Understanding what moves the stock index prices is crucial for a successful trading strategy. Knowing the bigger picture can help you make an informed decision and identify the right time to place a buy or sell order instead of trying to predict price movements sporadically.

It is true that the past performance of any financial instruments, indices included, doesn't always serve as a good indication of their future movements. It's important to look at other factors that drive stock index prices up or down to identify trading opportunities.

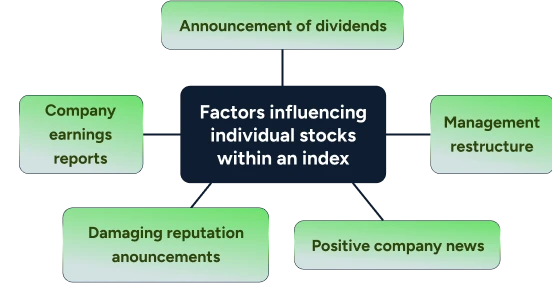

These factors can be divided into two groups: those that influence individual stock prices within an index and those that drive an index as a whole.

Factors influencing individual stocks within an index

The first group is particularly important for indices weighted by market cap or stock price, as their price can be significantly affected by the top-performing stocks.

For example, tech giants like Apple, Microsoft, Amazon, Google (Alphabet) and Meta make up almost 40% of the Nasdaq 100 (NAS 100) index, each accounting for 3-11% weight of the index. If any of these companies experience significant changes in their stock price, it will affect the price of NAS 100 to a much greater extent than a company holding only 0.2% weight of the index.

To evaluate the possible price fluctuations of top performance in an index, experienced traders usually identify them first and then look for the following information:

Company earning reports

Bigger than expected profits are likely to drive the stock (and index) price up, while unexpected losses can have the opposite effect. Earnings reports are usually released quarterly and published during the first month of the following quarter.

Announcement of dividends

Some traders are hunting for dividends, buying shares shortly before the dividend announcement, also called the ex-dividend date. This drives the demand up, increasing the stock price as a result. After the dividend pay-out day, they sell their shares, which causes an immediate drop in their price. As most companies pay dividends quarterly or semiannually, it is worth keeping an eye on these releases to catch index trading opportunities.

Management restructure

A CEO or any other key role replacement can have a big impact on the stock price, affecting the entire index price. The direction of the price movement usually depends on market sentiment. If traders see the successor as competent, it can increase the stock price and vice versa.

Positive company news

Announcements of a new product launch or expansion usually indicate a company’s solid growth plan, which can drive its share price up, increasing the index price consequently. However, this factor largely depends on market sentiment as well.

Alleged controversies

A company's involvement in controversial reports usually affects its reputation negatively, thereby affecting its share price and bringing the index price down. In some cases, damage can be caused not only by a company’s reputation but by the reputation of its leader as well. For example, Elon Musk, the co-founder and CEO of Tesla, brought price swings to the company’s shares with his publicity stunts more than once.

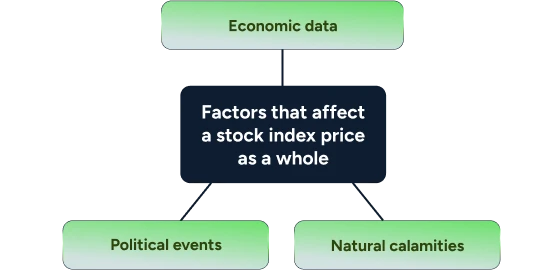

Factors that affect a stock index price as a whole

This group of factors usually has a much stronger impact on an index price than factors affecting individual stocks. They can be divided into three sub-groups: economic data, political events and natural calamities.

When analysing these factors, traders need to keep in mind the origin of the index and the companies listed within it. For example, the US data and events are the most influential for American indices, such as S&P 500, Dow Jones, and Nasdaq 100. On the other hand, for the Euro Stoxx 50 index, which includes stocks from 11 countries within the Eurozone, traders need to keep an eye on data from the countries of origin of the top-performing stocks.

Economic data

Indicators such as interest rates, inflation and Gross Domestic Product (GDP) are among the main factors affecting index prices. As many indices are grouped by industry or country, significant changes in the mentioned numbers usually hit the whole index.

For example, if the inflation rate in the US increases, it will negatively impact the whole US stock market, bringing down the prices of all major indices in a ripple effect. In the opposite scenario, a strong USD usually has a positive effect on them.

Increasing interest rates can have a similar effect on index prices, making business loans much more costly for companies, which, in turn, slows down their development, bringing stock prices down.

On the other hand, a rising GDP signals a strengthening economy and can positively impact an index, driving its price up.

Keep in mind that all economic processes are interlinked – an increasing GDP in the long term usually means increasing inflation, which means increasing interest rates to fight it and so on. Hence, economic indicators need to be analysed as an aggregate rather than on their own. An economic calendar is a great tool that helps traders have all the worldwide data releases in one place.

Political events

Political instability within a country tends to influence the country’s stock market indices negatively. Weak government, protests, and controversial policies can cause a visible decline in index prices. Elections can bring a lot of volatility to the index price too, but this volatility is primarily caused by public sentiment, reacting to election promises given by winning candidates.

Some large-scale political events have a strong negative influence not only on the countries involved but also on the global economy.

At the end of June 2016, when the UK voted in favour of leaving the EU, and it became clear that Brexit was, in fact, happening, over USD 2 trillion was wiped out from the global stock market in a single day.

Another example is the Russian invasion of Ukraine. The war disrupted the supply chains of many commodities that used to be supplied by both Ukraine and Russia, affecting the global stock market. Moreover, sanctions aiming to paralyse the Russian economy affected multiple economic sectors, causing an almost 10% plunge in the global stock market during the first week of the war. However, as the NATO alliance showed strong support for Ukraine, the stock market bounced back.

Natural factors

Natural disasters, such as tsunamis, floods, wildfires, and public health emergencies, like the infamous COVID-19 pandemic, can bring not only serious physical damage but economic damage as well. These events interrupt the production and distribution of goods and services, affecting global markets and bringing the prices of stock indices down. COVID alone, for example, sent the stock market into a free fall, causing the sixth-worst percentage price drop in history. However, in the long run, the pandemic has benefitted the tech industry, and tech-heavy indices have had significant growth which is reflected in their prices.

Traders looking for index trading opportunities need to pay close attention to the news covering important events. However, this data can only indicate possible price movements, not a 100% accurate prediction. To create a holistic trading plan, it’s important to evaluate several factors consecutively and draw an informed conclusion.

Moreover, market sentiment or public perception can often influence index prices more than anything else. Unfortunately, since it’s a subjective matter, it cannot be predicted in advance, but some traders use technical analysis to spot price movements caused by market sentiment. We’ll discuss technical analysis in one of our following articles.

For now, let’s first see how you can trade indices with the information we have covered in this article. The good news is that when you trade indices with CFDs, you can capitalise on both rising and falling prices. Check out our How to trade indices article to see how it works.