Articles (45)

ThinkTrader Web - TradingView User Guide

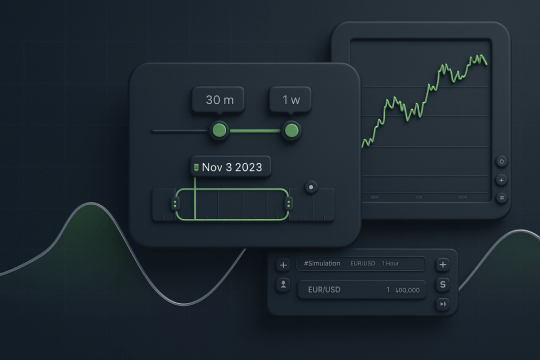

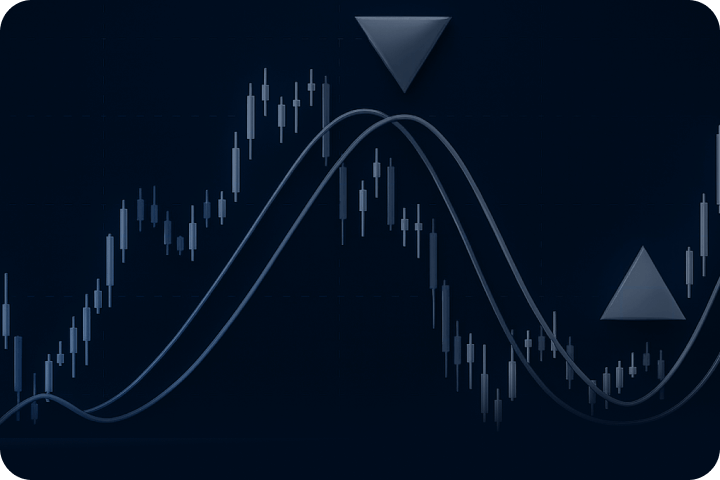

<p>ThinkTrader Web enters a new era with the integration of TradingView charts. TradingView’s intuitive and powerful charts are designed to aid you in making more informed trading decisions. These charts cater to all levels of experience, whether you’re a seasoned trader or just starting out.</p> <p>Discover ThinkTrader Web’s new charting interface, powered by TradingView, for a seamless and efficient way to monitor and analyse the markets.</p> <h3>What is TradingView? </h3> <p>TradingView is a cutting-edge trading chart provider that has revolutionised the way traders access market data. Globally known for its user-friendly interface combined with powerful analytical features, TradingView offers a comprehensive range of charting tools for better decision making.</p> <h3>How to access TradingView charts on ThinkTrader Web? </h3> <p>TradingView charts are fully integrated into ThinkTrader Web’s interface. To access the charts, all you need to do is log in on ThinkTrader Web. </p> <p>Don’t have an account yet? No problem. Simply head to ThinkPortal and open a new account.</p> <h3>TradingView features </h3> <p>As you log in to ThinkTrader Web, you will immediately get access to TradingView’s charting interface. Here are the key components and features that TradingView offers.</p> <h3>Chart types </h3> <p><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture1_1.png" /></p> <p>TradingView’s sleek chart windows are where you’ll spend most of your time analysing the markets. The chart window displays price movements in your chosen chart type. </p> <p>Choose from TradingView’s 13 chart types to complement your trading strategy: </p> <ul> <li>Bars </li> <li>Candles </li> <li>Hollow candles </li> <li>Columns </li> <li>Line </li> <li>Line with markers </li> <li>Step line </li> <li>Area </li> <li>HLC area </li> <li>Baseline </li> <li>High-low </li> <li>Heikin Ashi </li> <li>Renko </li> <li>Line break </li> <li>Kagi </li> <li>Point & figure </li> </ul> <h3>Time frames </h3> <p><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture2_1.png" /></p> <p>TradingView offers a versatile range of time frames, allowing traders to analyse market trends and patterns over various periods. Understanding these time frames effectively is crucial for both short- and long-term trading strategies.</p> <p>Located at the top of the TradingView chart window, click the button to open a dropdown menu for different time frames. This feature allows for quick and easy switching between various periods. TradingView offers a variety of options that you can maximise for better decision making.</p> <ul> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{122}" paraid="1900490906" xml:lang="EN-US">1 minute </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{126}" paraid="665826024" xml:lang="EN-US">5 minutes </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{130}" paraid="1545845398" xml:lang="EN-US">10 minutes </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{134}" paraid="428893242" xml:lang="EN-US">15 minutes </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{138}" paraid="1923105792" xml:lang="EN-US">30 minutes </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{142}" paraid="1102247723" xml:lang="EN-US">1 hour </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{146}" paraid="61749682" xml:lang="EN-US">4 hours </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{150}" paraid="200973453" xml:lang="EN-US">1 day </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{154}" paraid="129446316" xml:lang="EN-US">1 week </li> <li lang="EN-US" paraeid="{e1e67508-3f48-4237-bbf4-e81fe81035b7}{158}" paraid="1655478611" xml:lang="EN-US">1 month </li> </ul> <p>The choice of time frame should align with your trading style and strategy. Short-term traders might prefer minute or hourly charts for quick trades, while long-term traders may opt for daily or weekly charts to understand longer-term trends. </p> <h3>Drawing tools </h3> <p><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture3_1.png" /></p> <p>Situated at the side of the chart window, this toolbar contains an extensive set of drawing tools. These tools are crucial for chart mark-ups, trend analysis, and pattern identification. Here's an overview of what you can expect and how to use them:</p> <p>Located on the left side of the chart window, the side toolbar features various icons. Each icon represents a different drawing tool or function. </p> <p>Types of drawing tools available on ThinkTrader Web:</p> <ul> <li lang="EN-US" paraeid="{cba26489-6615-4d0f-ae16-b5f65ce0b2b9}{68}" paraid="519850178" xml:lang="EN-US">Trend lines and arrows - essential for identifying and marking trend directions </li> <li lang="EN-US" paraeid="{39836a35-0514-4a22-ad62-c2a20153ac60}{121}" paraid="227503749" xml:lang="EN-US">Geometric shapes - useful for highlighting key chart areas or patterns like triangles, rectangles, and circles </li> <li lang="EN-US" paraeid="{657fe92a-fa54-41a8-b95d-ec5727fc040e}{12}" paraid="218871322" xml:lang="EN-US">Fibonacci tools - these include retracement, extension tools, and circles for understanding potential support and resistance levels </li> <li lang="EN-US" paraeid="{657fe92a-fa54-41a8-b95d-ec5727fc040e}{192}" paraid="1147681384" xml:lang="EN-US">Drawing tools - text and emoticons for adding notes directly on your chart </li> <li lang="EN-US" paraeid="{832c159a-f00e-4113-81a4-417dabdc699a}{97}" paraid="1476881051" xml:lang="EN-US">Customisation - Each tool comes with customisation options. Right-click on a drawn object to change the colour, thickness, and style </li> </ul> <p>All your drawn elements can be easily edited, moved, or deleted. You can also clone or lock them in place for more detailed analysis. Traders often practice drawing trend lines to connect significant highs and lows and use geometric shapes to identify chart patterns. </p> <h3>Indicators and Strategies </h3> <p><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture4-(1).png" /></p> <p>TradingView boasts a comprehensive range of powerful technical indicators and strategies. Traders consider indicators as vital tools that offer deep insights into market trends and potential trading opportunities. </p> <p>To access the list of indicators, click on the ‘Indicators’ button located at the top toolbar. This will open a window showcasing a wide range of available indicators. </p> <p><strong>Types of indicators available: </strong></p> <ul> <li lang="EN-US" paraeid="{ef91d53e-af02-45bb-ada7-31b5e7bd31e2}{1}" paraid="201540585" xml:lang="EN-US">Trend indicators - such as Moving Averages, Bollinger Bands, and MACD help identify the market trend </li> <li lang="EN-US" paraeid="{255c9261-bc76-4423-810b-c108bf45a7f8}{155}" paraid="622257580" xml:lang="EN-US">Momentum indicators – such as the RSI and Stochastic Oscillator indicate overbought or oversold conditions </li> <li lang="EN-US" paraeid="{2c1eae90-835f-4670-9106-b0618e63b58b}{44}" paraid="1992357696" xml:lang="EN-US">Volume indicators – such as Volume Oscillator and On-Balance Volume provide insights into trading volume and market strength </li> <li lang="EN-US" paraeid="{4685afcb-e3c3-480c-8dbb-6935a5e69294}{171}" paraid="1496369134" xml:lang="EN-US">Volatility indicators – such as ATR and Bollinger Bands give an idea about market volatility </li> </ul> <p lang="EN-US" paraeid="{7c58c32e-ad72-4904-942c-9748ed6d60f6}{72}" paraid="666409873" xml:lang="EN-US">To apply an indicator, simply select your desired indicator from the list. You can customise its parameters and appearance according to your trading style. </p> <p lang="EN-US" paraeid="{50db5711-d709-4538-b92f-df4c05ad377f}{82}" paraid="1420725562" xml:lang="EN-US">TradingView also allows multiple indicators to be applied on the same chart. This offers a more comprehensive analysis to validate trading signals. Once you've set up an indicator, you can save these settings for future use, ensuring consistency in your analysis.</p> <h3>Bottom toolbar</h3> <p lang="EN-US" paraeid="{5253e938-9b7e-451a-ba5a-dec57eb029f3}{218}" paraid="269356383" xml:lang="EN-US">The bottom toolbar on TradingView offers multiple features essential for market analysis.</p> <p> </p> <p><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture5-(1).png" /></p> <p>Time scale adjustments – this feature lets you modify the time scale of the chart, which is useful for viewing market movements over different periods. This can range from minute-by-minute changes to broader historical trends.</p> <p><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture6-(1).png" /></p> <p>Date range selection: Easily select and view a specific date range on your chart. This is useful for focusing on a particular period of interest, like post-announcement effects or during significant economic events.</p> <h3 lang="EN-US" paraeid="{5253e938-9b7e-451a-ba5a-dec57eb029f3}{218}" paraid="269356383" xml:lang="EN-US">Multi-chart display</h3> <p lang="EN-US" paraeid="{5253e938-9b7e-451a-ba5a-dec57eb029f3}{218}" paraid="269356383" xml:lang="EN-US"><img alt="" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/Picture7-(1).png" /></p> <p>TradingView on ThinkTrader Web offers a multi-chart display feature that allows traders to simultaneously monitor up to 8 different instruments.</p> <p>Click the layout button located on the top toolbar to open a dropdown menu with options of different chart layouts. These range from a single chart view to multiple chart layouts, allowing you to view up to 8 charts simultaneously.</p> <p>To set up a multi-chart display, choose your preferred layout, depending on how many markets you wish to track at once. You can display different instruments or timeframes on each chart so you can compare multiple markets or strategies in real-time.</p> <p>Within the multi-chart layout, each chart can be customised independently. Apply different indicators, drawing tools, and timeframes to each chart based on your trading strategy. This flexibility is perfect for traders who monitor correlations between different instruments or need to keep an eye on various segments of the market simultaneously.</p> <p>However, TradingView also offers the convenience of synchronisation. You can sync tools, drawings, and indicators across all charts in your layout. This ensures consistency in your analysis and saves time, especially when comparing similar markets.</p> <h3>TradingView on ThinkTrader Web</h3> <p lang="EN-US" paraeid="{5253e938-9b7e-451a-ba5a-dec57eb029f3}{218}" paraid="269356383" xml:lang="EN-US">ThinkTrader provides traders access to thousands of instruments across global financial markets, such as forex, stocks, indices, cryptocurrencies, commodities, ETFs, and futures. Level up your trading by maximising TradingView’s powerful features and ThinkMarkets’ excellent trading conditions today.</p> <p>If you have any questions regarding TradingView and ThinkTrader Web, our 24/7 client support team is available via live chat, email, or phone, and can support in 20+ languages.</p> <p> </p> <p> </p>

What is a micro lot in forex? Calculate & trade micro lot size

<p>A micro lot in forex represents 1,000 units of the base currency. Micro lot trading allows new traders with small accounts to experience the market without the high risk and psychological stress of handling larger positions.</p> <p>But whether micro lots suit your needs depends on more than just account size and tolerance for risk. It also depends on your goals and experience. Some beginner traders use a micro account in forex to manage risk in volatile times, while others do so to test new trading strategies.</p> <p>At ThinkTrader, you can start trading micro lots in forex with a ThinkMarkets account from just $50. Trading micro lots is straightforward with a platform that provides an intuitive order interface, built-in position sizing calculators, and powerful risk management tools.</p> <p>But in this guide, you will learn more than just that. We will go over:</p> <ul> <li>How much is a micro lot in forex to help you get a head start</li> <li>Calculating micro lot size and pip value</li> <li>When to trade with micro lots in forex</li> <li>How micro lots help with risk management</li> <li>When is the best time to scale forex trading micro lots</li> <li>How to trade micro lots on ThinkMarkets</li> </ul> <p>Before we compare all the available forex trading lot sizes, let's define micro lots clearly.</p> <p><br /> <strong>Ready to start trading micro lots? Sign up for a <a href="https://www.thinkmarkets.com/en/thinktrader-account/">ThinkTrader account</a> here.</strong></p> <h2>What is a micro lot in forex?</h2> <p>A micro lot in forex is the smallest unit of the three standardised contract sizes, equalling a micro lot movement of one pip. Micro lot trading enables forex traders to trade the forex market with considerably lower exposure than the other two lot sizes allow: the standard lot and mini lot.</p> <p>The decision to trade with forex micro lots often reflects the reality of beginner traders, who prefer to start small and scale as they learn. Brokers with micro accounts meet this need by providing micro accounts, which enable traders to deposit as little as $50 or less. The minimum lot size in forex for most brokers is typically the micro lot (0.01), though some offer even smaller nano lots.</p> <p>Trading micro lots may offer reduced exposure, but it also keeps profit and loss swings small. Understanding what is micro trading can help beginner traders recognise that it's not just about smaller positions but also about strategic risk management and learning.</p> <p>For example, a typical 100 pip daily fluctuation on the EURUSD pair with 1 micro lot would change your P&L by around $10, be it on the winning or losing side. An easier way to think of this is to consider 1,000 units as 1,000 cents, which equals $10.</p> <p><img alt="" src="/getmedia/9006c84c-4e2a-4e0c-a5fe-4ef57b2cd16b/Academy-Forex-Micro-lot-pip-value-usd.png" /></p> <div style="text-align: center;"> <span style="text-align: center;">Micro lot pip value ($)</span></div> <h2>How much is a micro lot in forex trading?</h2> <p>A micro lot is exactly 1,000 units of the base currency, or 1% of the trade size of a standard lot. How much is 1 micro lot in forex? On <a href="https://www.thinkmarkets.com/en/trading-academy/forex/what-affects-forex-exchange-rate/">forex trading</a> platforms, this is usually listed as 0.01. One standard lot is shown as 1.00 and represents 100,000 units of the base currency, while mini lots are shown as 0.1 and are worth 10,000 units.</p> <p>The pip value of forex micro lots is 10 to 100 units smaller compared to the larger position sizes. For currency pairs where USD is the quote currency, a micro lot has a pip value of $0.1, whereas a one-pip movement in a standard lot size has a value of $10. This means that for every micro pip movement in the exchange rate of a currency pair, the value of your forex position changes by 10 cents.</p> <p style="text-align: center;"><img alt="" src="/getmedia/534d157a-17a2-4783-addc-788e04cea29a/Academy-Forex-Forex-lot-size-explained-in-units-volume-and-pip-value.png" /> Forex lot size explained in units, volume and pip value</p> <p>Let’s see how the pip value of a forex micro lot is calculated exactly.</p> <h2>Calculating a micro lot size in forex trading</h2> <p>To calculate lot size and the exact pip value of a micro lot, you need the current exchange rate between your account currency and the quote currency in your trade. A micro lot calculator can help automate these calculations for faster position sizing.</p> <p>The formula is:</p> <p><img alt="" src="/getmedia/a28d1b0e-e605-4c01-8283-1a11d55f2aa1/Academy-Forex-pip-value-formula.png" /></p> <p>When the quote currency and your account currency are the same, the pip value is equal to the price changes in your traded instrument. If your account currency is USD, then 1 pip is worth $0.10, and your account statement will show this same value.</p> <h3>EUR/USD micro lot pip example</h3> <p>For EURUSD, the forex pip calculation is simple. Since the quote and account currencies are the same, the exchange rate between the two is not considered.</p> <p><strong>Instrument: EUR/USD</strong></p> <ul> <li><strong>Account currency:</strong> USD</li> <li><strong>Quote currency:</strong> USD</li> <li><strong>Lot size:</strong> 0.01 forex lot (1,000 units)</li> <li><strong>Pip size:</strong> 0.0001</li> <li><strong>Pip value</strong> = 0.0001 × 1,000 = $0.10 per pip</li> <li><strong>50-pip move</strong> = $5 profit or loss per micro lot</li> </ul> <p>Using the formula above, we get:</p> <p style="text-align: center;"><strong>Pip Value = Pip Size (0.0001) × Units (1,000) = $0.10 per pip</strong></p> <p><img alt="" src="/getmedia/3db128c4-d7dd-4f12-99bf-dc0dcf51a10a/Academy-Forex-Micro-lot-pip-value-equals-10-cents-in-EURUSD.png" /></p> <div style="text-align: center;"> <span style="text-align: center;">Micro lot pip value equals 10 cents in EURUSD</span></div> <p>However, when your account currency is different from the quote currency, you have to calculate pips by factoring in the current exchange rate.</p> <p>Let’s see how it works with the following USDJPY example.</p> <h3>USD/JPY micro lot pip example</h3> <p>JPY pairs quote pips at two decimal places (0.01). For a 0.01 lot, and taking the current exchange into account, the pip value is 10 JPY (~$0.07). However, the value of a forex pip can change over time as the USDJPY rate fluctuates.</p> <p>For example, a 50-pip move is about $3.35 (50 x $0.0667) at an exchange rate around 150.00.</p> <p>Here is how that’s reflected using our formula:</p> <p style="text-align: center;"><strong>Pip Value (USD) = (Pip Size (0.01) × Units (1,000)) ÷ USDJPY (150) = $0.0667 per pip</strong></p> <p>Now, let’s consider <a href="https://www.thinkmarkets.com/en/trading-academy/commodities/what-is-gold-trading-why-trade-gold/">gold</a>, which uses the dollar as the quote currency. It works similarly, even though gold is a precious metal.</p> <h3>XAU/USD (Gold) micro lot pip example</h3> <p>A position of 1 standard lot on gold equals 100 troy ounces, so 1 micro lot (0.01) simply equals 1 troy ounce of gold. Thus, the minimum position size you can enter on gold is 1 troy ounce. Taking the current price around $3,500, this is the minimum position value you can hold on <a href="https://www.thinkmarkets.com/en/trading-academy/commodities/how-to-trade-gold-a-short-guide/">gold</a>.</p> <p>If the minimum price increment in gold (XAU/USD) is $0.01, then a $0.01 move equals $0.01 per micro lot. A $1.00 move in the <a href="https://www.thinkmarkets.com/en/trading-academy/commodities/gold-trading-strategy-for-2025/">price of gold</a> will equal $1.00 per micro lot.</p> <p>Using the same formula, we get:</p> <p style="text-align: center;"><strong>Tick Value (USD) = Tick Size ($0.01) × Ounces per micro lot (1) = $0.01</strong></p> <p>For traders who want to use advanced tools to help with these calculations, a pip forex calculator or FX pip calculator can automatically compute pip values across different currency pairs and lot sizes.</p> <p>Now that you know how to calculate a micro lot, let's also take a deeper dive into the other types of lots in <a href="https://www.thinkmarkets.com/en/trading-academy/forex/what-is-forex-trading/">forex trading</a>.</p> <p><strong>Have your own gold trading strategy? Access a <a href="https://www.thinkmarkets.com/en/thinktrader-account/">micro lot account</a> with only $50.</strong></p> <h2>Micro and other types of lots for forex traders</h2> <p>Forex lot sizes are defined in fixed contracts, which represent how many units of the base currency you are <a href="https://www.thinkmarkets.com/en/trading-academy/forex/order-types/">buying or selling</a>. The forex minimum lot size varies by broker but typically starts at the micro lot level.</p> <p>In <a href="https://www.thinkmarkets.com/en/forex-trading/">forex trading</a>, there are three standardised lot sizes - standard lot, mini lot, micro lot - as we have already mentioned, suitable for different traders:</p> <ul> <li><strong>Standard lot</strong></li> <li><strong>Mini Lot</strong></li> <li><strong>Micro Lot</strong></li> </ul> <p>The relationship between these is simple: standard, mini, micro lot sizes follow a 100:10:1 ratio. Here’s a forex lot size chart to visualise the differences between lot sizes.</p> <p><img alt="" src="/getmedia/7d9d7684-cb11-42a0-b9cd-51a219ad2dd1/Academy-Forex-Comparison-table-of-micro-mini-and-standard-lot-sizes-in-forex-trading.png" /></p> <div style="text-align: center;"> <span style="text-align: center;">Comparison table of micro, mini, and standard lot sizes in forex trading</span></div> <h2>Main differences between a micro lot and mini and standard lots</h2> <p>Standard, mini, and micro lots can all be traded from the same account on the same markets and with the same instruments. However, the differences in capital requirements and risk profile implications are huge.</p> <p>Let’s go over each of them to see why understanding how they impact your account is crucial.</p> <h3>Micro account capital requirements</h3> <p>The amount of capital required for each lot size in forex trading depends on your risk rules, the typical <a href="https://www.thinkmarkets.com/en/thinktrader/thinktrader-introduces-trailing-stop-loss-feature-for-advanced-risk-management/">stop distance</a>, the volatility of the assets you trade, and the leverage assigned to your account. Forex trading with small capital often requires starting with micro lots to maintain proper risk management.</p> <p>In practice, standard lots are often used by traders with larger balances (e.g., $5,000+), mini lots by those with mid‑sized balances ($500–$5,000), and micro lots by traders with smaller balances (sub $500) who want lower per‑pip exposure. This is particularly important when choosing between different forex account types.</p> <p>Now, each of these scenarios has a different effect on your risk profile.</p> <h3>Risk management profile differences</h3> <p>Each step up in the lot size multiplies your dollar movement per pip. A standard lot vs micro lot comparison shows that standard lots carry the highest exposure (about $10 per pip on FX pairs), so your nominal profit/loss swings are larger. Mini lots sit in the middle at roughly $1 per pip, while micro lots give the smallest exposure at around $0.10 per pip.</p> <p>To put it all in context, a 50‑pip move against you in EURUSD is $500 on a standard lot, $50 on a mini lot, and $5 on a micro lot. This is why many traders prefer trading with smaller lots when starting out. What is the lowest lot size in forex? For most brokers, it's the micro lot at 0.01, making it the best lot size for beginners.</p> <h2>When to trade a micro lot size in forex</h2> <p>Choosing to trade a micro lot size depends on your trading goals and objectives, trading experience, and risk tolerance. You can use the risk profile above as your guide, then match the size with your trading plan. For those particularly interested in micro trading or micro <a href="https://www.thinkmarkets.com/en/trading-academy/forex/how-to-trade-forex/">forex trading</a>, knowing when to use these smaller positions is paramount.</p> <p><img alt="" src="/getmedia/32bb2fa8-1002-4e6e-bd6c-1c14f8d9c31f/Academy-Forex-When-to-trade-micro-lots-in-forex.png" /></p> <div style="text-align: center;"> <span style="text-align: center;">When to trade micro lots in forex</span></div> <p>Use micro lots when:</p> <ul> <li>You’re <strong>new to micro forex</strong> because lower per‑pip exposure helps you learn without large P/L swings.</li> <li>You’re <strong>trading a small balance</strong> (e.g., sub $500) and want tighter dollar risk per trade.</li> <li>You’re <strong>testing or <a href="https://www.thinkmarkets.com/en/traders-gym/">refining a strategy</a></strong> in live markets before allocating more capital.</li> <li>You need to <strong>scale in and out of trades</strong> or to fit wider stops and more volatile instruments while keeping risk within your comfortable limits.</li> <li>You need to <strong>manage correlated exposure</strong> across multiple positions without exceeding your risk thresholds.</li> </ul> <p>If you are unsure which forex trading lot size is right for you, keep your percentage risk fixed and test each size in a ThinkMarkets demo account. The results will show you exactly what level of risk you are comfortable with.</p> <p>Lot size choice is the first part of managing risk. The other part is understanding how leverage and margin work in practice, because they influence how you are exposing your account to risk.</p> <p><strong>Not sure which lot size is right for you? Practise with a <a href="https://www.thinkmarkets.com/en/demo-account/">ThinkMarkets demo</a> account.</strong></p> <h2>How leverage and margin affect micro lot positions</h2> <p>Leverage and margin allow you to open a micro lot forex position while providing only a fraction of its full value. Understanding the best leverage for micro account trading is so important for <a href="https://www.thinkmarkets.com/en/trading-academy/cfds/risk-management-tools-in-cfd-trading/">risk management</a>. With 100:1 leverage, you can control a $1,000 position with only $10. This small fraction is the margin, while the ratio between it and the nominal value is your leverage ratio.</p> <p>Here is the formula:</p> <p><img alt="" src="/getmedia/b83992d6-f9df-41da-bd0e-24ce3f2fd8e0/Academy-Forex-How-leverage-and-margin-affect-micro-lot-positions.png" /></p> <p>With micro lots, leverage can reduce margin to only a few dollars. This is how it works in practice on EURUSD at 1.05:</p> <p><img alt="" src="/getmedia/b08c4043-6089-4ad3-8a98-3f2b3e3b5a30/Academy-Forex-Required-leverage-and-margin-for-1-micro-lot.png" /></p> <div style="text-align: center;"> <span style="text-align: center;">Required leverage and margin for 1 micro lot</span></div> <p>The combination of higher leverage and lower margin can tempt overexposure, although your real risk comes from stop-loss distance and pip value. Even a micro lot forex position can produce large losses if the stop is wide or you stack multiple trades that go against you.</p> <p>For instance, at 500:1 leverage, a 1,000-unit EUR/USD position needs only around $2 in margin, but that leaves $98 to open additional positions. And you will still be fully exposed to the original position of 1,000 euros.</p> <p>To avoid getting trapped in the psychological traps of leverage and margin, you need a strategic approach to risk management. There are primarily two position sizing methods that help keep risk within acceptable limits.</p> <h2>Position sizing strategies to trade forex micro lots</h2> <p>Micro lots shine for precise position sizing because they let you dial in your exact risk without jumping to trading a standard lot, the largest lot size, ahead of time. The micro account lot size flexibility allows for precise risk management through the smallest price movements. Two approaches keep your risk consistent, no matter how, and trading conditions change:</p> <p><strong>1. The percentage-based approach</strong></p> <p><strong>2. The fixed amount approach</strong></p> <p>Let’s break down how each of them works.</p> <h3>1. Percentage-based risk approach</h3> <ul> <li>Determine your risk % per trade (e.g., 1% of your account)</li> <li>Determine your stop-loss in pips</li> <li>Calculate the lot size to achieve the desired percentage risk</li> </ul> <p>Here’s the formula:</p> <p><img alt="" src="/getmedia/e7b4a973-56ad-4e63-a415-5b95ab3f0122/Academy-Forex-Calculate-percentage-based-risk-approach.png" /></p> <p><strong>Example:</strong> for a $1,000 account, risking 1% with a 50-pip stop-loss:</p> <p><strong>Lot Size = ($1,000 × 0.01) / (50 × $0.10) = 0.02 lots</strong></p> <h3>2. Fixed amount approach</h3> <ul> <li>Decide on a fixed dollar amount you are willing to risk per trade</li> <li>Calculate the lot size based on the distance of your stop-loss</li> </ul> <p>Here’s the formula:</p> <p><img alt="" src="/getmedia/e5fe72ea-219c-4294-b9c2-c516c1c6890a/Academy-Forex-Caluclate-fixed-amount-risk-approach.png" /></p> <p><strong>Example:</strong> To risk $10 on a trade when your stop-loss is 50-pips:</p> <p><strong>Lot Size = $10 / (50 × $0.10) = 0.02 lots</strong></p> <p>Both methods keep risk consistent. The percentage approach is more adaptable as your account grows, while the fixed-dollar method offers simplicity.</p> <p>Now that you understand the basic micro lot position sizing strategies, it’s time to put them into use. At ThinkMarkets, you will have access to an intuitive platform, top-notch analysis tools, and industry-leading risk management features.</p> <h2>Start trading micro lots on ThinkMarkets</h2> <p>Let’s walk through the process of trading micro lots on ThinkMarkets step by step:</p> <h3>Step 1: Register for a ThinkMarkets trading account</h3> <p>Create a <a href="https://www.thinkmarkets.com/en/account-types/">ThinkMarkets account</a> and choose your account type from the available forex trading account types:</p> <ul> <li>Standard</li> <li>ThinkZero (raw spreads)</li> <li>ThinkTrader ($50 deposit)</li> </ul> <p>ThinkMarkets is one of the leading micro account forex brokers and best micro account brokers offering competitive conditions for small-scale traders.</p> <h3>Step 2: Open the charts on the broker trading platform</h3> <p>After funding your account, you can start trading through one of ThinkMarkets' trading platforms:</p> <ul> <li>ThinkTrader – proprietary platform integrated with TradingView</li> <li>MetaTrader 4</li> <li>MetaTrader 5</li> </ul> <p>Log in to and open a chart for your desired currency pair or instrument.</p> <h3>Step 3: Analyse the market and select a forex pair</h3> <p>Identify potential trading opportunities using <a href="https://www.thinkmarkets.com/en/trading-academy/technical-analysis/definition-charts-and-strategy-method/">technical</a> and <a href="https://www.thinkmarkets.com/en/trading-academy/forex/fundamental-analysis-definition-drivers-and-trading-methodology/">fundamental analysis</a>. Review the <a href="https://www.thinkmarkets.com/en/trading-academy/market-events/how-to-use-the-thinkmarkets-economic-calendar/">economic calendar</a> daily and define your trading plan for the chosen FX instrument.</p> <h3>Step 4: Choose lot size (0.01) in ThinkTrader or MT4/MT5</h3> <p>To place your order:</p> <ul> <li>1. Click the "Buy" or "Sell" button next to the instrument in the watchlist</li> <li>2. In the volume field, enter "0.01" for a micro lot</li> <li>3. Select your order type (market, limit, or stop)</li> </ul> <h3>Step 5: Set stop-loss and take-profit levels</h3> <p>Placing stop-loss and take-profit orders remains a crucial risk management step:</p> <ul> <li>1. Set your stop-loss at a level determined by your analysis and risk tolerance</li> <li>2. Set your take-profit at a level that provides a favourable risk-to-reward ratio (at least 1:2)</li> <li>3. Consider using trailing stops to protect potential profits as the trade moves in your favour</li> </ul> <h3>Step 6: Use a position size calculator to calculate lot size risk</h3> <p>ThinkTrader includes a built-in trading calculator to help you determine the appropriate micro lot size for a trade:</p> <ul> <li>1. Determine your acceptable risk per trade (typically 1-2% of your account)</li> <li>2. Enter your stop-loss distance in pips</li> <li>3. The calculator will recommend the appropriate lot size</li> </ul> <h3>Step 7: Monitor pip value relative to your account balance</h3> <p>After entering your trade, monitor its performance:</p> <ul> <li>1. Track the pip value fluctuations in relation to your account balance</li> <li>2. Ensure the position's fluctuations remain within your risk comfort zone</li> <li>3. Consider moving the stop-loss level when the trade moves in your favour</li> </ul> <p>Now that you know how to place micro lot forex trades and how they work in practice, it’s worth weighing up the advantages and limitations.</p> <p><strong><a href="https://www.thinkmarkets.com/en/thinktrader-account/">Start trading micro lots</a> on ThinkMarkets and put the position sizing strategies into action today!</strong></p> <h2>Pros and cons of trading with micro forex lots</h2> <p>Micro lots make forex more accessible and flexible, but they come with both benefits and limitations. Here’s a balanced look to help you decide when they may fit your needs. When comparing forex micro accounts vs standard accounts, consider these factors:</p> <p><img alt="" src="/getmedia/eaa68554-616e-4ae8-8fd8-61134aab5594/Academy-Forex-Micro-trading-pros-and-cons.png" /></p> <div style="text-align: center;"> <span style="text-align: center;">Micro trading pros and cons</span></div> <h3>Micro lots trader advantages</h3> <ul> <li><strong>Lower risk exposure:</strong> With pip values around $0.10, market swings translate into modest gains or losses, giving you space to practise without heavy losses.</li> <li><strong>Capital efficiency:</strong> You can start live trading with a modest account (e.g., as low as $500) without fearing that your balance will be at risk from normal <a href="https://www.thinkmarkets.com/en/trading-academy/forex/day-trade/">day-to-day</a> price fluctuations.</li> <li><strong>Flexible position sizing:</strong> Adjust in 0.01 lot increments to match the exact risk level you want for a certain position.</li> <li><strong>Psychological benefits:</strong> Smaller profit/loss fluctuations reduce stress, which can improve decision‑making and trade execution.</li> <li><strong>Live testing with limited risk:</strong> Trade forex micro lots to validate a new <a href="https://www.thinkmarkets.com/eu/trading-academy/forex/popular-forex-trading-strategies/">strategy</a>. Evaluate entry, exit, and trade management rules in real conditions. Scale up once the results prove your strategy.</li> </ul> <h3>Micro lots trader limitations</h3> <ul> <li><strong>Limited profit potential:</strong> Small pip values translate into small gains on winning trades. You will need more time and more trades to grow your account while trading with micro lots.</li> <li><strong>Risk of overtrading:</strong> When losses feel trivial, it can be tempting to add more trades without proper setups. A written <a href="https://www.thinkmarkets.com/TMXWebsite/media/TMXWebsite/10-tips-to-successful-trading-pdf.pdf">trading plan</a> can help maintain quality over quantity in your trading.</li> <li><strong>Not ideal for larger accounts:</strong> Traders with significant capital often require mini or standard lots to reach return goals.</li> </ul> <h2>Is micro lot trading in forex right for you?</h2> <p>Micro lot trading in forex could be right for you if you only have a small amount to start with. The forex micro account lot size flexibility makes it ideal for beginners and those testing strategies. If you are at a more advanced level, forex micro lots can help with testing strategies or prioritising tight risk control. Understanding what is a micro account in forex lets you decide if this approach aligns with your trading goals. However, when you have reached a point where your goal is achieving higher returns, it might be time to explore larger lot sizes.</p> <p>For traders seeking higher exposure for the potential of higher returns, mini lots or standard lots are the way to go. You can scale up once you have achieved consistent results trading forex with micro lots or once you have a larger account size of at least $500 for mini and $5000 for standard. In either case, the potential for higher returns comes with a high risk of loss. Veteran traders have strong risk management systems in place to keep potential drawdowns or losses in check.</p> <p><strong>Still unsure of your strategy? Refine it for free and risk-free on <a href="https://www.thinkmarkets.com/en/traders-gym/">Traders Gym</a>!</strong></p> <p> </p> <p> </p>

Forex hedging: Definition, risk strategies & FX examples

<p>Forex hedging is a risk management strategy that protects a portfolio from losses with new positions that move in the opposite direction of existing ones. While hedging in forex can incidentally produce gains, the primary goal is to hedge currency risk, not make a profit.</p> <p>The benefits of forex hedging for a diversified portfolio are well-recorded. For instance, a 2010 working paper from the International Monetary Fund (IMF) found that hedging a currency exposure reduced volatility in foreign investments substantially. However, forex hedging carries higher trading costs, particularly for frequent direct hedges where spread costs can compound.</p> <p>At ThinkMarkets, we offer raw 0.0-pip spreads on major FX pairs through ThinkZero accounts available on ThinkTrader. The trading platform allows you to open and close hedging positions automatically and monitor your net exposure in real time, making it straightforward to implement forex hedging strategies.</p> <p>What you’ll learn in this guide:</p> <ul> <li>Forex hedging meaning, when to hedge, and how currency risk management fits your trading plan.</li> <li>Hedging instruments in forex (derivatives) and the costs: spreads, swaps, commissions and slippage.</li> <li>Three FX hedging strategies: direct hedge, cross hedge and correlated‑pair hedge, with simple hedge‑ratio sizing.</li> <li>A step‑by‑step setup and a worked forex hedging example, plus common mistakes to avoid.</li> </ul> <p>Let’s begin by defining what forex hedging is and how it differs from speculative trading.</p> <p><strong>Open your ThinkZero account and take advantage of 0.0 spreads on FX majors.</strong></p> <h2>What is Forex hedging?</h2> <p>Forex hedging is a method to neutralise portfolio fluctuations by entering a counter-position in a currency pair that will gain value as your initial position starts to lose value. A hedge in <a href="/en/trading-academy/forex/what-is-forex-trading/">forex</a> involves going long and short on the same or different currency pairs to offset losses. Imagine going both long and short on the EURUSD forex pair at the same time to hedge risk.</p> <p><img alt="FX hedging eurusd (ThinkMarkets)" src="/getmedia/01408ff0-0282-4fc8-a19a-2880cbec4487/Academy-Forex-EURUSD-Forex-hedge-example.png" /></p> <p style="text-align: center;">EURUSD Forex hedge example</p> <p>Hedging <a href="/en/trading-academy/cfds/risk-management-tools-in-cfd-trading/">forex risk</a> is essential for traders who want to manage volatility and protect their capital. The goal isn’t to make gains but to reduce losses from potential negative price moves while keeping the original position open.</p> <p>Before we go deeper into how hedging in forex works, it’s useful to contrast it with speculation.</p> <h3>Difference between FX hedging and speculation</h3> <p>The key distinction between hedging and speculation lies in their impact: hedging offsets existing exposure to reduce volatility and drawdowns, whereas speculation creates new risk in pursuit of returns. A speculator judges success by profit versus risk taken. A hedger judges success by how much variability and downside were reduced relative to the plan.</p> <p>The next question is whether hedging in forex makes sense for you and when it adds more value than it costs.</p> <h3>Who hedges FX risk in Forex and why</h3> <p>There are many different players who are hedging FX risk in forex, but their objectives and tools differ. Here is a brief overview of the key market participants that extensively use forex hedging strategies:</p> <ul> <li><strong>Multinational corporations</strong> protect foreign exchange revenues, budgets and margins from FX swings, typically with forward contracts and, where available, options.</li> <li><strong>Importers and exporters</strong> lock exchange rates on receivables/payables to stabilise pricing on cross‑border transactions.</li> <li><strong>Asset managers and funds</strong> reduce currency “noise” in global portfolios so underlying asset decisions drive returns.</li> <li>Banks and financial institutions manage trading‑book and client exposures, and meet risk‑control mandates.</li> <li><strong>Retail forex traders</strong> cushion event risk, overnight/weekend gaps, and smooth equity curves without abandoning a <a href="/en/trading-academy/forex/how-to-trade-forex/">trade idea</a>.</li> </ul> <p>Understanding who hedges and why sets the basis. The next step is what this means for you as an active trader: why, when, and how hedging forex can add value in practice.</p> <h3>Why is a hedge in Forex important for traders?</h3> <p>For active forex traders, a hedge in forex is important because it is a practical layer of defence that complements stops and position sizing. These are the key benefits for traders:</p> <ul> <li><strong>Trade risk mitigation:</strong> Offsetting long or short traders when you <a href="/en/trading-academy/forex/order-types/">buy or sell</a> a currency pair helps reduce potential losses from unfavourable <a href="/en/trading-academy/forex/what-affects-forex-exchange-rates/">FX market moves</a> against your trades.</li> <li><strong>Volatility risk protection: </strong>Hedges reduce the impact of <a href="/en/trading-academy/forex/fundamental-analysis-definition-drivers-and-trading-methodology/">macro events</a> like the release of CPI, NFP and central bank surprises when <a href="/en/trading-academy/forex/forex-spreads/">spreads</a> and price gaps widen.</li> <li><strong>Capital preservation:</strong> By limiting the potential for trades going south, traders can hold longer-term positions and eventually secure profits or reinvest.</li> <li><strong>Better decision-making:</strong> Having a solution to a potential loss makes it easier to stick to a <a href="https://www.thinkmarkets.com/TMXWebsite/media/TMXWebsite/10-tips-to-successful-trading-pdf.pdf" target="_blank">plan</a> and avoid emotional outbursts.</li> <li><strong>Flexibility:</strong> Use partial or direct hedges or correlation hedges to keep drawdowns and margin strain in check while still keeping some upside.</li> </ul> <p><img alt="Benefits of fedging forex risk in FX market (ThinkMarkets)" src="/getmedia/5132bc8a-58ad-40a1-be01-89c24fd5c725/Academy-Forex-trading-hedging-strategies-may-benefit-traders.png" /></p> <p style="text-align: center;">Forex trading hedging strategies may benefit traders</p> <p>If hedging forex fits your goals, you will need to understand how forex hedging <a href="/en/trading-academy/forex/popular-forex-trading-strategies/">strategies</a> actually work, the mechanics behind it and the hedging tools you can use.</p> <h2>How Forex hedging strategies work</h2> <p>Forex hedging strategies work by establishing counterpositions to balance your existing traders, with the goal of reducing the impact of adverse market movements on your bottom line. The closer the hedge mirrors your original exposure, the more stable your P&L becomes.</p> <p>Most retail FX hedge strategies fall into different hedging techniques. The three most popular hedging strategies in forex are:</p> <ol> <li><strong>Direct hedge</strong></li> <li><strong>Cross hedge</strong></li> <li><strong>Correlation hedge</strong></li> </ol> <p><img alt="Types of hedging forex strategies (ThinkMarkets)" src="/getmedia/4096f976-437b-45bf-8745-828696e38c45/Academy-Forex-How-will-hedging-works-depends-on-the-employed-forex-trading-strategy.png" /></p> <p style="text-align: center;">How well hedging works depends on the employed forex trading strategy</p> <h3>1. Direct hedge</h3> <p>A direct hedge means opening an equal and opposite position on the same currency pair. If you take a long position of 1 lot EURUSD and you then take a short position of 1 lot EURUSD, your net exposure is near zero: losses on one side are offset by gains on the other, minus hedging costs.</p> <p>Traders use direct forex hedges when they want immediate, high‑fidelity protection during a short window, for example, before a central bank decision, across a weekend, or while spreads are likely to widen. The trade-off is straightforward: you pay two spreads (and swaps if held overnight) and cap any drawdowns while the hedge is on. Many traders prefer partial direct hedges, like shorting 0.5 lot against a 1‑lot long, to reduce volatility but keep some participation if the move goes their way.</p> <p><strong>Quick steps:</strong></p> <ul> <li>Identify exposure (e.g., long 1.0 lot EURUSD).</li> <li>Decide protection level (full vs partial).</li> <li>Execute the opposing position (short 1.0 lot for full; short 0.5 lot -> 50% hedge).</li> <li>Remove the hedge once the catalyst passes or your thesis changes.</li> </ul> <p>The effectiveness of direct hedges is higher over short windows; costs compound if held for long.</p> <h3>2. Cross hedge</h3> <p>With a cross hedge, you neutralise the exposure to one currency in the pair using a different pair that shares that currency. Suppose you are long EURUSD. You are long euros and short US dollars, effectively hedging against the dollar. To neutralise the USD leg, you might buy USDJPY.</p> <p>Let’s take an example: long 1 lot EURUSD at 1.1000 means long €100,000 and short $110,000.</p> <p>Buying roughly $110,000 notional USDJPY (about 1.10 lots) offsets most of the USD moves, leaving you effectively long EURJPY between the two trading pairs. This introduces basis risk because the hedge won’t track EURUSD perfectly. However, it can be a useful way to remove exposure to a dominant currency while keeping your view on a cross.</p> <p>Some examples of cross-hedge combinations in forex are:</p> <ul> <li>EURUSD forex hedge with EURGBP></li> <li>USDCAD forex hedge with USDCHF</li> <li>GBPUSD forex hedge with GBPJPY</li> </ul> <h3>3. Correlated pair hedge</h3> <p>Here, you offset risk using two currency pairs that tend to move together. For example, a long EURUSD might be partially hedged by short GBPUSD if the two have shown solid positive correlation recently.</p> <p>Correlation values range from –1 (perfect negative correlation) to +1 (perfect positive correlation). For example, if correlation is around +0.80 and the volatilities of the two pairs are similar, a 1.0 lot original exposure should be paired with 0.8 lots in the hedge. Sizing is based on relationship strength and volatility, not just equal lots.</p> <p><img alt="Strategies for hedging in trading (ThinkMarkets)" src="/getmedia/5232393b-4435-45e9-a42a-bbe89724b625/Academy-Forex-FX-Hedging-Strategies-Comparison.png" /></p> <p style="text-align: center;">FX Hedging Strategies Comparison</p> <p>Knowing forex hedge strategies is one thing; hedging through a specific set of trading instruments is another.</p> <p><strong>Want to hedge, but are only a beginner? Open a demo and put your hedge strategy to the test.</strong></p> <h2>What instruments are used for FX hedge management</h2> <p>There are many instruments one can use to manage FX hedges based on what best matches your timeframe and precision needs, as well as your cost budget. Here are the four most common forex options:</p> <ul> <li><strong>CFDs:</strong> Fast, granular execution for direct, cross and correlation hedges. Costs are spreads, commissions, and overnight swaps.</li> <li><strong>Futures:</strong> Exchange‑traded and standardised. Suitable for larger or scheduled hedges but less granular; consider contract size, expiry and roll costs.</li> <li><strong>Forwards:</strong> Lock in a future rate for cash flows. Flexible for receivables and payables, but not as good for short-term active trading.</li> <li><strong>Options:</strong> Pay a premium to limit the risk of loss while keeping gains. Liquidity and premium costs are very important.</li> </ul> <p>Let’s put the framework to work with a realistic example of hedging in forex using CFDs.</p> <h2>Forex hedging example: Risk management of a position gone wrong</h2> <p>Before delving into the hedge example (CFD hedge), remember that an effective hedge in forex combines a clear objective and a sizing method that reflects volatility and correlation, i.e. effective risk management.</p> <p>Let’s get into the math side of forex hedges to ensure you have all you need to get started.</p> <h3>Forex market hedge ratio calculation</h3> <p>The goal is to turn a desired protection level into a simple, executable hedge size. A practical way to do that is with a hedge ratio that reflects how closely your hedge offsets the exposure you want to reduce.</p> <h4><strong>Hedge ratio formula</strong></h4> <p><img alt="Hedge calculator (ThinkMarkets)" src="/getmedia/233bea45-bac8-4e78-a89f-ef1c72137534/Academy-Forex-Hedge-effectiveness-formula.png" /></p> <p style="text-align: center;">Hedge effectiveness formula</p> <p><strong>What this means in practice:</strong></p> <ul> <li>If you are hedging with the exact same pair (direct hedge), correlation is effectively 1.0, so the hedge size is simply the percentage you want to protect.</li> <li>If you use a related instrument (as in a cross or correlated hedge), correlation will be less than 1.0, and volatilities may differ, so you scale the size accordingly. The lower the correlation, the less protection each unit of hedge delivers.</li> <li><strong>Setup:</strong> Long 1.00 lot EURUSD; target 50% protection using GBPUSD.</li> <li><strong>Inputs:</strong> Correlation = +0.85; volatility ratio = 0.90; Notional ratio = 0.87 ($110k lot value EURUSD ÷ $127k lot value GBPUSD).</li> <li><strong>Size:</strong> Hedge = 1.00 × 0.50 × 0.77 × 0.87 = 0.33 lots short GBPUSD.</li> </ul> <h3>Forex hedging example</h3> <p>Imagine you are long 1.00 lot of EURUSD at 1.1000, expecting euro strength due to a hawkish ECB policy change. But ahead of US CPI, it dipped to 1.0990, leaving you $100 down (10 pips).</p> <p>Your thesis still holds. The euro could rebound if inflation comes in soft, but you want to protect around 50% of your exposure without fully capping the upside. You plan to exit the hedge post-release or if the price moves above 1.1010.</p> <p>You pick GBPUSD and short 0.33 lots at 1.2950, using the aforementioned hedge formula.</p> <p><strong>Downside scenario:</strong> EURUSD to 1.0940, -50 pips; GBPUSD to 1.2900, -50 pips</p> <ul> <li>EURUSD loses $500</li> <li>GBPUSD hedge gains = $165</li> <li><strong>Net</strong> = -$335</li> </ul> <p><strong>Upside scenario:</strong> EURUSD to 1.1040, +50 pips; GBPUSD to 1.3000, +50 pips</p> <ul> <li>EURUSD gains $500</li> <li>GBPUSD hedge loses = $165</li> <li><strong>Net</strong> = +$335.</li> </ul> <p>Costs:</p> <ul> <li>Two spreads plus potential swaps</li> <li>Imperfect correlation adds basis risk from GBP-specific moves</li> </ul> <p>With the hedging calculations cleared, let’s see how to set up a hedge trade in forex.</p> <h2>How to hedge Forex trades</h2> <p>To hedge a forex trade effectively, you need a structured framework that defines your exposure, objectives, method, sizing, execution, and ongoing management of the hedge.</p> <p>The process can be broken down into a series of clear steps:</p> <p><img alt="Trading hedging account with hedge broker (ThinkMarkets)" src="/getmedia/8a94db10-52d4-48fb-b064-1c1df69a80b0/Academy-Forex-FX-hedging-in-a-systematic-way.png" /></p> <p style="text-align: center;">FX hedging in a systematic way</p> <h3>Step 1. Identify downside risk exposure</h3> <ul> <li>Make a list of what you are effectively long and short by currency leg across all open positions.</li> <li>Note entries, size, pip value, and the time window you need to cover (minutes around a release, days across a central‑bank week).</li> <li>Flag concentration risk (e.g., a USD‑heavy book).</li> </ul> <h3>Step 2. Set currency hedging objectives</h3> <ul> <li>Decide the protection level (full neutrality for a short window, or partial to keep upside),</li> <li>Define the duration (event‑driven vs ongoing), and set removal triggers in advance (time, price, event outcome).</li> <li>Simple cost budget for spreads, swaps/forward points, and any option premium.</li> <li><strong>Exit triggers:</strong> Time‑based (after the event) and condition‑based (price, volatility, correlation).</li> </ul> <h3>Step 3. Select a CFD hedging method</h3> <ul> <li>Direct hedges are best for short, high‑uncertainty windows.</li> <li>Cross hedges neutralise a dominant currency leg while keeping a cross view.</li> <li>Correlation hedges offer flexibility but demand monitoring.</li> </ul> <h3>Step 4. Calculate size using online tools</h3> <ul> <li>Same‑pair hedges are straightforward (lot‑for‑lot for full protection; scale for partial).</li> <li>Cross (match the shared leg): Convert to the shared currency notional. Example: Long 1 lot EURUSD at 1.1000 → short USD ≈ $110,000. Buy ≈ 1.10 lots of USDJPY to hedge USD.</li> <li>For related instruments, use a correlation- and volatility-aware ratio and match notional amounts on the shared leg when cross-hedging. Keep sizing rules simple and consistent.</li> </ul> <h3>Step 5. Execute on the forex broker platform</h3> <ul> <li>Place the hedge and set alerts.</li> <li>Around major news, spreads can widen, consider limits or smaller clips.</li> <li>Label or group forex positions so net exposure is easy to track.</li> </ul> <h3>Step 6. Monitor and manage</h3> <ul> <li>After catalysts or large moves, reassess correlation/volatility and resize or remove the hedge per your triggers.</li> <li><strong>Track costs and ask:</strong> did drawdowns and variance fall as planned after costs? Refine if not.</li> <li>Remove or reduce the hedge when triggers fire or your thesis is confirmed/invalidated.</li> </ul> <p>Let’s now examine common hedging mistakes and how to avoid them for smarter hedging.</p> <p><strong>Trade up to 4,000 instruments with zero commission across seven global markets on ThinkTrader!</strong></p> <h2>Hedging mistakes & tips when trading forex</h2> <p>Even solid trading plans can fail when mistakes creep in. Here are the most common ones and practical solutions for them.</p> <ul> <li><strong>Over-hedging</strong> happens when you protect too much, too often. It turns potential winners flat, doubling costs like spreads and swaps while killing upside. Studies show excessive hedging in forex can reduce portfolio returns by up to 25% in volatile markets.</li> <li><strong>Underestimating costs</strong> is a silent killer. Beyond obvious spreads, swaps and premiums add up, especially in choppy conditions where slippage widens. Many beginners overlook this, turning a smart hedge into a net loss.</li> <li><strong>Failing to monitor and adjust</strong> (set and forget) combines poor timing with static thinking. Correlations shift after news, volatility spikes, and hedge ratios drift as prices move—what worked at open may fail halfway during a trade. Without active checks, you are exposed when conditions evolve.</li> <li>Hedging weakly correlated pairs gives <strong>false comfort</strong>. If pairs don't move together reliably (below 0.7 correlation), protection crumbles during stress. Always verify with recent data. Mismatched hedges can lead to up to 30% higher losses in correlation breakdowns.</li> </ul> <p><strong>Practical tips</strong></p> <ul> <li><strong>Hedge selectively:</strong> Limit hedging to high-risk windows like major data releases, using a partial coverage of 30% to 70% to preserve potential gains.</li> <li><strong>Factor all costs upfront:</strong> Calculate spreads, swaps, and opportunity costs. If they exceed the expected protection, abort.</li> <li><strong>Stay active:</strong> Review correlations daily after catalysts or weekly; adjust sizes for price movements like you would do in a live position.</li> <li><strong>Verify pairs:</strong> Use rolling 30 or 60-day correlations above 0.7, but test on demo first to avoid any surprises.</li> </ul> <p><img alt="Risk exposure (ThinkMarkets)" src="/getmedia/96811f72-6f36-41a9-9c68-afd2f97171ad/Academy-Forex-Hedge-Common-hedging-mistakes-and-practical-fixes.png" /></p> <p style="text-align: center;">Common hedging mistakes and practical fixes</p> <p>Now that we've covered the dos and don'ts, let's see if hedging forex aligns with your <a href="/en/trading-academy/technical-analysis/method-to-analyse/">trading style</a>.</p> <h2>Is hedging right for you?</h2> <p>Forex hedging is for traders and investors who want to lock in an exchange rate to protect their portfolio from adverse price moves. However, as with any other form of trading in the financial markets, there is a high risk of losing money when hedging forex.</p> <p>Still, for swing or position traders, hedging in forex makes it possible to ride longer-term trends through short-term bursts of volatility. But hedging forex is not universally suitable for all trading styles and requires regular monitoring, since correlations can shift quickly and costs can add up. For scalpers, for example, the extra costs of hedging forex trades usually outweigh the benefits. If you are thinking of opening a forex hedging account to countertrade your risk, there is a lot to consider.</p> <p>Ready to hedge forex pairs with reduced costs? Try ThinkZero here!</p>

Short selling: What is it, types & strategies