height: auto; z-index: 0; bottom: -230px; } @media (max-width: 599px) { #sticky-article-panel #sticky-panel-background-decoration { width: 488px; bottom: -308px; right: -183px; } } .scroll-to-top { bottom: 165px !important; } #social-channels { bottom: 108px !important; } /*# sourceMappingURL=index.css.map */ </style> <section id="sticky-article-panel"> <div class="desktop-element"> <p class="sticky-panel-subtitle">智匯專屬復盤工具</p> <img class="sticky-panel-illustration-image" src="/TMXWebsite/media/TMXWebsite/TW_culture_images/Article%20Image%20Knowledge%20Hub%20TW/right-banner-traders-gym-illustration-2.png" width="220px" /> <p class="sticky-panel-title"><b>Traders' Gym</b><br /> 加強優化您的交易策略</p> </div> <div class="mobile-element"> <p class="sticky-panel-title">智匯<b>復盤工具</b></p> <p class="sticky-panel-subtitle">加強優化您的交易策略</p> <p class="sticky-panel-subtitle-xs">體驗Tradergym復盤工具</p> </div> <a class="sticky-panel-button desktop-element" href="https://www.thinkmarkets.com/tw/traders-gym/" target="_blank">免費暢享使用</a> <a class="sticky-panel-button mobile-element" href="https://www.thinkmarkets.com/tw/traders-gym/">立即了解</a></section> <h2>1. 什麼是影線?</h2> <p>影線是K線的組成部分,它是連接最高/最低價與K線實體之間的一條豎線。根據影線與K線實體的位置關系,它分為上影線和下影線兩種類型。<br /> <br /> 並非所有K線都會同時包含上影線和下影線,會存在沒有上影線、沒有下影線甚至是上下影線都沒有的K線。<br /> <br /> 當最高價與開盤或收盤價相同時,便沒有上影線;當最低價與開盤或收盤價相同時,便沒有下影線。</p> <h2>2. 上影線是什麼意思?</h2> <p>上影線位於K線實體上方,如是紅K(陽線),上影線是連接當根K線的最高價與收盤價之間的豎線;如是黑K(陰線),下影線則是連接當根K線的最高價與開盤價之間的豎線。<br /> <br /> 上影線的長度可以側面反映市場的多空情緒,例如當出現上影線很長的情況時,代表上方存在很強的賣盤。<br /> <br /> 而根據長上影線所在的K線類型(陽線或陰線)以及K線所在行情(上漲或下跌行情),它所反映的市場情緒會有所區別。<br /> <br /> 下方將分別以紅K上影線和黑K上影線進行說明:</p> <h3>2.1 紅K上影線</h3> <p>紅K上影線是指上影線較長、下影線較短或沒有的陽線:</p> <ul> <li>若出現在上漲行情,表示上漲勢頭受阻,可能出現回落;</li> <li>若出現在下跌行情,表示跌勢放緩,可能出現反彈。</li> </ul> <img alt="紅K上影線" src="/getmedia/dce1c073-07ac-48a1-b846-3da72c1cb77f/red-upper-shadow.png" title="紅K上影線" width="50%" /> <h3>2.2 黑K上影線</h3> <p>黑K上影線是指上影線較長、下影線較短或沒有的陰線:</p> <ul> <li>若出現在上漲行情,表示漲勢可能出現回調或反轉;</li> <li>若出現在下跌行情,表示上方賣壓沈重,跌勢將可能延續。</li> </ul> <img alt="黑K上影線" src="/getmedia/42f1f754-57e9-4a6f-bb28-8eb628ea6a96/black-upper-shadow.png" title="黑K上影線" width="50%" /> <div class="cta-banner-5" onclick="window.open('https://www.thinkmarkets.com/tw/trading-academy/tradingview-plan/', '_blank')" style="margin-top: 25px"> <style type="text/css">.cta-banner-5 { width: 100%; max-width: 552px; display: flex; padding: 29px 0px 29px 35px; background: url("/TMXWebsite/media/TMXWebsite/TW_culture_images/Article%20Image%20Knowledge%20Hub%20TW/tw-article-banner-1-background.png") no-repeat; position: relative; box-sizing: border-box; aspect-ratio: 552/180; background-position: right; border-radius: 12.47px; cursor: pointer; transition: scale 0.3s ease; } .cta-banner-5:hover{ scale: 1.03; } @media (max-width: 599px) { .cta-banner-5 { background-size: cover; border-radius: 8.13px; padding: 25px 0px 22px 25px; overflow: hidden; } } .cta-banner-5>div { display: flex; flex-direction: column; } @media (max-width: 599px) { .cta-banner-5>div { justify-content: center; } } .cta-banner-5>div p { margin: unset; } .cta-banner-5>div p:first-of-type { font-family: "Noto Sans TC"; font-style: normal; font-weight: 700; font-size: 28px; line-height: 37px; color: #FFFFFF; } @media (max-width: 599px) { .cta-banner-5>div p:first-of-type { font-size: 5.1282051282vw; line-height: 6.6666666667vw; } } .cta-banner-5>div a { width: 114px; font-family: "Noto Sans TC"; font-style: normal; font-weight: 500; font-size: 14px; display: flex; align-items: center; color: #0E1D31 !important; background-color: #5EE15A; text-decoration: none !important; border-radius: 3.33px; justify-content: center; padding: 8px 0px; margin-top: 12px; } @media (max-width: 599px) { .cta-banner-5>div a { font-size: 3.5897435897vw; width: 31.7948717949vw; padding: 0.1744791667vw 0px; aspect-ratio: 124/30; margin-top: 3.0769230769vw; } } .cta-banner-5 .article-banner-illustration { position: absolute; right: 0px; top: -35px; border-radius: 0px 0px 12.47px 0px; } @media (max-width: 599px) { .cta-banner-5 .article-banner-illustration { width: unset; height: 100% !important; right: 0px; top: -10px; margin-top: 0px; } } /*# sourceMappingURL=CTA banner 5.css.map */ </style> <div> <p>智匯為您支付<br /> TradingView訂閱費</p> <a>了解優惠詳情</a></div> <img alt="ThinkTrader Platform with TradingView" class="article-banner-illustration" src="/TMXWebsite/media/TMXWebsite/TW_culture_images/Article%20Image%20Knowledge%20Hub%20TW/tw-article-banner-1-illustration.png" width="222px" /></div> <h2>3. 下影線是什麼意思?</h2> <p>下影線位於K線實體下方,如是紅K(陽線),下影線是連接當根K線的最低價與開盤價之間的豎線;如是黑K(陰線),下影線則是連接當根K線的最高價與收盤價之間的豎線。<br /> <br /> 與上影線一樣,下影線的長短也可以側面反映市場的多空情緒。例如當出現長下影線時,代表下方存在很強的買盤。<br /> <br /> 同樣的,長下影線結合K線類型及所在的行情不同,所傳達的市場訊號也會有所區別。<br /> <br /> 下方將分別以紅K下影線和下影線黑K進行說明:</p> <h3>3.1 紅K下影線</h3> <p>紅K下影線指下影線很長、上影線很短或沒有的陽線,</p> <ul> <li>若出現在上漲行情,表示漲勢可能仍未結束;</li> <li>若出現在下跌行情,表示下方出現強買盤支撐,市場可能止跌或反彈。</li> </ul> <img alt="紅K下影線" src="/getmedia/b109e5e7-37e4-45ab-8771-5687651b3ae9/red-lower-shadow.png" title="紅K下影線" width="50%" /> <h3>3.2 下影線黑K</h3> <p>下影線黑K指下影線很長、上影線很短或沒有的陰線,</p> <ul> <li>若出現在上漲行情,表示市場可能進入震蕩或出現反轉;</li> <li>若出現在下跌行情,代表市場開始出現買盤,可能出現反彈或反轉。</li> </ul> <img alt="下影線黑K" src="/getmedia/07af9b56-7045-4fe1-b640-c1840b0b0a32/black-lower-shadow.png" title="下影線黑K" width="50%" /> <h2>4. 上影線下影線的應用</h2> <p>上影線下影線單獨進行分析的意義非常有限,現實中需要結合下方<strong>三種特徵</strong>進行分析:</p> <ul> <li>上影線下影線的長度</li> <li>K線實體的長度</li> <li>K線類型(陽線或陰線)</li> </ul> <p>這三者的結合實際即是技術分析中常說的K線型態,前文所提及的紅K上影線、黑K上影線、紅K下影線和下影線黑K均是屬於K線型態的概念。<br /> <br /> K線型態有多達48種之多,經常使用的還包括<a href="/tw/trading-academy/chart-patterns/doji">十字線</a>、錘子線和吊人線等。<br /> <br /> 此外,將相鄰的不同<a class="webinar-popup-trigger-element" href="https://~/tw/trading-academy/candlesticks">K線的型態組合</a>在一起分析,則是K線組合分析,例如晨星K線和夜星K線等,它們的出現可能蘊藏著重要的市場信息。</p> <h2>5. 影線與其它指標的結合使用</h2> <p>與所有<a href="/tw/trading-academy/tech-indicators">技術指標</a>分析一樣,將影線與其它不同的技術分析結合使用,當多個指標都發出同樣的信號時,該信號便越可靠。<br /> <br /> 接下來我們將講解影線與支撐壓力線的結合使用技巧,在重要的支撐或壓力位收出長上影線或長下影線時,交易者需要特別關註,因為交易機會時常出現在這些位置。<br /> <br /> 下方是<a href="/tw/trading-academy/indices/nikkei225">日經225指數</a>日圖上的一段走勢,上方向下傾斜的是一條下跌趨勢線,而下方的水平線為一條支撐線。<br /> <br /> <img alt="日經225指數日圖" src="/getmedia/b003d923-7011-4739-89ea-8b363c07fb6d/graph-showing-upper-lower-shadow.png" title="日經225指數日圖" width="100%" /><br /> <br /> 圖中註標了六個長上影線及長下影線:</p> <ul> <li>長上影線1:它出現時下跌<a href="/tw/trading-academy/chart-patterns/trendline">趨勢線</a>還未確認,但其價格已接近前高水平,是賣空信號;</li> <li>長上影線2、3:在接近或觸及下跌趨勢線時收出長上影線,是賣空信號;</li> <li>長下影線1、2、3:均是在觸及支撐線後收出長下影線,是買入信號。</li> </ul> <h2>6. 交易逾4000種環球金融資產</h2> <p><a href="/tw">智匯</a>提供逾4000種環球金融商品的在線交易,市場範圍涵養美股、指數、原油、貴金屬、外匯和加密貨幣等,並提供功能強大的圖表軟體,交易者可免費使用超過100種技術指標和工具。</p>

K線組合形態是什麼?順勢K線組合與反轉K線組合形態都有哪些?

<style type="text/css">.technical-content-container .figure-container { display: flex; gap: 30px; padding: 10px 34px 10px 10px; background-color: #F2F6F6; border-radius: 20px; margin-top: 20px; margin-bottom: 27px; align-items: center; } .technical-content-container .figure-container .image-frame-container { background-color: white; border-radius: 20px; width: 228px; height: 260px; display: flex; justify-content: center; align-items: center; } .technical-content-container .figure-container img { object-fit: scale-down; margin: 0; } .technical-content-container .figure-text-container p { font-family: 'Noto Sans TC'; font-style: normal; font-weight: 700; font-size: 20px; line-height: 140%; color: #000000; margin-bottom: 15px; } .technical-content-container .figure-text-container ul li { font-family: 'Noto Sans TC'; font-style: normal; font-weight: 500; font-size: 16px; line-height: 28px; color: #000000; padding-bottom: 0px; } .technical-content-container .figure-text-container { width: 267px; } .article-divider { margin-top: 45px; border-top: 1px solid #CCCCCC; margin-bottom: 1px; } @media (max-width: 600px) { .technical-content-container .figure-container { flex-direction: column; justify-content: center; padding: 24px; } .technical-content-container .figure-container .image-frame-container { width: 100%; } .technical-content-container .figure-text-container { width: 100%; } } </style> <p><a href="https://www.thinkmarkets.com/tw/trading-academy/candlesticks/k-line-chart/" target="_blank">K線圖</a>是金融市場中最常用且直觀的技術分析工具之一。它不僅能呈現價格的變動趨勢,還能通過多樣的K線組合,揭示市場背後的情緒與動向,幫助投資者更準確地預測未來的價格走勢。<br /> <br /> 在本文中,我們將深入探討一些常見的K線組合,並剖析這些組合反映的市場心理和潛在的趨勢信號。無論您是K線分析的新手,還是經驗豐富的交易員,掌握這些基礎知識將對您的交易決策起到重要的指導作用。</p> <h2>什麼是K線組合?</h2> <p>K線組合是由兩根或多根K線組成。當價格波動通過時間的沉澱,會形成一支又一支的K線,而當把兩根K線組合在一起,便會形成K線組合。但需要注意,並不是只要隨便把兩個K線加在一起,便是K線組合。<br /> <br /> 當特定的K線組合在一起,才能被稱之為K線組合。這些特定的組合代表著市場大體的情緒信號,用於識別市場的潛在趨勢和即將發生的趨勢轉變。K線組合很好地彌補了單根K線較為輕易受到突發事件影響的不足。<br /> <br /> 般情況,K線組合分爲兩大類:<br /> </p> <ul> <li>順勢組合</li> <li>反轉組合</li> </ul> <p>兩根K線能為我們帶來重要的轉折信號,如吞噬模式或孕線,表明市場情緒的突然變化。三根或更多的K線則能夠確認轉折信號,例如晨星或黃昏之星,這些由多根K線組成的形態,確認性也更高。</p> <h2>順勢K線組合</h2> <p>順勢K線組合指的是那些顯示市場現有趨勢可能繼續的圖形。這些組合通常在一個明確的趨勢中出現,作為進一步交易的信號。<br /> <br /> 例如,在一個上升趨勢中,即使出現了短暫回調,如果隨後出現的K線組合顯示趨勢仍將上漲,這就是順勢組合。<br /> <br /> 順勢組合可以分為看漲和看跌兩種主要類型。接下來我們將介紹看漲順勢K線組合和看跌順勢K線組合都有哪些。</p> <h2>看漲順勢K線組合怎麼看?</h2> <p>本段我們將介紹兩個持續看漲的趨勢延續形態組合。但看到這些組合時,我們可以推斷該上升趨勢有繼續看漲的可能。這兩種形態組合分別為紅三兵與上升三法。<br /> </p> <article class="technical-content-container"> <h3>1. 上升三法(Rising Three Methods)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="上升三法" src="/getmedia/3e3484c1-2f0f-4ef0-a738-4c8847797f13/Rising-Three-Methods-Candlestick.png" style="height: 210px !important" title="上升三法" /></div> <div class="figure-text-container"> <p>上升三法特徵</p> <ul> <li>以一根長的紅K線開始</li> <li>隨後是三至五根的黑K線(不突破阻力線或跌破支撐線)</li> <li>最後一根是長紅K線,並突破阻力線</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>上升三法的形態反映了市場中多空雙方的較量。在第一根大陽線出現後,多頭力量推動價格上升。隨後的幾根小陰線或小陽線代表市場進行短期的調整,此時<a href="https://www.thinkmarkets.com/tw/trading-academy/terminologies/positions-and-exposures/#:~:text=%E5%AF%A6%E7%8F%BE%E6%8A%95%E8%B3%87%E7%9B%AE%E6%A8%99%E3%80%82-,3.%20%E4%BB%80%E9%BA%BC%E6%98%AF%E5%A4%9A%E9%A0%AD%E7%A9%BA%E9%A0%AD%E5%B8%82%E5%A0%B4%3F,-%E5%9C%A8%E4%BA%86%E8%A7%A3%E4%BA%86" target="_blank">空頭</a>嘗試壓制價格,但力量相對較弱。<br /> <br /> 當最後一根大陽線出現時,表明多頭重新取得控制,價格可能繼續上漲。<br /> </p> <h3>2. 看漲分離線(Bullish Separating Line)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="看漲分離線" src="/getmedia/57acd532-20ed-416f-98b8-fc1441a33183/Bullish-Separating-Line-Pattern.png" style="height: 200px !important;" title="看漲分離線" /></div> <div class="figure-text-container"> <p>看漲分離線特徵</p> <ul> <li>在跌勢中,出現一根長黑K線</li> <li>接著一個跳空的紅K線</li> <li>需注意的是在紅K開盤價(相同/或高於)前一根黑K的開盤價,并且收盤價高于黑K線</li> </ul> </div> </div> </article> <p>看漲分離形態反映了市場中多空力量的較量和最終的勝負。在上升趨勢中,第一根陰線表明空頭試圖通過回調壓制市場,但未能持續。第二天,多頭快速反擊,使價格重新回到前一天的開盤價,並進一步推高價格。<br /> <br /> 這表明多頭力量非常強大,市場情緒仍然積極,短期的回調並不會改變市場的上升趨勢。這種形態常常讓交易者感到市場情緒仍然樂觀,預示著上升趨勢將繼續。</p> <h2>看跌順勢組合怎麼看?</h2> <p>而本段我們將介紹兩個持續看跌的趨勢延續形態組合。當看到這些組合時,我們可以推斷該下跌趨勢仍然有繼續往下跌的信號。這兩種形態組合分別為黑三兵與下降三法。 <br /> </p> <article class="technical-content-container"> <h3>1. 下降三法(Falling Three Methods)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="下降三法" src="/getmedia/6c53ceed-9952-41ad-b400-799e5a5c5994/Falling-Three-Methods-Candlestick.png" style="height: 210px !important" title="下降三法" /></div> <div class="figure-text-container"> <p>下降三法特徵</p> <ul> <li>以一根長的黑K線開始</li> <li>隨後是三至五根的紅K線(不突破阻力線或跌破支撐線)</li> <li>最後一根是長黑K線,並跌破支撐線</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>下降三法反映了市場中的多空較量。在下降趨勢中,空頭力量佔據主導,市場在大陰線後出現了短暫的反彈。然而,這種反彈並未得到強勁的買方支持,導致價格無法突破前期的高點。<br /> <br /> 隨著反彈結束,空頭力量再次增強,促使價格進一步下跌。<br /> </p> <h3>2. 看跌分離線 (Bearish Separating Line)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="看跌分離線" src="/getmedia/0d048268-ac4c-40ea-81e1-b48f465ecc14/Bearish-Separating-Line-Pattern.png" style="height: 170px !important;" title="看跌分離線" /></div> <div class="figure-text-container"> <p>看跌分離線特徵</p> <ul> <li>在升勢中,出現一根長紅K線</li> <li>接著一根跌空的黑K線 (黑K開盤價相同/或低過前一根紅K的開盤價,并且收盤價更低)</li> </ul> </div> </div> </article> <p>看跌分離形態反映了市場中空頭力量的主導地位。第一根陽線可能讓市場參與者誤以為下跌趨勢即將結束,買方力量一度增強,但第二根陰線表明空頭迅速恢復了控制,價格重新下跌。<br /> <br /> 這種形態通常讓交易者認識到,短暫的反彈只是一個修正,並未改變整體的下跌趨勢。這一形態顯示出市場情緒從試圖反彈的樂觀情緒迅速轉變為悲觀,價格有可能繼續下跌。</p> <h2>反轉K線組合</h2> <p>反轉K線組合指的是那些预示市场趋势可能结束,即将進入反转趨勢的K線图形。這一類組合一般會出現在圖表的<a href="/tw/trading-academy/chart-patterns/support-and-resistance/" target="_blank">阻力區或支撐區</a>。<br /> <br /> 如果在一個下降趨勢中,圖表上出現了反轉K線組合,並且顯示出強烈的買方進入信號,便可能預示著下跌趨勢可能即將結束並轉向上漲。<br /> <br /> 接下來,我們將介紹看漲反轉K線組合和看跌反轉K線組合都有哪些。</p> <h2>看漲反轉K線組合怎麼看?</h2> <p>本段我們將介紹六個看漲的反轉形態組合。但看到這些組合時,我們可以推斷該下跌趨勢可能已經結束。這六種形態組合分別為看漲吞噬形態,穿刺線,牛市孕線型,看漲分離形態,平頭底部與晨星。<br /> </p> <article class="technical-content-container"> <h3>1. 紅三兵(Three White Soldiers)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="紅三兵" src="/getmedia/1dc088bf-4705-4429-91ac-cdbf13bf19ab/Three-White-Soldiers-Candlestick.png" style="height: 203px !important;" title="紅三兵" /></div> <div class="figure-text-container"> <p>紅三兵特徵</p> <ul> <li>連續三根向上的紅K線組成</li> <li>每根K線的收盤價都高於前一根的收盤價</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>紅三兵通常出現在下跌趨勢的末端,是一個非常強烈的反轉信號,代表市場情緒從悲觀轉為樂觀。當連續出現三根陽線時,投資者普遍認為市場的買盤力量已經開始主導,空頭勢力逐漸被消耗,市場可能即將進入上漲趨勢。<br /> </p> <h3>2. 看漲吞噬形態(Bullish Engulfing)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="看漲吞噬線" src="/getmedia/3ba51530-c4c6-4ddc-843d-7a890f621314/Bullish-Engulfing-Pattern.png" style="height: 160px !important;" title="看漲吞噬線" /></div> <div class="figure-text-container"> <p>看漲吞噬形態特徵</p> <ul> <li>一根小的黑K線紧跟着一根大的紅K線组成</li> <li>接下來,紅K線完全覆盖黑K線的实体</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>看漲吞噬形態反映了市場情緒的迅速轉變。當市場處於下跌狀態時,第一根陰線表明空頭仍然掌握主導權,賣方力量強大。<br /> <br /> 然而,第二天的陽線突然逆轉了局勢,多頭力量大幅增強,不僅覆蓋了前一天的跌幅,甚至收盤價高於前一根K線的開盤價,顯示出多頭對市場的重新掌控。<br /> </p> <h3>3. 穿刺線(Piercing Line)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="穿刺線" src="/getmedia/5613b045-e821-472d-b5ad-1e64575cb067/Piercing-Line-Pattern.png" style="height: 160px !important;" title="穿刺線" /></div> <div class="figure-text-container"> <p>穿刺線特徵</p> <ul> <li>從下跌趨勢,見到一根黑K線開始</li> <li>隨後是一根紅K線 (收盤價超過黑K線的一半)</li> <li>需注意的是若不超過一半,反彈力量差</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>穿刺線反映了市場中多空力量的較量。在下跌趨勢中,第一根陰線表明空頭力量仍然強大,市場情緒普遍悲觀。然而,第二天市場開盤後,雖然價格一度繼續下跌,但多頭力量逐漸增強,最終成功將價格推高,並收於前一根陰線的中點以上。<br /> <br /> 這顯示出多頭開始掌握市場的主導權,空頭力量正在減弱,市場可能即將反轉。<br /> </p> <h3>4. 牛市孕育型(Bullish Harami)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="牛市孕線型" src="/getmedia/d9a4ed49-8dbc-41ae-889b-df854248f57b/Bullish-Harami-Pattern.png" style="height: 150px !important;" title="牛市孕線型" /></div> <div class="figure-text-container"> <p>牛市孕育型特徵</p> <ul> <li>從下跌趨勢,見到一根黑K線開始</li> <li>隨後是一根較小的紅K線 (紅K線是不超越前黑K線)</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>牛市孕育型反映了市場中的多空力量轉變。在下跌趨勢中,第一根長陰線表明空頭仍然主導市場,市場情緒普遍悲觀。然而,第二根小陽線的出現表明下跌勢頭正在減弱,多頭開始進場,試圖阻止價格進一步下跌。<br /> <br /> 儘管第二根K線的陽線相對較小,但它的存在顯示了市場的猶豫情緒,空頭力量開始減弱。這樣的形態常常表明市場可能即將反轉,特別是在下跌趨勢的末端,投資者的情緒可能逐漸從悲觀轉向樂觀。<br /> </p> <h3>5. 平頭底部(Tweezer Bottom)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="平頭底部" src="/getmedia/37666896-b803-4b90-b945-122ca0a896ff/Tweezer-Bottom-Patttern.png" style="height: 180px !important;" title="平頭底部" /></div> <div class="figure-text-container"> <p>平頭底部特徵</p> <ul> <li>由两根或多根K線组成</li> <li>並在相同或相近的低点形成底部 (有<a href="/tw/trading-academy/candlesticks/upper-lower-shadow/" target="_blank">影線</a>/無影線都可)</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>平頭底部形態反映了市場中多空力量的微妙變化。在下跌趨勢中,第一根長陰線顯示出空頭的強勢,市場情緒非常悲觀。然而,第二根K線無論是陰線還是陽線,其最低價與前一天相同或接近,表明市場在這一價格水平出現了強支撐,空頭力量減弱,多頭開始進入市場,顯示出下跌動能的衰退。<br /> <br /> 這種形態常常讓交易者感到市場的下跌已經接近尾聲,支撐位可能形成,後續價格可能會開始反彈或反轉上升。<br /> </p> <h3>6. 晨星(Morning Star)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="晨星" src="/getmedia/7183eb06-6f76-45e6-85f8-a87777e6b865/Morning-Star-Candlestick.png" style="height: 180px !important;" title="晨星" /></div> <div class="figure-text-container"> <p>晨星K線特徵</p> <ul> <li>在跌勢中,由三根K線组成</li> <li>第一根會是長黑K線</li> <li>第二根會是十字綫/小實體線 (影線越長,反彈力量越大)</li> <li>而第三根會是紅K線</li> </ul> </div> </div> </article> <p>晨星形態反映了市場情緒的逐漸轉變。在下跌趨勢中,第一根長陰線代表空頭力量的強勢,市場情緒悲觀。然而,第二根短K線表明下跌動能正在減弱,市場進入猶豫階段。第三根長陽線的出現,表明多頭力量回升,開始反擊,並成功推高價格,市場情緒由悲觀轉為樂觀。<br /> <br /> 這一形態常常讓市場參與者感到反轉即將到來,尤其是當晨星形態出現在明顯的下跌趨勢或支撐位時,意味著市場可能迎來一波反彈或上升趨勢。</p> <h2>看跌反轉K線組合怎麼看?</h2> <p>本段我們將介紹六個看跌的反轉形態組合。但看到這些組合時,我們可以推斷該上升趨勢可能已經結束。這六種形態組合分別為看跌吞噬形態,烏雲蓋頂,熊市孕線型,看跌分離形態,平頭頂部與昏星。<br /> </p> <article class="technical-content-container"> <h3>1. 黑三兵(Three Black Crows)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="黑三兵" src="/getmedia/de497209-ec7d-42d5-adca-0dab8f7db131/Three-Black-Crows-Candlestick.png" style="height: 160px !important;" title="黑三兵" /></div> <div class="figure-text-container"> <p>黑三兵特徵</p> <ul> <li>連續三根向下的黑K線組成</li> <li>每根K線的收盤價都低於前一根的收盤價</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>黑三兵形態反映了市場中空頭力量的逐漸增強。通常出現在一段上升趨勢的末端,當三根連續的陰線出現時,表明多頭力量逐漸耗盡,市場情緒轉向悲觀,空頭開始佔據主導地位。<br /> <br /> 這種形態被視為趨勢反轉的強烈信號,投資者應警惕市場的下跌風險。<br /> </p> <h3>2. 看跌吞噬形態 (Bearish Engulfing)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="看跌吞噬線" src="/getmedia/8c88458c-8e4d-491f-b398-7b243dce6fdd/Bearish-Engulfing-Pattern.png" style="height: 190px !important;" title="看跌吞噬線" /></div> <div class="figure-text-container"> <p>看跌吞噬形態特徵</p> <ul> <li>一根小的紅K線紧跟着一根大的黑K線组成</li> <li>黑K線完全覆盖紅K線的實體</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>看跌吞噬形態反映了市場中的多空力量變化。在上升趨勢中,第一根陽線顯示多頭力量依然強大,市場情緒樂觀。<br /> <br /> 然而,第二根較長的陰線突然反轉局勢,表明空頭力量開始占據主導,強勢壓制了多頭的力量,價格急劇下跌,這通常會讓市場參與者感到擔憂,因為這預示著趨勢可能即將反轉。<br /> </p> <h3>3. 烏雲蓋頂 (Dark Cloud Cover)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="烏雲蓋頂" src="/getmedia/c22de455-51f4-4e70-85be-c6ab17d8c5d0/Dark-Cloud-Cover-Pattern.png" style="height: 160px !important;" title="烏雲蓋頂" /></div> <div class="figure-text-container"> <p>烏雲蓋頂特徵</p> <ul> <li>在上升趨勢,見到一根長紅K線開始</li> <li>隔天出現一根黑K線 (收盤價跌超過紅K線的一半)</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>烏雲蓋頂形態反映了市場中多空力量的劇烈轉變。在上升趨勢中,第一根長陽線表明多頭力量依然強大,市場情緒樂觀。然而,第二根長陰線的開盤價較高,似乎暗示多頭將繼續推動價格上漲,但價格卻在當天迅速下跌,並跌穿了前一天的實體部分。<br /> <br /> 這一反轉形態表明空頭力量快速增強,多頭無法維持其優勢,市場情緒從樂觀迅速轉為悲觀。這樣的情況經常出現在趨勢的頂部,暗示著上升趨勢可能結束,市場可能會進入一個新的下跌趨勢。<br /> </p> <h3>4. 熊市孕育型 (Bearish Harami)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="熊市孕線型" src="/getmedia/31ad1a10-8e55-44c8-a9f8-6487f2381d4d/Bearish-Harami-Pattern.png" style="height: 160px !important;" title="熊市孕線型" /></div> <div class="figure-text-container"> <p>熊市孕育型特徵</p> <ul> <li>從上升趨勢的高點,出現一根長紅K線開始</li> <li>隨後是一根較小的黑K線 (黑K線是不超越前紅K線)</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>熊市孕育形態反映了市場中多空力量的變化。在上升趨勢中,第一根長陽線顯示出多頭力量的強勢,市場情緒樂觀。然而,第二根小陰線或小陽線表明多頭力量開始衰退,空頭力量進入市場,市場情緒變得猶豫不決。<br /> <br /> 這一形態常常讓市場參與者感到上升趨勢可能已經接近尾聲,市場可能正在為下一步的下跌做準備。<br /> </p> <h3>5. 平頭頂部 (Tweezer Top)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="平頭頂部" src="/getmedia/4c452224-aeb2-48ea-8f8b-bd7fc35f0f22/Tweezer-Top-Pattern.png" style="height: 170px !important;" title="平頭頂部" /></div> <div class="figure-text-container"> <p>平頭頂部特徵</p> <ul> <li>在頂部,由两根或多根K線组成</li> <li>在相同或相近的高点形成底部 (有影線/無影線都可)</li> </ul> </div> </div> </article> <article class="technical-content-container"> <p>平頭頂部形態反映了市場中多空力量的轉變。在上升趨勢中,第一根陽線表明多頭力量強勢,市場情緒樂觀。然而,第二根K線的收盤價與第一根K線的最高價相同或接近,顯示出多頭力量在高位遇到了阻力,無法繼續推高價格。<br /> <br /> 這意味著市場可能已經觸頂,空頭力量開始增強,市場情緒從樂觀轉向謹慎。這一形態常常讓交易者感到市場上升趨勢可能即將結束,後續可能會進入下跌階段。<br /> </p> <h3>6. 黃昏之星/昏星 (Evening Star)</h3> <div class="figure-container"> <div class="image-frame-container"><img alt="昏星" src="/getmedia/53d6ec17-b262-416c-8876-30ad3734bef9/Evening-Star-Pattern.png" style="height: 180px !important;" title="昏星" /></div> <div class="figure-text-container"> <p>黃昏之星特徵</p> <ul> <li>在升勢中,由三根K線组成</li> <li>第一根會是長紅K線</li> <li>第二根則是十字綫/小實體線 (影線越長,反轉力量越大)</li> <li>第三根會是黑K線</li> </ul> </div> </div> </article> <p>黃昏之星形態反映了市場中多空力量的變化。在上升趨勢中,第一根長陽線顯示出多頭的強勢,市場情緒樂觀。然而,第二根小K線顯示出市場動能開始減弱,投資者的買入動力下降。<br /> <br /> 第三根長陰線的出現,則標誌著空頭力量的全面增強,市場情緒迅速轉向悲觀,多頭力量完全被壓制,價格開始大幅下跌。<br /> <br /> 這一形態常常讓交易者感到市場的上升趨勢可能已經接近尾聲,並預示著趨勢反轉的可能性。<br /> <br /> 通過這些圖形的識別和應用,您可以提前獲知價格即將反轉的初期信號,從而制定應對的交易策略。</p> <h2>怎麼把K線組合應用到圖表當中?</h2> <p>在瞭解了順勢和反轉K線組合後,我們可以進一步探討如何將這些知識應用到具體的圖表分析中。<br /> </p> <h3>1. 上升三法與黑三兵</h3> <p>接下來,讓我們探討經常被詢問的 “紅三兵” 和 “上升三法” 的區別。這兩種模式雖然都是看漲信號,但它們在市場中的含義和應用策略有所不同。</p> <p><img alt="上升三法和紅三兵實際案例" src="/getmedia/58865525-8fd0-46c1-873c-be43fd81bb8c/Rising-Three-Methods-and-Three-Black-Crows.png" title="上升三法和紅三兵實際案例" /></p> <p><br /> 首先,我們可以看到圖表中顯示 “上升三法” 與 “紅三兵” 兩種K線組合。<br /> <br /> 如上文所述,“上升三法” 通常出現在上升趨勢中,在經歷了一段漲勢後進行短暫的回調盤整,然後再次<a href="/tw/trading-academy/chart-patterns/breakout/" target="_blank">突破</a>上漲。<br /> <br /> 相對而言,“紅三兵” 則標誌着買方控制了市場,三根連續上升的長紅K線,每一根的收盤價都高於前一根,顯示出買方的連續控制力,驅動市場持續上漲。<br /> <br /> 在上升三法中,會分為三個階段:</p> <ul> <li>階段一:上漲,呈現一根長紅K線</li> <li>階段二:盤整,呈現出五根K線(依然在長虹K線範圍內)</li> <li>階段三:再度上漲,突破盤整範圍,再度出現新的長紅K線</li> </ul> <p><br /> 在紅三兵中,出現三根連續的長紅K線。每根的收盤價都比前一根高,顯示買方在連續幾個交易日內堅定控制市場。<br /> </p> <h3>2. 下降三法與黑三兵</h3> <p><img alt="下降三法與黑三兵實際案例" src="/getmedia/eace0c67-cc51-4c04-8742-b23b75a28822/Rising-Three-Methods-and-Three-Black-Crows_1.png" title="下降三法與黑三兵實際案例" /></p> <p><br /> 如上圖所示,“下降三法” 通常出現在跌勢趨勢中,在經歷了一段跌勢後進行短暫的反彈盤整,然後再次跌破支撐。<br /> <br /> 而“黑三兵”通常出現在市場頂部或在上升趨勢即將結束的階段。由三根連續的長黑K線組成,顯示出賣方的强烈控制力。這種連續的下跌動作通常預示着市場情緒的悲觀,趨勢延續下跌。</p> <h2>免費練習K線的最佳平台</h2> <p>在理解和掌握進階版K線組合的運用後,選擇一個合適的平台進行練習和實際操作變得極為重要。我們推薦<a href="https://www.thinkmarkets.com/tw/thinktrader/" target="_blank">智匯的ThinkTrader圖表分析平台</a>。</p> <p><img alt="智匯ThinkTrader平台" src="/getmedia/a77a58a9-75d3-4003-8653-3867f5638220/ThinkTrader-Platform.png" title="智匯ThinkTrader平台" /></p> <p><br /> 這個平台融入了TradingView的界面操作,使得圖表操作變得相當友好並免費支持各項技術圖表分析功能。<br /> <br /> ThinkTrader也是一個交易平台,它不僅提供了基於TradingView的高級圖表和技術分析工具,同時也允許在圖表上操作下單,使交易變得更加簡單便捷。只需通過<a href="https://portal.thinkmarkets.com/account/register/live?lang=zh-Hant">註冊智匯賬號</a>,您便可免費使用ThinkTrader上的圖表與各項技術分析。</p> <h2>總結</h2> <p>在本文中,我們深入探討了順勢和反轉K線組合,深入瞭解這些組合如何幫助我們識別市場趨勢的持續與轉變。<br /> <br /> 特別對於交易者而言,能夠迅速識別並理解K線組合背後的市場動態是極其重要的。這不僅能夠把握市場先機,還能制定出及時的交易策略,從而顯著提高成功交易的概率。</p>

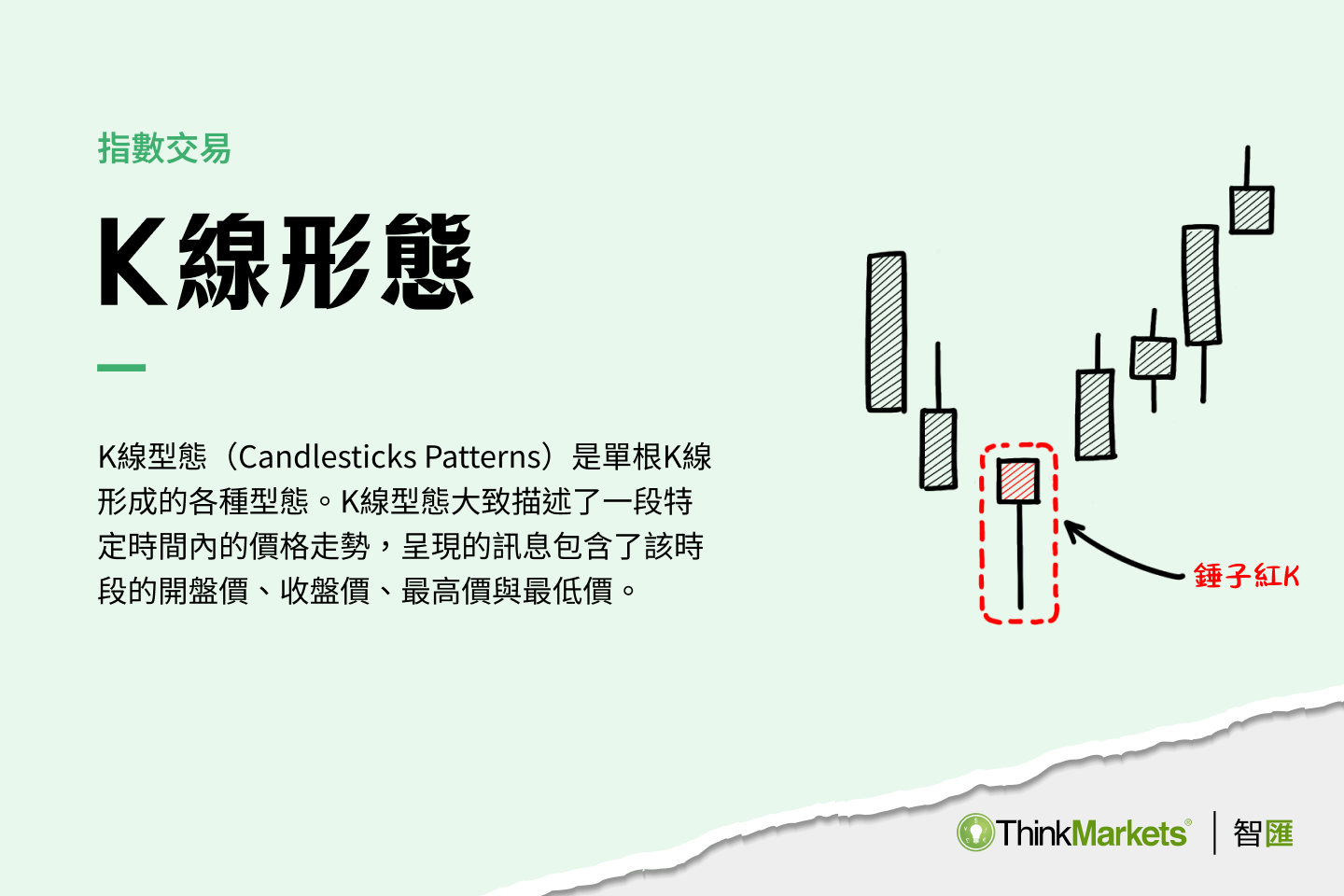

K線型態有哪些?一篇教你掌握基本單根K線形態的背後含義