Artículos (40)

¿Qué es el análisis técnico en el trading?

<section> <p>La parte más importante de cualquier estrategia de trading es saber cuándo entrar y salir del mercado. En nuestras guías y artículos anteriores, hemos cubierto diversos factores que influyen en los movimientos de precios en los mercados financieros, como indicadores económicos y el clima político.</p> <p>Analizar estos factores se denomina análisis fundamental, y es un método muy popular entre los traders para evaluar los movimientos futuros de precios.</p> <p>Sin embargo, algunos traders consideran que los conocimientos obtenidos a través del análisis fundamental no son suficientes para determinar niveles exactos de compra y venta. Es aquí donde el análisis técnico puede ser útil.</p> <p>En este artículo, explicaremos qué es el análisis técnico, cómo funciona y sus principales tipos.</p> <h3>¿Qué es el análisis técnico?</h3> <p>El análisis técnico es el proceso de evaluar movimientos de precios pasados de un instrumento para determinar sus futuros movimientos. Se llama técnico porque se basa exclusivamente en estadísticas y no se ve afectado por noticias, factores económicos o políticos.</p> <p>Aunque este método es ampliamente utilizado por traders en todo el mundo, es importante entender que los precios pasados no predicen ni determinan los precios futuros, y toda la información obtenida a través del análisis técnico es únicamente indicativa.</p> <p>El análisis técnico incluye múltiples herramientas. Un analista técnico experimentado utiliza diversas combinaciones de ellas para comparar resultados y tomar decisiones informadas de trading. Estas herramientas pueden dividirse en tres categorías: líneas de tendencia, patrones de gráficos e indicadores técnicos.</p> <p>Las tres categorías analizan gráficos de precios. Por lo tanto, sea cual sea el tipo que elijas, lo más importante es aprender a leer gráficos de precios.</p> <h3>¿Qué es un gráfico de precios?</h3> <p>Un gráfico de precios en el trading es una secuencia gráfica de precios históricos de un instrumento. Los gráficos son el núcleo del trading, ya que ayudan a los traders a monitorear el valor de sus posiciones actuales, analizar movimientos de precios pasados y obtener pistas sobre hacia dónde podría moverse el precio. Entender cómo leer un gráfico de precios es un paso clave para aprender análisis técnico.</p> <p>Cada plataforma de trading ofrece diferentes tipos de gráficos, y la elección depende completamente de las preferencias del trader. La plataforma ThinkTrader, por ejemplo, cuenta con más de 15 tipos diferentes de gráficos para satisfacer las necesidades de los traders.</p> <p><img alt="Gráfico de precios" src="/getmedia/6aae82dc-4ad4-43ba-9b7b-fdbf2373e549/article-what-is-technical-analysis-price-chart-1.webp" style="width: 552px; height: 464px;" /></p> <p>Algunos de los más populares son los gráficos de velas, barras y líneas:</p> <p><img alt="Tipos de gráficos" src="/getmedia/ffc042b3-bc5a-4a9e-81e8-da5cb1ba5b5c/article-what-is-technical-analysis-chart-types.webp" style="width: 552px; height: 258px;" /></p> <p>Como el gráfico de velas es el más utilizado por los traders, veamos cómo funciona en detalle.</p> <h3>Gráfico de velas</h3> <p>Un gráfico de velas se llama así porque cada unidad del mismo se parece a una vela. El marco temporal de las velas puede ajustarse desde un minuto hasta un mes, dependiendo de la estrategia:</p> <p><img alt="Gráfico de velas" src="/getmedia/0f95f823-f6c9-42e1-a8f7-dcfb6ace79e7/article-what-is-technical-analysis-candlestick-chart.webp" style="width: 552px; height: 431px;" /></p> <p>Independientemente del marco temporal elegido, cada vela consta de dos elementos principales: la mecha y el cuerpo, que representan cuatro precios de un instrumento:</p> <ul> <li>Precio de apertura</li> <li>Precio máximo alcanzado durante el periodo elegido</li> <li>Precio más bajo alcanzado durante el periodo elegido</li> <li>Precio de cierre</li> </ul> <p>Las velas se colorean en función de si el mercado subió o bajó durante el periodo elegido. Las velas verdes (blancas en algunas plataformas) indican precios alcistas o alcistas, y las rojas (negras) representan precios bajistas, también llamados bajistas.</p> <p><img alt="Mechas de velas" src="/getmedia/38272a03-b39f-4a17-85b3-e0377aacfc0a/article-what-is-technical-analysis-candlestick-wicks.webp" style="width: 552px; height: 327px;" /></p> <p>En el análisis técnico, es precisamente la relación entre las velas individuales lo que ayuda a los traders a predecir el movimiento futuro de los precios.</p> <h3>Tipos de análisis técnico</h3> <p>Como mencionamos antes, las herramientas de análisis técnico se dividen en tres categorías principales: líneas de tendencia, patrones de gráficos e indicadores técnicos.</p> <ul> <li><strong>Líneas de tendencia:</strong> Ayudan a identificar la dirección general del precio y posibles niveles de entrada y salida.</li> <li><strong>Patrones de gráficos:</strong> Son secuencias gráficas que pueden indicar cambios o continuaciones de tendencias.</li> <li><strong>Indicadores técnicos:</strong> Basados en cálculos matemáticos, analizan tendencias y potenciales puntos de entrada y salida.</li> </ul> <p>Para empezar a familiarizarte con el análisis técnico, te recomendamos abrir una cuenta demo en ThinkTrader y explorar los gráficos de precios. Esta plataforma ofrece herramientas analíticas extensas que te permitirán avanzar en tu aprendizaje.</p> </section>

Trading 101: apalancamiento dinámico – qué es, cómo funciona y más

<section> <p>Operar en ThinkTrader o MT5 ofrece acceso a una herramienta avanzada que puede optimizar su experiencia de trading: el apalancamiento dinámico.<br /> </p> <p>Esta guía tiene como objetivo ayudarle a comprender en detalle qué es el apalancamiento dinámico, cómo funciona y, sobre todo, cómo puede utilizarlo para maximizar su potencial de beneficio mientras gestiona eficazmente el riesgo.</p> </section> <section> <h2>Comprendiendo el apalancamiento dinámico: ¿qué es?</h2> <p><br /> El apalancamiento dinámico es un mecanismo que ajusta de manera automática el nivel de apalancamiento según un criterio definido por el bróker. En el caso de ThinkMarkets, este ajuste se basa en el tamaño de la operación.<br /> <br /> A diferencia del apalancamiento fijo, donde la proporción de apalancamiento se mantiene constante y el apalancamiento dinámico varía automáticamente, adaptándose a la magnitud de sus posiciones en tiempo real.</p> </section> <section> <h2>Cómo funciona el apalancamiento dinámico</h2> <p><br /> Al operar con una cuenta de ThinkMarkets que incorpora apalancamiento dinámico, su nivel de apalancamiento se ajusta automáticamente en función del tamaño de cada orden. Existe una relación inversa entre el tamaño de la posición y el apalancamiento aplicado: a medida que aumenta su exposición, el apalancamiento disminuye en parte de la operación.<br /> </p> <p>Este proceso es completamente automático y se recalcula en tiempo real, contribuyendo a reducir su exposición al riesgo en operaciones de mayor volumen. En entornos volátiles, este sistema resulta especialmente útil, ya que actúa como una herramienta de control de riesgo que le ayuda a evitar pérdidas significativas.</p> </section> <section> <h2>Ejemplo práctico: escenario XAGUSD</h2> <p>Veamos un ejemplo para comprender mejor cómo funciona el apalancamiento dinámico.<br /> </p> <p>Supongamos que decide abrir una posición larga de 25 lotes en XAGUSD, con un precio de $50. A continuación, se muestra la tabla de niveles de apalancamiento utilizada por ThinkMarkets.</p> <img alt="" src="/getmedia/d7c85a34-d297-456a-8b08-d34b6929ba7b/Table3_ES_DL.png" /> <p><br /> Según los niveles de apalancamiento de ThinkMarkets:<br /> </p> <ul> <li>Los primeros 10 lotes tienen un apalancamiento de 500:1 con un requisito de margen del 0.2%.</li> <li>Los siguientes 10 lotes se asignan a un apalancamiento de 200:1, con un margen requerido del 0.5%.</li> <li>Los últimos 5 lotes reciben un apalancamiento de 100:1 con un margen requerido del 1%.</li> </ul> <h3>Cálculo del requisito de margen</h3> </section> <img alt="" src="/getmedia/e9cfda59-7acc-404f-9aa0-691f16ab75b7/Table4_ES_DL.png" /> <p><br /> Esto significa que, para una posición de 25 lotes en XAGUSD, el margen total requerido sería de $600, considerando que el precio del activo era de $50.<br /> </p> <p>Para obtener más información sobre cómo se ajusta el apalancamiento según la clase de activo y el tamaño de la operación, haga clic en el siguiente <a href="https://www.thinkmarkets.com/latam/dynamic-leverage-tiers/" target="_blank">enlace</a>.</p> <section> <h3>Ventajas del apalancamiento dinámico</h3> <p>Aunque el concepto pueda parecer técnico, el apalancamiento dinámico ofrece beneficios notables que pueden fortalecer su estrategia de trading:<br /> </p> <p><strong>Gestión de riesgo</strong><br /> <br /> El apalancamiento dinámico ajusta automáticamente su exposición según el tamaño de la posición. A medida que amplía su operación, el apalancamiento se reduce, disminuyendo la posibilidad de pérdidas considerables en relación con el saldo de su cuenta. Este mecanismo es especialmente útil durante periodos de alta volatilidad, cuando los movimientos del mercado pueden ser más bruscos.<br /> <br /> <strong>Flexibilidad</strong><br /> <br /> La posibilidad de abrir posiciones con un apalancamiento mayor le permite aprovechar más oportunidades incluso con un capital limitado. En ThinkMarkets, puede acceder a un apalancamiento de hasta 2500:1 en determinados mercados y tipos de cuenta. Recuerde que un mayor apalancamiento puede incrementar tanto los beneficios como las pérdidas, por lo que debe utilizarlo con prudencia.<br /> <br /> <strong>Preservación del capital</strong><br /> <br /> El objetivo principal de toda estrategia de trading sostenible es proteger el capital. Al reducir el apalancamiento en operaciones más grandes, el sistema dinámico evita una sobreexposición innecesaria. Esto contribuye a mantener la continuidad operativa incluso tras periodos de pérdidas, favoreciendo una gestión responsable a largo plazo.</p> </section> <section> <h3>Cómo integrar el apalancamiento dinámico en su estrategia</h3> <p>Comience a familiarizarse con el apalancamiento dinámico realizando operaciones pequeñas. La cuenta ThinkTrader le permite operar con un apalancamiento de hasta 2500:1, con un depósito mínimo de tan solo $50. Aproveche esta característica para potenciar sus oportunidades de rentabilidad, siempre manteniendo una gestión responsable del riesgo.<br /> </p> <p>Supervise atentamente sus posiciones para comprender cómo se ajusta el apalancamiento a medida que aumenta el tamaño de sus operaciones. Le recomendamos utilizar órdenes take profit y stop loss para asegurar beneficios y limitar posibles pérdidas de forma eficiente.<br /> </p> <p>A medida que se adapte al uso del apalancamiento dinámico en su operativa, familiarícese con los niveles de apalancamiento disponibles en su mercado preferido. Calcule correctamente sus requisitos de margen para evitar activaciones prematuras de una llamada de margen.<br /> </p> <p>En conclusión, el apalancamiento dinámico ofrece a los operadores una ventaja significativa al proporcionar flexibilidad para implementar estrategias más agresivas en posiciones pequeñas, al mismo tiempo que protege el capital y ayuda a gestionar el riesgo en exposiciones mayores. No obstante, es fundamental comprender y anticipar los riesgos asociados al trading antes de aplicarlo en su estrategia.<br /> </p> <p>Opere con apalancamiento dinámico en un entorno sin riesgo abriendo una cuenta demo de ThinkTrader.<br /> </p> </section> <p><a href="https://portal.thinktrader.com/account/individual/demo?_gl=1*nsqoa0*_gcl_au*MjAxMTA4MjU0Ny4xNzU1NzEzMzg3" target="_blank">Crear cuenta</a></p>

Tamaño de posición: la guía definitiva para traders de forex

<p>El tamaño de posición efectivo es una parte clave para tener éxito en el trading de forex. Es lo que determina cuánto capital asignas a cada operación, equilibrando las posibles ganancias con niveles de riesgo aceptables.</p> <p>En esta guía definitiva sobre el tamaño de posición, exploraremos las calculadoras de lotes y compartiremos conocimientos que podrían ayudarte a mejorar tu desempeño en el trading.</p> <h2>Entendiendo el tamaño de posición en el trading de forex</h2> <p>El tamaño de posición es el proceso de decidir cuánto comprar o vender en una operación de forex. No se trata solo de ingresar al mercado, sino de hacerlo con un riesgo calculado que se ajuste a tu plan de trading y tolerancia al riesgo.</p> <p>Al gestionar bien tus tamaños de posición, puedes proteger tu capital de trading de grandes pérdidas y, además, aumentar tus posibilidades de obtener ganancias consistentes a lo largo del tiempo.</p> <h2>La importancia de los tamaños de lote</h2> <p>En el trading de forex, las divisas se negocian en cantidades específicas conocidas como lotes. Un lote representa una cantidad estandarizada de la moneda base en un par de divisas.</p> <p>Comprender los tamaños de lote es fundamental, ya que afecta el valor de cada movimiento de pip, lo que a su vez influye en tus posibles ganancias o pérdidas.</p> <h3>Tipos de tamaños de lote</h3> <ul> <li><strong>Standard:</strong> Equivalente a 100,000 unidades de la moneda base. Por ejemplo, operar un lote standard de EUR/USD significa comprar o vender 100,000 euros.</li> <li><strong>Mini:</strong> Representa 10,000 unidades de la moneda base. Operar con lotes mini permite a los traders con cuentas más pequeñas participar en el mercado.</li> <li><strong>Micro:</strong> Igual a 1,000 unidades de la moneda base. Los lotes micro ofrecen mayor flexibilidad y menor exposición al riesgo.</li> <li><strong>Nano:</strong> Algunos brokers ofrecen lotes nano, equivalentes a 100 unidades de la moneda base. Son ideales para traders que desean comenzar con una inversión pequeña.</li> </ul> <p>Entender estos tamaños de lote te ayuda a personalizar tus operaciones según el tamaño de tu cuenta y tu estrategia de gestión de riesgos.</p> <h3>Cálculo del tamaño de posición</h3> <p>Calcular el tamaño de posición correcto es esencial para una gestión de riesgos eficaz. Para hacerlo manualmente, debes considerar varios factores:</p> <ul> <li><strong>Balance/capital de la cuenta:</strong> El monto total de capital en tu cuenta de trading.</li> <li><strong>Porcentaje de riesgo por operación:</strong> El porcentaje de tu capital que estás dispuesto a arriesgar en una sola operación, generalmente entre 1% y 2%.</li> <li><strong>Distancia del stop-loss:</strong> La cantidad de pips entre tu precio de entrada y tu nivel de stop-loss.</li> <li><strong>Valor del pip:</strong> El valor monetario de cada movimiento de pip para el par de divisas que estás operando.</li> </ul> <h2>Utilizando las calculadoras de tamaño de lote</h2> <p>Los cálculos manuales son simples, pero pueden llevar tiempo, especialmente cuando operas con varios pares de divisas con diferentes valores de pip. Aquí es donde una calculadora de tamaño de lote se vuelve imprescindible.</p> <p>Una calculadora de tamaño de lote simplifica el proceso al calcular automáticamente el tamaño de posición óptimo según tus datos. Solo necesitas ingresar tu capital, porcentaje de riesgo, distancia del stop-loss y el par de divisas. La calculadora hace el resto.</p> <h3>Beneficios de usar una calculadora de tamaño de lote</h3> <p>Usar una calculadora de tamaño de lote ofrece varios beneficios que pueden mejorar tu experiencia de trading.</p> <p>Mejora la precisión al reducir errores de cálculo, ayudando a evitar exposiciones de riesgo no intencionadas.</p> <p>Aumenta la eficiencia al ahorrarte tiempo, permitiéndote concentrarte más en el análisis del mercado y la ejecución de operaciones.</p> <p>Además, proporciona comodidad al facilitar ajustes rápidos para diferentes operaciones y condiciones de mercado.</p> <p>Muchas plataformas en línea ofrecen calculadoras de tamaño de lote gratuitas, y algunas plataformas de trading las incluyen directamente para facilitar tu operativa.</p> <h3>El papel de las calculadoras de tamaño de posición en MT4</h3> <p>MetaTrader 4 (MT4) es una de las plataformas de trading más utilizadas en la industria del forex. Admite el uso de indicadores personalizados y scripts, incluyendo la calculadora de tamaño de posición para MT4. Este indicador se integra perfectamente en la plataforma, proporcionando cálculos en tiempo real.</p> <h3>Ventajas de la calculadora de tamaño de posición en MT4</h3> <ul> <li>Elimina la necesidad de cambiar entre diferentes aplicaciones o sitios web.</li> <li>Actualiza automáticamente los cálculos basados en precios de mercado en tiempo real.</li> <li>Permite personalizar la configuración según tus preferencias de trading y reglas de gestión de riesgos.</li> </ul> <p>Para usar esta función, busca una calculadora de tamaño de posición compatible con MT4, descárgala e instálala. Así podrás optimizar tus operaciones directamente desde los gráficos.</p> <h3>Desarrollando una estrategia de tamaño de posición</h3> <p>Crear una estrategia sólida de tamaño de posición es fundamental para el éxito a largo plazo en el trading de forex. Implica más que cálculos: se trata de integrar el tamaño de posición en tu plan de trading general.</p> <h3>Estableciendo tus parámetros de riesgo</h3> <p>Determina el porcentaje de tu capital de trading que estás dispuesto a arriesgar en cada operación. Esta tolerancia al riesgo debe reflejar tus metas financieras y tu comodidad psicológica con posibles pérdidas.</p> <h3>Consistencia en la aplicación</h3> <p>Aplica tu porcentaje de riesgo de manera consistente en todas las operaciones. Esto ayuda a gestionar el riesgo total y evita decisiones emocionales, especialmente después de una serie de ganancias o pérdidas.</p> <h3>Ajustes según las condiciones del mercado</h3> <p>Aunque la consistencia es clave, también es importante considerar la volatilidad del mercado. En mercados más volátiles, podrías reducir el tamaño de tu posición para compensar distancias de stop-loss más amplias.</p> <h2>Errores comunes en el tamaño de posición</h2> <p>Incluso los traders experimentados pueden cometer errores en el tamaño de posición. Ser consciente de estos errores comunes puede ayudarte a evitarlos.</p> <h3>Sobreapalancamiento</h3> <p>Usar un apalancamiento excesivo puede amplificar tanto las ganancias como las pérdidas. El sobreapalancamiento ocurre cuando los traders toman posiciones demasiado grandes para el tamaño de su cuenta, aumentando el riesgo de sufrir grandes pérdidas.</p> <h3>Ignorar los niveles de stop-loss</h3> <p>No establecer o no respetar los niveles de stop-loss puede socavar la efectividad de tu estrategia de dimensionamiento de posiciones.</p> <p>Siempre calcula el tamaño de tu posición basándote en un stop-loss predeterminado para garantizar una adecuada gestión del riesgo.</p> <h3>Decisiones de trading emocionales</h3> <p>Permitir que las emociones dicten tus decisiones de trading puede llevar a tamaños de posición inconsistentes y a un aumento del riesgo.</p> <p>Mantente fiel a los tamaños de posición calculados, incluso después de una serie de ganancias o pérdidas, para mantener la disciplina.</p> <h3>El aspecto psicológico del tamaño de posición</h3> <p>Un tamaño de posición efectivo no solo protege tu capital, sino que también tiene un impacto positivo en tu psicología de trading.</p> <p>Saber que cada operación lleva un nivel de riesgo controlado puede reducir el estrés y ayudarte a tomar decisiones más racionales.</p> <p>Esto te permite centrarte en tus metas a largo plazo, ignorando las fluctuaciones a corto plazo.</p> <h2>Usando el tamaño de posición en tu plan de trading</h2> <p>Un plan de trading completo debe incluir directrices detalladas sobre el tamaño de posición. Este plan actúa como un roadmap para tus actividades de trading, garantizando consistencia.</p> <h3>Pasos para integrar el tamaño de posición</h3> <ol> <li>Decide el porcentaje máximo de tu capital que estás dispuesto a arriesgar por operación.</li> <li>Establece reglas para calcular los tamaños de posición según diferentes escenarios y condiciones del mercado.</li> <li>Utiliza calculadoras de tamaño de lote o indicadores de calculadora de tamaño de posición para mantener la precisión.</li> <li>Revisa regularmente tu estrategia de tamaño de posición y ajustala a medida que tu cuenta crece o cambian las condiciones del mercado.</li> </ol> <h2>Mejorando tu desempeño en el trading</h2> <p>Para profundizar tu comprensión sobre el tamaño de posición, explora recursos educativos como cursos en línea, webinars o tutoriales. Este tipo de recursos ofrece oportunidades de aprendizaje interactivo y conocimientos de expertos.</p> <p>Consulta recursos educativos diseñados para plataformas como MT4, incluyendo tutoriales sobre cómo usar herramientas como la calculadora de tamaño de posición.</p> <p>El tamaño de posición es una parte fundamental del trading de forex, ya que impacta cómo gestionas el riesgo y obtienes resultados consistentes.</p> <p>Al comprender la importancia de los tamaños de lote y usar herramientas como calculadoras de tamaño de lote, puedes mejorar tu trading. Integrar estas prácticas en tu plan de trading te ayudará a tener un mejor desempeño.</p> <p>El éxito en el trading no se trata solo de obtener ganancias, sino también de preservar tu capital.</p> <p>Un buen tamaño de posición te ayuda a operar con confianza, asegurándote de que cada operación se ajuste a tu plan de gestión de riesgos. Mantener la disciplina y educarte te pone en el camino hacia tus metas de trading.</p>

¿Qué es un pip en el trading de forex?

<h2>¿Qué es un pip?</h2> <ul> <li>Un "pip" es el incremento entero más pequeño en cualquier par de forex.</li> <li>Para pares cotizados en 3 decimales, un incremento de pip se basa en el segundo decimal.</li> <li>Para pares cotizados en 5 decimales, un incremento de pip se basa en el cuarto decimal, como el EUR/USD a continuación.</li> </ul> <p><img alt="pips" src="/TMXWebsite/media/TMXWebsite/pips_1.png" /><br /> </p> <h2>Ejemplo</h2> <ul> <li>EUR/USD: Un movimiento de 1.362(9)8 a 1.363(0)8 es un movimiento de 1 pip.</li> <li>En USD/JPY, un movimiento de 104.4(7)1 a 104.4(8)1 es 1 pip.</li> </ul> <p>Entonces, ¿cuánto vale un pip? Esto se determina por la moneda de tu cuenta, el par que estás operando y el tamaño de la posición de tu operación.</p>

Estrategias Populares de Trading de Forex para Traders Exitosos

<p><strong>Identificar una estrategia exitosa de trading de Forex</strong> es uno de los aspectos más importantes en el comercio de divisas. En general, existen numerosas estrategias diseñadas por diferentes tipos de traders para ayudarte a obtener ganancias en el mercado.</p> <p>Sin embargo, cada trader individual debe encontrar la mejor estrategia de Forex que se adapte a su estilo de trading y tolerancia al riesgo. Al final, no hay una talla única para todos.</p> <p>Para obtener ganancias, los traders deben centrarse en eliminar las operaciones perdedoras y lograr más operaciones exitosas. Cualquier estrategia de trading que te acerque a este objetivo podría resultar exitosa.</p> <h2>Cómo elegir la mejor estrategia de trading de Forex</h2> <p>Antes de proceder a discutir las estrategias de trading de Forex más populares, es importante entender los mejores métodos para elegir una estrategia de trading. Hay tres elementos principales que deben tenerse en cuenta en este proceso.</p> <h3>Marco de tiempo</h3> <p>Elegir un marco de tiempo que se adapte a tu estilo de trading es muy importante. Para un trader, hay una gran diferencia entre operar en un gráfico de 15 minutos y un gráfico semanal. Si te inclinas más hacia convertirte en un scalper, un operador que busca beneficiarse de movimientos pequeños del mercado, deberías enfocarte en marcos de tiempo más bajos, como gráficos de 1 minuto a 15 minutos.</p> <p>Por otro lado, los swing traders probablemente utilicen un gráfico de 4 horas y un gráfico diario para generar oportunidades de trading rentables. Por lo tanto, antes de elegir tu estrategia de trading preferida, asegúrate de responder a la pregunta: ¿cuánto tiempo quiero permanecer en una operación?</p> <p>Períodos de tiempo variables (largo, mediano y corto plazo) corresponden a diferentes estrategias de trading.</p> <h3>Número de oportunidades de trading</h3> <p>Al elegir tu estrategia, debes responder a la pregunta: ¿con qué frecuencia quiero abrir posiciones? Si buscas abrir un mayor número de posiciones, debes centrarte en una estrategia de scalping.</p> <p>Por otro lado, los traders que tienden a dedicar más tiempo y recursos al análisis de informes macroeconómicos y factores fundamentales probablemente pasarán menos tiempo frente a los gráficos. Por lo tanto, su estrategia de trading preferida se basará en marcos de tiempo más amplios y posiciones más grandes.</p> <h3>Tamaño de posición</h3> <p>Encontrar el tamaño de operación adecuado es de suma importancia. Las estrategias de trading exitosas requieren que conozcas tu sentimiento de riesgo. Arriesgar más de lo que puedes es problemático, ya que puede llevar a pérdidas mayores.</p> <p>Un consejo popular al respecto es establecer un límite de riesgo en cada operación. Por ejemplo, los traders tienden a establecer un límite del 1% en sus operaciones, lo que significa que no arriesgarán más del 1% de su cuenta en una sola operación.</p> <p>Por ejemplo, si tu cuenta vale US$ 30,000, deberías arriesgar hasta US$ 300 en una sola operación si el límite de riesgo se establece en el 1%. Dependiendo de tu sentimiento de riesgo, puedes ajustar este límite al 0.5% o al 2%.</p> <p>En general, cuanto menor sea el número de operaciones que estás buscando abrir, mayor debería ser el tamaño de la posición, y viceversa.</p> <h2>Tres estrategias exitosas</h2> <p>En este punto, has identificado un marco de tiempo, el tamaño de posición deseado en una sola operación y la cantidad aproximada de operaciones que estás buscando abrir durante un período de tiempo específico. A continuación, compartimos tres estrategias populares de trading de Forex que han demostrado ser exitosas.</p> <h3>Scalping</h3> <p><strong>El scalping de Forex</strong> es una estrategia de trading popular centrada en movimientos pequeños del mercado. Esta estrategia implica abrir un gran número de operaciones con el objetivo de obtener pequeñas ganancias en cada una.</p> <p>Como resultado, los scalpers trabajan para generar ganancias más grandes al obtener una gran cantidad de ganancias pequeñas. Este enfoque es completamente opuesto a mantener una posición durante horas, días o incluso semanas.</p> <p>El scalping es muy popular en Forex debido a su liquidez y volatilidad. Los inversores buscan mercados donde la acción del precio se mueva constantemente para capitalizar las fluctuaciones en incrementos pequeños.</p> <p>Este tipo de operador tiende a centrarse en ganancias de alrededor de 5 pips por operación. Sin embargo, esperan que un gran número de operaciones sean exitosas, ya que las ganancias son constantes, estables y fáciles de lograr.</p> <p>Una clara desventaja del scalping es que no puedes permitirte permanecer en la operación demasiado tiempo. Además, el scalping requiere mucho tiempo y atención, ya que debes analizar constantemente los gráficos para encontrar nuevas oportunidades de trading.</p> <p dir="ltr">Veamos ahora cómo funciona el scalping en la práctica. A continuación, verás el gráfico de 15 minutos del par EUR/USD. Nuestra estrategia de scalping se basa en la idea de que buscamos vender cualquier intento de la acción del precio de moverse por encima del promedio móvil de 200 períodos.<br /> </p> <p dir="ltr"><img alt="EUR/USD 15-Minute Chart" src="/TMXWebsite/media/TMXWebsite/EUR-USD-chart.jpg" /></p> <p dir="ltr">En aproximadamente 3 horas, generamos cuatro oportunidades de trading. Cada vez, la acción del precio se movió ligeramente por encima del promedio móvil de 200 períodos antes de girar a la baja. Un stop loss se coloca 5 pips por encima del promedio móvil, mientras que la acción del precio nunca superó el promedio móvil en más de 3.5 pips.<br /> </p> <p dir="ltr">El take profit también es de 5 pips, ya que nos enfocamos en lograr un gran número de operaciones exitosas con ganancias más pequeñas. Por lo tanto, en total se recopilaron 20 pips con una estrategia de scalping.<br /> </p> <h3 dir="ltr">Day Trading</h3> <p dir="ltr"><strong>El day trading</strong> se refiere al proceso de operar divisas en un solo día de trading. Aunque es aplicable en todos los mercados, la estrategia de day trading se utiliza principalmente en Forex. Este enfoque de trading te aconseja abrir y cerrar todas las operaciones en un solo día.<br /> </p> <p dir="ltr">Ninguna posición debe permanecer abierta durante la noche para minimizar el riesgo. A diferencia de los scalpers, que buscan permanecer en los mercados durante unos minutos, los day traders suelen estar activos durante el día monitoreando y gestionando las operaciones abiertas. Los day traders suelen utilizar marcos de tiempo de 30 minutos y 1 hora para generar ideas de trading.<br /> </p> <p dir="ltr">Muchos day traders tienden a basar sus estrategias de trading en noticias. Eventos programados como estadísticas económicas, tasas de interés, PIB, elecciones, etc., tienden a tener un fuerte impacto en el mercado.<br /> </p> <p dir="ltr"><img alt="GBP/USD 1-Hour Chart" src="/TMXWebsite/media/TMXWebsite/GBP-USD-chart.jpg" /></p> <p dir="ltr">En el gráfico anterior, observamos un ejemplo de una operación exitosa de day trading en el par GBP/USD. El day trader ha utilizado el gráfico de 1 hora para observar el par GBP/USD. Una vez que la acción del precio cerró por encima del promedio móvil de 200 períodos, se abrió una posición larga.<br /> </p> <p dir="ltr">El take profit se estableció en el nivel de resistencia anterior y el stop loss fue colocado ligeramente por debajo del promedio móvil de 200 períodos. El day trader logró capturar con éxito una operación de 150 pips en unas pocas horas.<br /> </p> <h3 dir="ltr">Swing Trading</h3> <p dir="ltr"><strong>El swing trading</strong> implica operar con un rango de varios días a varias semanas. Los traders de swing trading buscan aprovechar los movimientos de precios más grandes en el mercado de divisas. El enfoque de esta estrategia de trading implica mantener una posición durante varios días o incluso semanas.<br /> </p> <p dir="ltr">En comparación con el day trading y el scalping, el swing trading se centra en capturar movimientos más grandes en el mercado de divisas. Los swing traders utilizan marcos de tiempo más amplios, como gráficos diarios y semanales, para tomar decisiones comerciales informadas.<br /> </p> <p dir="ltr">Un ejemplo claro de swing trading en acción es el par USD/JPY. Si observas el gráfico semanal de USD/JPY, puedes ver cómo el swing trader aprovecha el impulso alcista. Una vez que el precio rompe por encima de la resistencia clave, se inicia una posición larga.<br /> </p> <p dir="ltr"><img alt="USD/JPY Weekly Chart" src="/TMXWebsite/media/TMXWebsite/Market%20News%20Articles/ZA-Market-news-usd-jpy-chart.png" /></p> <p dir="ltr">El stop loss se establece por debajo del nivel de soporte anterior y el take profit se coloca cerca del siguiente nivel de resistencia. En este caso, el swing trader captura un movimiento de 300 pips a lo largo de varias semanas.<br /> </p> <p dir="ltr">En conclusión, para elegir la mejor estrategia de trading de Forex, debes tener en cuenta factores como el marco de tiempo, el número de oportunidades de trading y el tamaño de la posición. Una vez que comprendas estos elementos, podrás decidir qué estrategia se adapta mejor a tu estilo de trading y objetivos financieros.<br /> </p>

Cómo entender las señales de trading de forex

Las señales de forex sirven para determinar las oportunidades de trading adecuadas en el momento adecuado.<br /> Las señales de forex son muy populares entre los traders principiantes para mejorar su tasa de éxito y enriquecer su experiencia de trading. Estas señales pueden ser generadas tanto por un analista o trader humano, como por una plataforma automatizada en un servicio de señales de forex. <h2>¿Qué son las señales de forex?</h2> <p dir="ltr">Las señales de forex sirven para determinar las oportunidades de trading adecuadas en el momento adecuado. Por su propia naturaleza, una señal de forex se refiere a una idea de trading centrada en un par de divisas específico, que debe implementarse a un precio y tiempo predefinidos.<br /> <br /> Independientemente de tu experiencia, usar señales de forex puede mejorar significativamente tu desempeño en el trading. Además, los traders expertos pueden utilizar las señales de forex para expandir su rentabilidad y experiencia.<br /> <br /> En cuanto a los traders novatos, las señales de forex ofrecen muchas ventajas, ya que les permiten obtener ganancias mientras adquieren conocimientos sobre el mundo del trading con divisas. Al usar las señales, los traders también pueden acelerar el proceso de aprendizaje, porque les ayuda a obtener una visión completa de las opciones de trading en las que se basa la señal.<br /> <br /> Es muy importante saber que una señal de trading es útil solamente cuando se utiliza en el momento adecuado, especialmente en un mercado volátil como el forex. Por otro lado, una señal puede volverse fácilmente inútil si un trader la recibe demasiado tarde.<br /> <br /> Para asegurarse de que los traders reciban las señales de trading en el momento adecuado, los proveedores envían las señales a través de múltiples canales de comunicación como SMS, correo electrónico y notificaciones push. Otra opción es descargar complementos que permiten a los traders recibir sus señales directamente en su plataforma de trading. Algunos traders utilizan comunidades de trading social para recibir señales de forex relevantes.<br /> <br /> En pocas palabras, las señales de trading de forex representan información esencial que se debe conocer relacionada con el mercado. En muchos sentidos, una señal de forex representa una actualización inmediata que los traders pueden incorporar en las decisiones de trading que ejecutan.<br /> </p> <h2>Tipos de señales de forex</h2> <p>Aunque muchos servicios de señales comparten algunas características, no existe un servicio de señales universal. En este artículo, cubrimos los cuatro servicios de señales de forex más comunes.</p> <h3>Señales de forex manuales vs. automatizadas</h3> <p dir="ltr">Este servicio se categoriza según la forma en que se generan las señales. Una señal de forex manual es creada por una persona que generalmente es un analista o un trader experimentado. Esto se debe a que, con el trading de señales manuales, el trader debe tomar la decisión final y el factor de inteligencia humana juega un papel importante.<br /> <br /> En contraste, las señales de trading automatizadas son creadas por una computadora o software que monitorea y analiza la acción del precio basado en algoritmos codificados.<br /> <br /> El principal beneficio que viene con el trading de señales automáticas es que excluye la emoción y proporciona una mayor velocidad de ejecución en el trading. Sin embargo, también tiene una desventaja porque se depende mucho de una computadora, sistema o individuo y se excluye el proceso de toma de decisiones.</p> <p> </p> <h3>Señales de forex pagas vs. gratuitas</h3> <p>Esta categoría se basa en el precio de un operador de servicio de señales. Como indica su nombre, los proveedores de señales de forex gratuitas ofrecen señales sin solicitar pago, mientras que los proveedores de señales de forex pagas ofrecen señales, pero requieren un pago por ese servicio. Esta última categoría generalmente solicita pagos únicos o suscripciones mensuales.<br /> </p> <h3>Señales de forex de entrada vs. salida</h3> <p dir="ltr">Esta es una categoría basada en la cantidad de detalles de una sugerencia de trading. Hay servicios de señales que proporcionan solo señales de entrada, que le dicen a un trader cuándo entrar al mercado, y hay otros proveedores que ofrecen solo señales de salida que le dicen a los traders cuándo cerrar su posición abierta.<br /> <br /> La mayoría de las veces, esto concierne a las señales de trading de forex a largo plazo en productos financieros que tienen tendencias durante períodos prolongados. Cuando se trata de señales de trading a corto plazo, una idea de trading generalmente tiene en cuenta tanto las señales de entrada como de salida.<br /> </p> <h2>¿Qué es el copy trading?</h2> <p dir="ltr">El copy trading es un tipo de trading que se ha vuelto muy popular en los últimos años porque permite a los nuevos traders obtener ganancias. De hecho, cada vez hay más traders que desarrollan carteras "basadas en personas" donde la idea es invertir en otros inversores que realizan las operaciones por ti, en lugar de operar con divisas por ti mismo.<br /> <br /> Hay varias formas en que se puede realizar el copy trading según la plataforma que elijas. Sea cual sea la plataforma, la idea principal es la misma: invierte una parte de tu cartera en un trader específico y copia todas sus operaciones de manera proporcional.<br /> <br /> Ten en cuenta que la mayoría de las plataformas no permiten invertir más del 20% de tu cartera en un solo trader, para fomentar la diversificación de la cartera. Esta es una política eficiente, ya que a veces los inversores parecen más hábiles de lo que realmente son o pasan por una mala racha. Por eso es prudente no tener demasiada de tu cartera invertida en un solo trader.<br /> <br /> Cuando se trata de monitorear gráficos y estadísticas, el copy trading es como el trading normal. Sin embargo, la principal diferencia es que en el copy trading estás monitoreando a personas reales en lugar de movimientos del mercado. Por eso es de suma importancia revisar la cartera de un trader antes de copiarlo. Aprende sobre su estrategia, historial y las estrategias de gestión de riesgos que utilizan.<br /> <br /> Algo que se puede asegurar es que el copy trading es excelente para los traders novatos. Es una forma más fácil de ingresar al mundo del trading y te permitirá ganar dinero generando oportunidades de trading a partir de inversores exitosos. Incluso si empiezas a perder, no puedes perder todo gracias a la política de diversificación de la cartera.<br /> <br /> Recuerda que ningún tipo de trading garantiza el éxito, pero al menos es una excelente manera de ganar experiencia. Y también es una excelente forma de aprender sobre trading, ya que estás aprendiendo de traders más experimentados y exitosos.<br /> </p> <h2><meta charset="utf-8" /><b>¿Quiénes proporcionan señales de forex?</b></h2> <p dir="ltr">Como ya hemos mencionado, existen proveedores de señales manuales y automatizadas. Los proveedores manuales suelen ser traders experimentados, analistas de mercado y estrategas. Los proveedores manuales ofrecen oportunidades de trading derivadas de su experiencia en el trading, su experiencia en análisis fundamental y técnico, así como sus estrategias de trading.<br /> <br /> Por otro lado, los proveedores de señales automatizadas se refieren a software informático que se desarrolla para crear instrucciones de trading cuando aparecen parámetros o condiciones específicas en el mercado. Los Expert Advisors (EA) son un ejemplo de proveedores de señales automatizadas ya que utilizan técnicas de análisis técnico basadas en indicadores de pronóstico, como Medias Móviles, Niveles de Fibonacci y Estocásticos.<br /> <br /> Alternativamente, también hay otros proveedores de señales automatizadas que utilizan métodos de análisis fundamental, incluyendo el monitoreo de comunicados de noticias económicas y el sentimiento del mercado. Puedes preferir proveedores de señales automatizadas a proveedores de señales manuales, o viceversa, dependiendo de lo que estés buscando.<br /> <br /> También puedes encontrar plataformas que colaboran con proveedores de señales de terceros de forma gratuita diariamente y semanalmente a través de reseñas y análisis del mercado.<br /> <br /> Una de las comunidades de auto-trading más grandes del mundo que vale la pena mencionar es MQL5. Cualquiera puede convertirse en un proveedor de señales en esta comunidad, sin embargo, hay una serie de condiciones que cumplir para asegurarse de que puedes suscribirte a un proveedor de señales que se ajuste a tus requisitos. MQL5 evalúa los resultados de trading confirmados de todos los proveedores y los califica.<br /> <br /> Además, puedes usar diferentes opciones de filtrado que te permitirán elegir tus proveedores de señales preferidos según su desarrollo porcentual, reducción y trading manual o algorítmico.<br /> <br /> Esta comunidad también te advertirá sobre cualquier proveedor que aún no haya entregado suficientes señales de forex o sobre nuevos proveedores de señales cuyos resultados exitosos podrían haber ocurrido por casualidad. Una vez que te suscribas a un proveedor de señales de MQL5, podrás copiar las operaciones del trader que hayas seleccionado.<br /> </p> <h2>Cómo usar las señales de forex</h2> <p>Primero que nada, asegúrate de elegir un buen broker. Los brokers confiables utilizan plataformas de confianza que son muy importantes para proporcionar señales de manera confiable.<br /> <br /> Luego, elige un proveedor adecuado. Esta es en realidad una tarea más difícil de lo que parece, aunque hay una gran cantidad de opciones para los traders que desean utilizar proveedores de señales de forex. Este es uno de los pasos más importantes, porque ejecutar operaciones basadas en señales poco fiables puede resultar en grandes pérdidas. Recuerda que estás poniendo mucha fe en el proveedor, así que asegúrate de elegir sabiamente.<br /> <br /> Por eso, debes realizar una investigación detallada sobre los proveedores de señales disponibles y elegir un proveedor con alta reputación y fiabilidad.<br /> <br /> Antes de decidirte y elegir un proveedor, infórmate sobre su desempeño y estrategias de trading. Hay proveedores de señales que ofrecen un período de prueba gratuito al que puedes suscribirte más adelante si estás satisfecho con los resultados.<br /> <br /> En cuanto a las estrategias automatizadas, generalmente puedes realizar backtesting para ver cómo le habría ido a la computadora en varias circunstancias del mercado. También sería prudente probar a los proveedores de señales en una cuenta demo antes de arriesgar capital real.<br /> <br /> También es importante saber que existen plataformas de trading que ofrecen funciones de personalización avanzadas que pueden marcar la diferencia, ya que no todos los proveedores de señales enriquecerán tu experiencia de trading. Una plataforma personalizable se asegurará de que puedas ajustar una señal confiable a tus objetivos e intereses de inversión.<br /> <br /> No olvides que el trading con pares de divisas puede ser a corto o largo plazo. Las señales a corto plazo se utilizan en el trading diario e intradía, mientras que las señales a largo plazo se utilizan por varios días.<br /> <br /> Ten en cuenta que estas señales son dependientes del tiempo, así que asegúrate de utilizar una señal tan pronto como la recibas.</p> <p> </p> <h2>Conclusiones clave</h2> <ul dir="ltr"> <li role="presentation">Las señales de trading son generadas tanto por un analista o trader humano como por una plataforma automatizada proporcionada a un suscriptor del servicio de señales de forex.</li> <li role="presentation">Las señales de forex ofrecen ventajas, ya que permiten a los traders obtener ganancias mientras adquieren conocimientos sobre el mundo del trading con divisas.</li> <li role="presentation">El copy trading permite invertir en otros inversores que realizan las operaciones por ti, en lugar de operar con divisas por ti mismo.</li> <li role="presentation">Hay proveedores de señales que ofrecen un período de prueba gratuito al que puedes suscribirte más adelante si estás satisfecho con los resultados.</li> <li role="presentation">Siempre realiza backtesting para verificar cómo le habría ido a la computadora en diversas circunstancias del mercado.</li> </ul>

The Simple Moving Average (SMA) indicator

<p dir="ltr">The <strong>Simple Moving Average </strong>(SMA) indicator is one of the most straightforward measures available to traders. <br /> </p> <p dir="ltr">It is a trend-defining indicator that isn’t necessarily made to be used in range-bound markets, but they can show you when that condition is approaching, thereby keeping you out of the market or having you switch the tools that you use.</p> <p>What is the simple moving average indicator?</p> <p dir="ltr">The simple moving average indicator is a measure of the average price over a certain amount of <a href="/latam/trading-academy/indicators-and-patterns/japanese-candlesticks/"><u>candlesticks</u></a>. <br /> </p> <p dir="ltr">For example, if the 20-day simple moving average indicator is added to a chart, it will calculate the average price over the previous 20 days. The indicator updates itself at every candlestick and creates a line that goes up and down on the chart, showing the overall flow of where the market is going. <br /> </p> <p dir="ltr">There are other versions of moving average indicators, but the simple moving average indicator is the easiest to use. You simply measure the average closing price of a certain amount of candles, divided by that many candles. <br /> </p> <p dir="ltr">This gives you the average price, and as time goes on the various levels are connected by a line, giving traders a clear view as to whether the average price is rising, falling, or simply going sideways over a certain amount of time.<br /> </p> <p dir="ltr">It can be used on any timeframe, but there are some that do tend to be used more than others. </p> <p>How to add a simple moving average indicator to MetaTrader</p> <p dir="ltr">To add a simple moving average indicator to <u>your charts</u>, click on the '<strong>Insert</strong>' menu, choose 'Indicators', and then select 'Trend', where you will find '<strong>Moving Average</strong>' on that menu. A dialog box will pop up with the title '<strong>Moving average</strong>', giving you several options. <br /> </p> <p dir="ltr">The '<strong>Period</strong>' box allows you to select how many candlesticks you wish to calculate the average price of, and then the '<strong>MA method</strong>' allows you to select which type of moving average you want to apply. In this case, you would obviously select '<strong>Simple</strong>.' You can also choose to apply to either the <em>close</em>, <em>high</em>, <em>low</em>, or <em>open</em>, but 99% of what you will see involves the close.<br /> <br /> <img alt="adding the Simple Moving Average indicator" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/adding-SMA.jpg" /></p> <p>How the simple moving average indicator is typically used</p> <p dir="ltr">The most common way this indicator is used is to determine the overall trend. Notice the red line that is sloping lower on the chart below. It shows that we are clearly grinding lower over the course of the last several days on the hourly chart in the AUD/NZD pair.<br /> </p> <p dir="ltr">The slope going lower is a function of the average price drifting lower and lower over time. Notice how at the beginning of the chart the 20 SMA was rising, but then the price broke down through the moving average to show that something had changed.<br /> </p> <p dir="ltr">Shortly after that, you’ll notice that a majority of the candlesticks were below the 20 SMA, showing that price had changed from rising over the course of the previous 20 hours to falling. <br /> </p> <p dir="ltr">This shows an overall trend change, and it gives you an idea as to whether you should be long or short a currency pair. In this case, it’s obvious that selling the Australian dollar against the New Zealand dollar was the right way to go. The moving average shows you just how right it was.<br /> <br /> <!--%3Cmeta%20charset%3D%22utf-8%22%20%2F%3E--><img alt="ALT: example of a 20 SMA trading strategy" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/20-SMA-strategy.jpg" /></p> <br /> <!--%3Cmeta%20charset%3D%22utf-8%22%20%2F%3E--> <p dir="ltr">For example, at the blue arrow you can see that the market was clearly in an uptrend and pulled back towards the 50 day EMA where we saw the market bounce significantly from that level and continue to go higher. </p> <p dir="ltr"><br /> One way that you could have looked at this is that the 'hammer' that had formed on the daily chart right at the 50 day simple moving average was a sign that buyers were finding dynamic support there. Later on, you can see that the market broke down below the 50-day simple moving average indicator, but then bounced back towards it where the red arrow shows a selling opportunity based upon a massive bearish candlestick. </p> <p dir="ltr"><br /> Later on, it tested the general vicinity of the 50-day simple moving average indicator three times where it sold off each time it got too close to it. </p> <p dir="ltr"><br /> At the very end of the chart the market closed well above the 50 day EMA and then started to rocket to the upside showing the 50 day EMA starting to slope higher, confirming than that the trend has obviously changed for the upside in favor of the Euro instead of sloping lower in favor the British pound like it had been previously.<br /> </p> <p dir="ltr">Another use for simple moving average indicators is to look for 'moving average crossovers'. This typically is used for 'buy and sell signals' and some traders even go so far as to always stay in the marketplace based upon how the signal is showing, either bullish or bearish. That being said, the simplest explanation is that you take a faster moving SMA and plot it with a slower moving SMA on a chart. In this example, we will use the CAD/CHF daily chart.</p> <p dir="ltr"><br /> On the chart, there is the red 20 day simple moving average, and the white 50 day simple moving average. </p> <p dir="ltr"><br /> In a 'moving average crossover system', the idea is that as the quicker moving average rises above the slower one, shorter-term traders are starting to come in and momentum is moving to the upside. At that point, traders will buy the market. </p> <p dir="ltr"><br /> On the other hand, when the faster moving average dips below the longer-term moving average, then it shows that short-term traders are starting to push momentum to the downside, and it becomes a sell signal. In this scenario, you buy when the indicator of the shorter time frame breaks higher, and you sell or find yourself short when the lower timeframe indicator breaks underneath. </p> <p dir="ltr"><br /> When you look at this chart, you can see the inherent problem with using this system without any type of filter. There would have been five potential losses before the market finally broke in your direction and would have had you selling into a major breakdown. </p> <p dir="ltr"><br /> One simple filter is to look at the longer-term simple moving average indicator, and what the slope is. For example, in this chart you can see that we were relatively flat for most of this, and that may have kept you out of the market as it shows that we weren’t really trending. </p> <p dir="ltr"><br /> On the final crossover, and the one that the market is currently trading, you can see that <strong>the longer-term 50-day EMA started to slope lower</strong>, and the two moving averages started to spread out, showing that there was a real divergence between the two time frames, and that momentum was picking up. </p> <p dir="ltr"><br /> In the end, quite often the simple moving average indicator is used with something along the lines of an oscillator in order to determine momentum, and possible diversions. There are other indicators people will use with it, but it seems to be oscillators are by far the most common.<br /> </p> <p>Some common simple moving averages<br /> </p> While there is no 'magic bullet', there are some common ones that are popular:<br /> <ul> <li>10-SMA, for fast moving short-term trades</li> <li>20-SMA, for slightly longer term momentum on short-term trades</li> <li>50-day SMA, which represents just a bit underneath a quarter</li> <li>100-day SMA, which represents half a year</li> <li>200-day SMA, which represents roughly one year of trading based upon trading hours</li> </ul>

Triple bottom candlestick pattern trading strategy

<p>The <strong>triple bottom </strong>is a bullish reversal pattern that occurs at the end of a downtrend. This <a href="/en/trading-academy/forex/japanese-candlesticks">candlestick pattern</a> suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. <br /> <br /> In this article, we look at the structure of the triple bottom chart pattern, what the market tells us through this formation. We are also sharing tips on the simple triple bottom trading strategy that will help you make profits. </p> <h2>What the pattern tells us </h2> <p>As the name suggests, the triple bottom consists of the three consecutive lows printed at the same, or near the same level. For this chart pattern to occur and be effective the price action has to trade in a clear downtrend.<br /> <br /> The sellers push the price lower to test the horizontal support for the first time, however, they meet a strong resistance from the side of the buyers. The price action rebounds higher as the sellers take a breather before the second attempt gets going. <br /> <br /> The outcome of the second attempt is the same, which now makes this level extremely important as the sellers, who are still in control of the price action, have now failed for the second time. </p> <p> </p> <p><img alt="a triple bottom chart pattern illustration" src="/TMXWebsite/media/TMXWebsite/Triple-Bottom-image-1.jpg" /></p> <p>In general, the price should return to around the same levels as during the previous rebound. Given that the downtrend is very strong, the sellers push the price action lower again to try and break the buyers’ resolve, but without much success again. <br /> <br /> Finally, they give up and the buyers assume control of the price action, this time extending the rebound much higher and eventually erasing most, or all, of the previous losses.<br /> <br /> If you look at the illustration above, the blue line represents the horizontal support that rejected the bears’ attempt to extend the downtrend. Up higher we have a neckline (the red line) which connects the highs of two rebounds. <br /> <br /> The neckline is arguably the most important element of the triple bottom pattern as its break to the upside activates the pattern and then helps us determine the stop loss and take profit. <strong>Hence, three mandatory features of the triple bottom chart pattern are:</strong><br /> </p> <ul> <li>A downtrend - the security’s price must trade lower;</li> <li>Horizontal support - A trend line connecting three roughly equally lows;</li> <li>A neckline - whose break signals the activation of the formation</li> </ul> <h2>Significance and limitations</h2> <p dir="ltr">The triple bottom chart pattern is a rare, but<em> extremely effective </em>reversal pattern. It’s rare since the successive creation of three equal lows doesn’t happen quite often. Therefore, the double bottom is a more frequent chart pattern as it requires one low less to happen.. </p> <p dir="ltr">On the other hand, its scarcity makes it a very strong and powerful pattern. The sellers are extremely exhausted after three consecutive attempts to break lower, which makes them exposed to a rally as buyers feel much more confident after defending a strong horizontal support.</p> <br /> The triple bottom formation doesn’t have any apparent weaknesses. Actually, its biggest limitation is that it doesn't occur quite often, otherwise<em> it would be the strongest reversal pattern out there</em>. <h2>Spotting the triple bottom pattern</h2> <p>Due to its rarity, the triple bottom is quite <em>easy to spot</em>. The first thing you should look for is <strong>a downtrend, </strong>i.e. a series of lower lows and lower highs. Three consecutive failed attempts to break lower usually stick out on the chart (see the chart below). <br /> <br /> As outlined above, the double bottom is a more frequent chart pattern. We advise you to simply mark two bottoms on a chart, and if the price action breaks above the neckline after the second bottom - you should continue by trading the double bottom. <br /> <br /> If, on the other hand, the sellers return to try and break the support in a third attempt, you should monitor the price action closely to see if the third try will end up in a failure. In that case, <em>a break of the neckline should activate the triple bottom chart pattern</em>.</p> <p> </p> <p><img alt="USD/JPY H4 chart - Spotting the triple bottom pattern" src="/TMXWebsite/media/TMXWebsite/Triple-Bottom-image-2.jpg" /></p> <p> </p> <p>In the chart above, we see USD/JPY on a daily chart that is moving lower. The bears then register three attempts to break below the horizontal support around the $108.50 mark, however without much success at all. If you look more closely, you will count at least 8 touches of the $108.50 handle, while we highlighted three lowest prints on a chart.</p> <h2>Trading the triple bottom formation</h2> <p>As outlined earlier, the triple bottom is a bullish reversal chart pattern. Hence, we are looking for clues when the market is ready to reverse its course. The signal that we are looking for <strong>is a break of the neckline</strong>. <br /> <br /> Looking at the chart above, a 4-hour chart, we see a strong breakout that launches the price action higher. As this breakout candle closes much higher, leaving us without an opportunity to dip into the market, we move to a 1-hour chart (below) to identify our entry.</p> <p> </p> <p><img alt="USD/JPY H1 chart - Trading the triple bottom pattern" src="/TMXWebsite/media/TMXWebsite/Triple-Bottom-image-3.jpg" /></p> <p> </p> <p>As with every chart pattern that involves a breakout, we have two opportunities for an entry - after the breakout candle closes above the neck line or waiting for a test. In this case, the second option is not available as the price action never returned to the “crime scene”. This was expected to a certain degree, given how explosive the breakout was. <br /> <br /> The power behind the breakout tells us that there is a high likelihood of the market extending higher. Hence, we set our entry as soon as the breakout candle closes above the neckline. The vertical blue, which measures the distance between the support and neckline, will help us determine the take profit. <br /> <br /> You just copy-paste the line, starting from the breakout point, with the other end signalling a level, where we should consider taking profits off the table. Any move below the neckline, after the price action closed above it, invalidates the pattern. Hence, this is where our stop loss is located. <br /> <br /> Given the power behind the breakout, we are not surprised to see that, during the next hourly trading session, our profit-taking level has been activated, making us 33 pips richer. On the other hand, we risked 17 pips, which translates into 1:2 risk-return ratio, a standard profitable setting.</p>

The Double Top Reversal Pattern

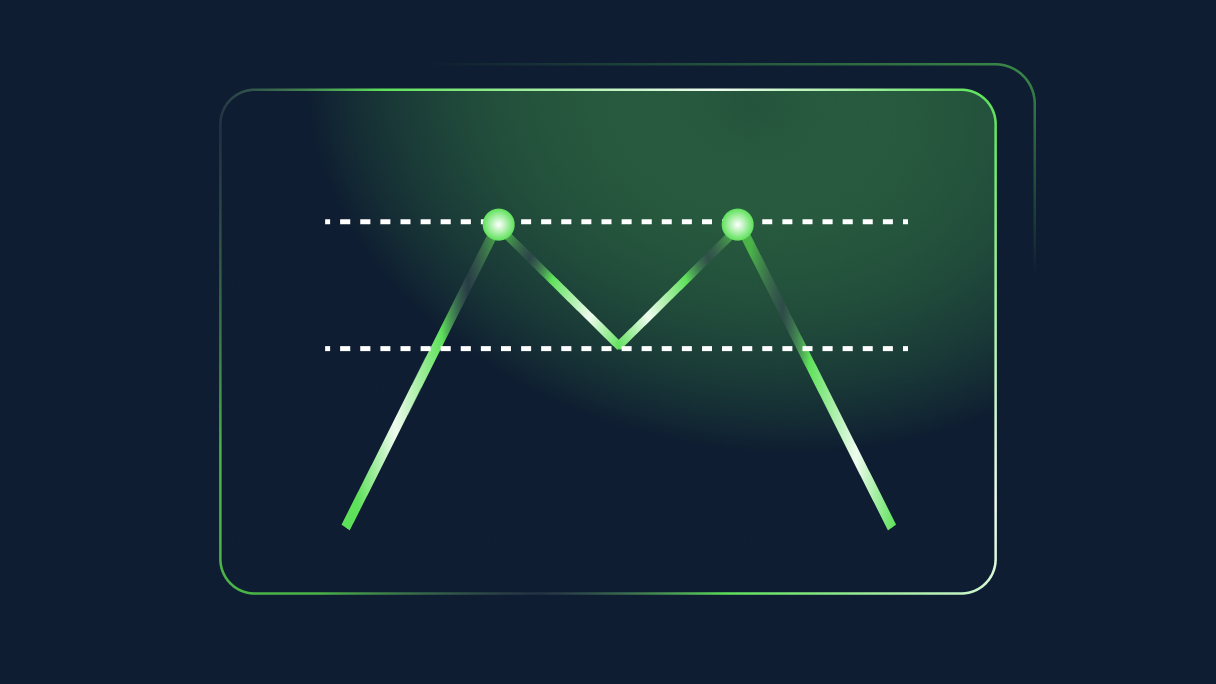

<p>The <strong>double top pattern</strong> is a <em>bearish reversal pattern</em> that can be observed at the top of an uptrend and signals an impending reversal. Unlike the double bottom formation that looks like the letter “W”, the double top chart pattern resembles the letter “M”, due to the two equal highs. <br /> <br /> In this blog post, we will describe how to correctly draw the double top, what its structure tells us, and how to make profit trading the double top pattern by sharing a simple trading strategy.</p> <h2>What the Double Top pattern tells us</h2> <p>The double top chart pattern is a bearish reversal pattern. As such, it can only occur in an uptrend as the buyers are successful in pushing the price action higher by creating a series of the higher highs and higher lows. </p> <p><br /> Their inability to extend this bullish series initiates the creation of the double top pattern as the second peak is not registered as a higher high, but rather as an equal high. This weakness is then used by the sellers to push the price action lower and erase previous gains. <br /> <br /> <img alt="" src="/TMXWebsite/media/TMXWebsite/Double-top-Image1.jpg" /></p> <p>In essence, there are three key elements of the double top chart pattern:<br /> </p> <ul> <li><strong>Uptrend</strong> - The price action must trade in an uptrend for the double top to make sense. Remember, this is a reversal pattern. </li> <li><strong>Two equal highs</strong> - Getting two exact same highs is hard to imagine. As long as we can see that the horizontal resistance that capped the earlier move higher stops the buyers once again, we register this as two equal highs.</li> <li><strong>Neckline</strong> - The lowest point of a pullback following the first peak is called the “neckline”. A simple horizontal trend line is drawn through the lowest point of the pullback. </li> </ul> <p> </p> <p>The double top formation is active once the price action breaks below the neckline. The market moves from creating the higher highs and higher lows to the lower lows, as the break of the neckline brings us lower prices compared to the lowest point of the initial pullback (the neckline). <br /> <br /> Ideally, a certain period of time should pass in between the two tops. In case the second peak occurs almost immediately after the first peak, with a minor pullback, there is a strong likelihood that the buyers will break above the first peak. In this case, <strong>the double top becomes a continuation pattern. </strong><br /> </p> <p>For this reason, the most effective double top patterns are those with a certain amount of time in between two lows. It is also absolutely crucial to wait for a break of the neckline before entering a market, to avoid situations where the double top formation becomes the continuation pattern.</p> <h2>Strengths and weaknesses</h2> Similar to the double bottom formation, a double top pattern is one of the strongest reversal patterns out there. One of its greatest strengths is its efficiency and high likelihood of being successful in predicting a change in the trend direction. <br /> <br /> The neckline existence equips the pattern with a clearly defined level to play against. The neckline marks the risk and it helps determine the take profit once the pattern is activated. <br /> <br /> On the other hand, the biggest weakness of the double top pattern is that you are countering what is, to that point, a very powerful trend. For this reason, there is always a chance that this scenario could eventually result in a continuation of the bullish trend. Therefore, a trader should always consult other technical indicators before entering the market. <h2>Spotting the double top pattern</h2> <p>The double top patterns are not so common in trading. However, once correctly identified, they become a powerful tool in the hands of a trader. A USD/CHF daily chart below gives us a great example of how to successfully counter the strong bullish trend. </p> <p><br /> An initial bullish move results in enormous gains of more than 500 pips for the buyers. The price action moves higher in an almost vertical manner, without any meaningful pullback. Following the first peak, the price action rotates lower in the first more significant pullback.<br /> <br /> <img alt="" src="/TMXWebsite/media/TMXWebsite/Double-top-Image-2.jpg" /><br /> <br /> The buyers are then able to regroup and organise another assault at the same horizontal resistance level around the $1.0050 handle. However, they fail again at the same resistance, which prompts a deeper pullback.</p> <h2>Trading the Double Top pattern</h2> <p>The basic principles for trading the double top pattern are the same as for the double bottom pattern. Once again, the pattern is only activated once there is a clean break and a close below the neckline, preferably on a daily basis. This way, you protect yourself against the failed breakdowns, when the price action briefly trades below the neck line without actually breaking it. <br /> <br /> Once the USD/CHF sellers bring the price action to the point where the previous pullback lower ended, their goal now is to create a lower low and initiate a new bearish trend. They become successful in their mission as there is a break of the neckline very quickly. </p> <p><img alt="" src="/TMXWebsite/media/TMXWebsite/Double-top-Image-3.jpg" /><br /> <br /> </p> <p>Similar to the head and shoulders reversal pattern, the double top offers two types of entry. First is a more aggressive entry, as you enter the market as soon as the candle closes below the neckline. <br /> <br /> The second route is based on a more conservative approach as traders wait for the price action to return higher to retest the broken neckline - a throwback - before entering the market at a higher (better price). <br /> <br /> This approach offers <strong>a better risk-reward ratio,</strong> but the chance of you missing out on a trade is also higher as the move higher may never happen. On the other hand, the first option offers you a mandatory ride in a trend, however, the entry may be quite lower.</p> <p> </p> <p>In this case, USD/CHF never offered us a second choice as the price action flushed lower. There was a minor rebound higher, but it never reached the broken neckline. In this case, our entry is at $0.9760, a level where the USD/CHF closed below the neckline for the first time. <br /> <br /> The stop-loss should be placed above the neckline, allowing some space for a potential failed breakout, if the price action rebounds to retest the neckline. Thus, we put a stop-loss at $0.9820, around 30 pips above the broken neckline. Please remember that any move and close above the neckline invalidates the activated double top pattern.</p> <p><br /> The take profit is calculated in the same manner as it is the case with the double bottom pattern i.e. measuring the distance between the resistance (double top) and the neckline. The same trend line is then copy-pasted from the point where the breakout occurred, with an end point of the trend line being our take profit. In our case, the trend line ends around $0.9530.<br /> <br /> The USD/CHF pulls back all the way to $0.9540, around 10 pips from our take profit. As with a stop loss, it is always advised to leave some room for the take profit, as some traders may exit their trades earlier. Ultimately, this trade banked us 220 pips while we risked only 30 pips.</p>

Trading The Morning and Evening Star Candlestick Patterns

<div dir="ltr"> <p dir="ltr">It is believed that there are more than 100 patterns based on Japanese candlesticks. We divide them into various categories, such as bullish vs. bearish, reversal vs. continuation, as well as simple and more complex formations.</p> <p dir="ltr">Both the morning and evening star patterns are considered to be more complex formations, mostly since they are based on three successive candles. As such, they occur more rarely than other patterns, especially the single-candle formations. <br /> </p> <h2 dir="ltr">Structures</h2> <p dir="ltr"><br /> The morning star is a bullish reversal pattern that occurs at the bottom of a downtrend. As other candlestick patterns, it only signals a potential reversal, an idea which should ideally be confirmed with other indicators</p> </div> <h2>Four elements to consider for a morning star formation</h2> <ol> <li>A downtrend must be in place since a morning star is a bullish reversal pattern</li> <li>The first candle should be a bearish candle, preferably longer</li> <li>The second candle should be indecisive as the bulls and bears start to balance out over the session</li> <li>The third candle should be a strong bullish candle, which practically all but confirms the reversal</li> </ol> <p><br /> <img alt="morning star candlestick pattern" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/morning-star-pic-1.jpg" /><br /> <br /> </p> <p dir="ltr">Although some analysts prefer to have a gap down, it is extremely rare to have gaps in Forex. Thus, many analysts argue that as long as these four conditions are met, it is a valid morning star pattern. <br /> <br /> It is important to note here that the second candle is the most important one. It can be bearish or bullish, as the focus is on indecisiveness and uncertain outcome as to which out of two sides will come out on top. <br /> </p> <h2>The evening star formation</h2> The evening star, on the other hand, has the same structure and it is also a reversal pattern. Unlike the morning star, the evening star occurs at the top of an uptrend and it signals a potential change in the price direction. <p dir="ltr"><img alt="evening star candlestick pattern" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/evening-star-pic-2.jpg" /></p> <!--%3Cmeta%20charset%3D%22utf-8%22%20%2F%3E--> <p dir="ltr">All four conditions present in the morning star structure are valid here as well. Near the end of an uptrend, the first candle should be long and bullish, the second one should be at the top and signal indecision (green or red), while the third and final candle signals a reversal is starting, as the buyers are no longer in control over the price action. </p> <p dir="ltr">You can use the historic price action and analyse the structure and behaviour of the morning and evening star patterns on the MetaTrader 5 trading platform, which you can access <a href="/latam/metatrader5"><u>here</u></a>.</p> <h2>Trading the morning star candlestick pattern</h2> <p dir="ltr">As said earlier, the occurrence of a morning star pattern is not as frequent as those of a single-candle formation. They are harder to spot, aside from you practically needing to fulfil all four conditions before you can verify its presence. </p> <p dir="ltr">In this case, we have the AUD/USD daily chart. The price had been trading lower until the point where it created a new short-term low. Prior to this candle, there is a long bearish candle that signals a strong downtrend.</p> <br /> <img alt="how to trade an evening star candlestick formation" src="https://k13-dev.thinkmarkets.com/TMXWebsite/media/TMXWebsite/trading-an-evening-star-pic-3_2.jpg" /><br /> <br /> However, the sellers fail to force a close near the session’s low and the price rebounds higher to create a doji candle, which signals the indecision among the buyers and sellers. The next candle is a long bullish candle which forms the morning star pattern. We can now be almost certain that the bullish reversal is about to start taking place.

Technical indicators: beginner’s guide

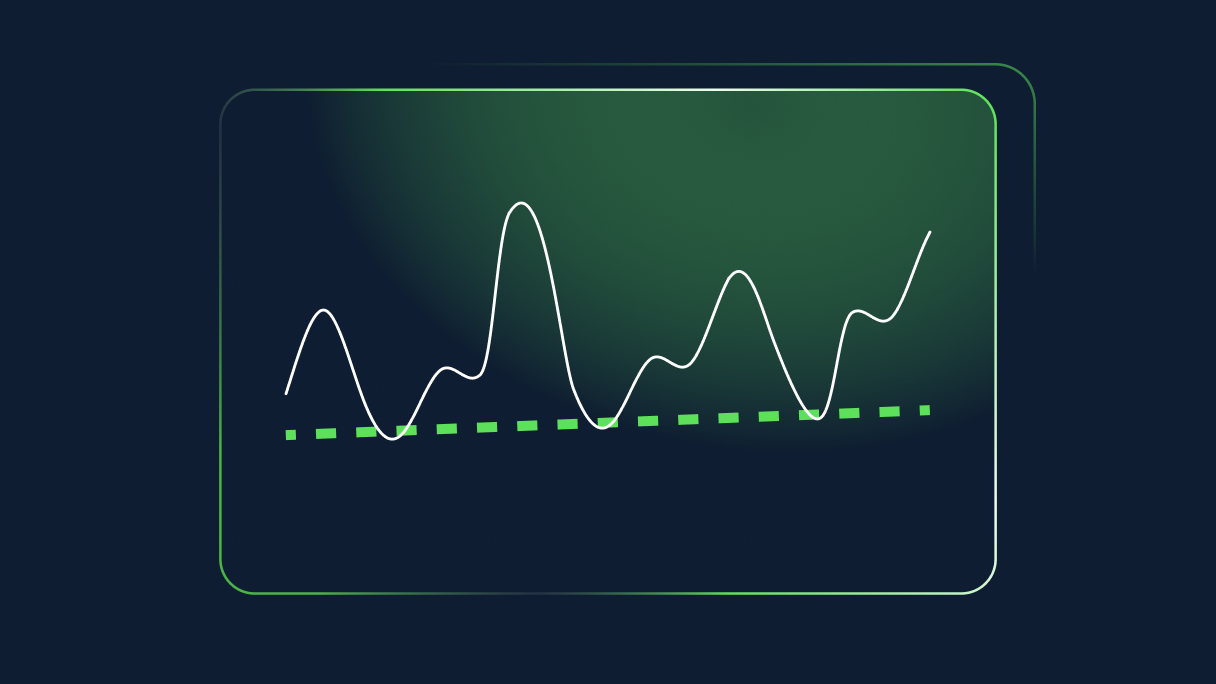

<p>Technical indicators are powerful tools that complement <a href="/latam/trading-academy/technical-analysis/support-resistance/">trendlines</a> and chart patterns in technical analysis. They provide traders with a comprehensive view of price movements and potential trading opportunities in financial markets.<br /> <br /> Despite their popularity and effectiveness, many novice traders feel hesitant to use indicators due to the perceived complexity associated with the term "technical". While it's true that learning about trading indicators requires effort, dedicating time to studying and practising with them is usually beneficial and can ultimately improve your trading strategy.<br /> <br /> In this article, we will help you grasp the concept of technical indicators, understand their functionality, and explore the main types based on their functionality.</p> <h2>What are technical indicators?</h2> <p>Technical indicators are pre-made mathematical calculations that analyse an instrument’s performance to help predict its future price movements.<br /> <br /> As you probably know by now, it’s impossible to forecast financial markets’ behaviour with 100% accuracy due to their fluid nature and dependence on unpredictable factors. However, technical indicators can help you identify some tendencies and make an informed trading prediction.</p> <h2>How do technical indicators work?</h2> <p>You can apply technical indicators on your trading platform in just a couple of clicks. Most trading platforms offer a wide array of indicators, and ThinkMarkets' proprietary platform, ThinkTrader, stands out with its selection of 120+ indicators:<br /> <br /> <img alt="Technical indicators" src="/TMXWebsite/media/TMXWebsite/Technical-indicators.png" /><br /> <br /> Experienced traders often combine multiple indicators with chart patterns to gain deeper insights. However, as a beginner, it's crucial not to overload your charts with too many indicators, as it can create excessive noise and lead to conflicting signals.<br /> <br /> To start your journey with technical indicators, it's advisable to experiment with a few indicators within each group and determine which ones align with your trading style. Now, let's explore the main types of indicators that might suit your needs.</p> <h2>Types of technical indicators</h2> <p>It's worth noting that technical indicators can be categorised in various ways, and you may find the same indicator placed in different groups. This occurs because many indicators have overlapping functionalities, and the categorisation often relies on each trader's perception of the indicator's primary function.<br /> <br /> One common approach to differentiate indicators is by classifying them as either trend indicators or oscillators. While both types serve the purpose of identifying trend directions or reversals and providing buy or sell signals, they have distinct characteristics and applications. There are also other types as well below.<br /> <br /> <img alt="Types of technical indicators" src="/TMXWebsite/media/TMXWebsite/Types-of-technical-indicators.png" /></p> <h2>Trend indicators</h2> <p>In our <a href="/latam/trading-academy/technical-analysis/support-resistance/">Trendlines in technical analysis</a>: support and resistance explained article, we discussed how to draw trendlines in a price chart to identify a trend direction or potential reversal.<br /> <br /> Trend indicators work the same way. Their primary function is to identify whether the price is going to move up, down or sideways. The difference is that indicators’ lines aren’t necessarily straight, as they analyse different data, providing some additional trading insights.<br /> <br /> Some of the most popular trend indicators are:<br /> </p> <ul> <li>Simple Moving Average indicator</li> <li>Average Directional Index (ADX/DMS) indicator</li> <li>Ichimoku Cloud indicator</li> <li>Parabolic SAR indicator</li> <li>Alligator indicator</li> </ul> <p> </p> <h2>Support and resistance indicators</h2> <p>Similar to trend indicators, support and resistance indicators resemble the functionality of support and resistance levels but automatically detect them in a price chart.<br /> <br /> Here are some of the most commonly used support and resistance indicators:<br /> </p> <ul> <li>Pivot points</li> <li>Fibonacci retracement levels</li> <li>Bill Williams Fractals indicator</li> </ul> <p> </p> <h2>Volatility indicators</h2> <p>Volatility indicators can help traders identify the periods of high and low volatility of an instrument. This insight is valuable for traders because high volatility usually comes with big price swings that bring a lot of trading opportunities but also an increased risk of losses. When traders know what volatility to expect, it allows them to adjust their trading strategy according to their risk appetite.<br /> <br /> Some of the most popular volatility indicators are:<br /> </p> <ul> <li>Bollinger Bands indicator</li> <li>Average True Range (ATR) indicator</li> </ul> <p> </p> <h2>Volume indicators</h2> <p>direction of a price movement depends on how much bullish (buying) or bearish (selling) power is present in the market. If bulls overpower bears, the price moves up. In the reverse scenario, when bears outnumber bulls, the price goes down. Volume indicators help measure bullish and bearish movements to understand whether they are strong enough for the price to continue moving in the same direction or weak enough to expect a reverse.<br /> <br /> Check out these popular volume indicators:<br /> </p> <ul> <li>On-Balance Volume (OBV) indicator</li> <li>Volume Weighted Average Price (VWAP) indicator</li> <li>Chaikin Money Flow indicator</li> <li>Money Flow Index (MFI) indicator</li> </ul> <p> </p> <h2>Oscillators (Momentum indicators)</h2> <p>The second group, oscillators, works slightly differently than overlays. An oscillator is an indicator that swings between two boundaries and suggests the overbought or oversold levels of an instrument, which may indicate a trend reversal.<br /> <br /> Oscillators are not applied directly over the price chart but are usually at the bottom of it. They are also called momentum indicators because they may indicate momentum or how fast the price is moving in a particular direction.<br /> <br /> Check out these popular volume indicators:<br /> </p> <ul> <li>On-Balance Volume (OBV) indicator</li> <li>Volume Weighted Average Price (VWAP) indicator</li> <li>Chaikin Money Flow indicator</li> <li>Money Flow Index (MFI) indicator</li> </ul> <br /> <img alt="Oscillators" src="/TMXWebsite/media/TMXWebsite/Oscillators.png" /><br /> <br /> Here are some of the widely used oscillators:<br /> <ul> <li>Relative Vigor Index (RVI) indicator</li> <li>Moving Average Convergence Divergence (MACD)</li> <li>Momentum indicator</li> <li>Relative Strength Index (RSI)</li> <li>Force Index indicator</li> <li>Awesome Oscillator</li> </ul> <br /> <br /> The Bill Williams Awesome Oscillator is an oscillator that traders use to measure momentum in a Bill Williams Accelerator<br /> <ul> <li>Bill Williams Accelerator Oscillator</li> <li>Commodity Channel Index (CCI)</li> <li>DeMarker Indicator</li> <li>Gator Oscillator</li> <li>Stochastic Oscillator</li> <li>Williams Percent Range</li> </ul> <p> </p> <h2>How to choose a technical indicator</h2> <p>There are no good or bad indicators; they all provide different insights. The most important part of trading with indicators is to have a solid understanding of how they work and to be able to read the signals they provide.<br /> <br /> If you are a new trader, go through our list of indicators, study how they function and apply them using a demo account, comparing the findings. After some practice, you will have a better idea of which indicator fits your trading strategy.</p>

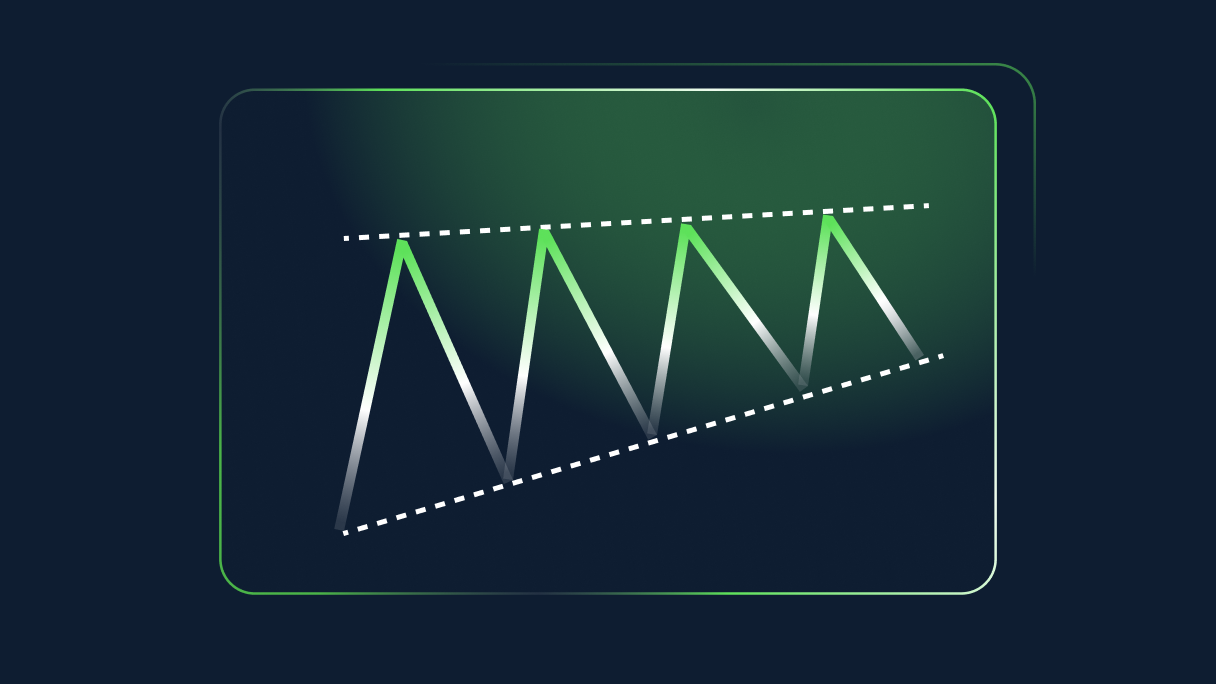

The ascending triangle candlestick chart pattern