Financial markets' moves are difficult to predict. However, your chances of success are much higher when you understand how the markets work and what exactly affects the prices of financial instruments. Understanding these details can help you plan your trades strategically instead of randomly guessing your next step and hoping for good luck.

When it comes to predicting currency exchange rates, it's important to understand that forex, like all financial markets, is heavily influenced by supply and demand. A decreasing supply paired with an increasing demand usually leads to rising prices. Similarly, an increased supply with decreased demand drives the prices down.

Factors affecting supply and demand and, therefore, the exchange rate movements of every currency pair can vary depending on the main pillars of each country's economy. For example, Australian and Canadian economies rely on natural resources export, which affects the exchange rate of the Australian and Canadian dollar (AUD and CAD) against other currencies. On the other hand, the United Kingdom and the pound (GBP) are more sensitive to political developments and interest rate movements.

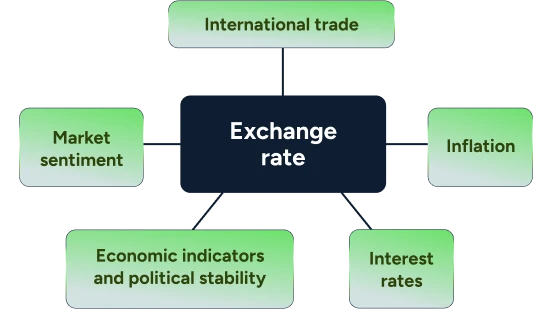

Despite these differences, trading experts have identified the common factors affecting supply and demand on forex.

Main factors affecting foreign exchange rates

International trade

Trading activities between different countries directly affect the value of their currencies. When a country exports some goods, in many cases, a buyer pays for the products in the exporter's local currency. If a country's exports are higher than its imports, it creates a high demand for its currency and, as a result, increases its value.

The amount of exports and imports of every country, in turn, depends on the country's needs and production structure. For example, the US and Brazil are long-term trading partners. Let's assume the US has been importing coffee from Brazil for USD 2 per kg, but suddenly Colombia offered a price of USD 1 per kg. If the US, one of the largest coffee importers, were to go for Colombian coffee instead of Brazilian because of more attractive import prices, it would decrease Brazilian exports significantly. As a result, the demand for the Brazilian real (BRL) and its exchange rate against a foreign currency, USD in this case, would also decline. At the same time, favourable export prices would increase demand for the Colombian peso (COP), strengthening it against USD.

Some specific countries, like Australia and New Zealand depend strongly on exports, and there is a high correlation between the price of what they export and their currency. However, for most other large economies, the state of their trade balance has minimal impact on the currency exchange rate. This was not the case 30 or 40 years ago when capital restrictions limited capital flow.

Inflation

Inflation means a rise in prices of goods over time that leads to the decreasing purchasing power of a country's currency. For example. if inflation in the UK increases by 10% over a year, that means that the British Pound has dropped 10% in value compared to the year earlier. In terms of exchange rates, if inflation is at 2% in the USA, then the GBP/USD exchange rate should depreciate by 8% in favour of the US Dollar to compensate for the difference in inflation between the two countries.

To track inflation rate changes, traders usually keep an eye on the Consumer Price Index (CPI) reports. Most countries release these reports monthly, except in Australia and New Zealand, which publish them quarterly. CPI is a widely considered measure of inflation because it tracks the percentage change in the price of a basket of goods commonly purchased by consumers.

Interest rates

High interest rates attract foreign capital to a country, promising foreign investors higher returns on their capital. With more investors entering the country's local market, the demand for its currency increases, driving its value higher. On the flip side, low interest rates make a country less attractive for foreign investment.

Interest rates and inflation are directly correlated – growing inflation is usually followed by increasing interest rates as governments are trying to battle currency depreciation. This, in turn, strengthens the currency and affects exchange rates.

In 2022 trading world witnessed a clear example of this process when the US Federal Reserve announced the sharpest interest rate hike since the 1980s, which resulted in the almost immediate US dollar strengthening while other currencies traded against it crashed.

Experienced traders usually keep an eye on central banks’ interest rate decisions to find trading opportunities.

Economic indicators and political stability

Besides inflation and interest rates, it's worth watching Gross Domestic Product (GDP), which provides a snapshot of the economic conditions of a country, the balance of payments, government debt, the unemployment rate and other factors. All of them influence the country's currency value in one way or another. Traders are able to see a schedule of these releases in the economic calendar, which is a very popular tool for identifying potential trading opportunities.

The number of different reports to check can get a little overwhelming for a new trader, but the good news is you don't have to check them all at once. Beginners tend to stick to the most important and self-explanatory ones. For example, GDP is the ultimate indicator of the economic health of any country. Fast GDP growth usually implies a strong economy and high demand for its currency, which in turn drives its price up.

The political environment of a country also has a significant influence on its currency exchange rate. Similar to the low interest rates, political turmoil makes a country less appealing for foreign capital, resulting in a declining exchange rate of its currency.

Both economic figures and political updates are usually heavily covered in the news, making news trading the most attractive trading strategy for beginners.

Once you get more comfortable with the basic figures we discussed above, you can move on to an in-depth analysis of multiple numbers suggesting changes in exchange rates. Keep in mind that any of the factors mentioned above can rarely influence price movements on their own. A comprehensive approach requires comparing a few numbers and drawing a general conclusion based on your findings.

Market sentiment

In anticipation of a currency's rise or fall, many traders start buying or selling a currency before it changes its value. This, in turn, increases its demand or supply, resulting in price swings triggered solely by traders' activity. This factor is usually hard to predict as it depends only on the human factor and traders' perception of the upcoming events.

This is where technical analysis with chart patterns and indicators come into play, which we will discuss in detail in our Technical analysis in trading blog.

Before you dive deeper into analysing forex, it may be a good idea to practice your newly obtained knowledge on a risk-free demo account. Our proprietary, award-winning trading platform ThinkTrader, for example, offers dozens of forex pairs and USD 10,000 of virtual money.

FAQs

Is forex good for beginners?

Yes, forex can be a good market for new traders to start their trading journey as it presents multiple trading opportunities. However, it is important to educate yourself on how it works and spend some time practising forex trading on a demo account before trading with real money.

How do I start trading forex?

To start trading forex, you first need to choose a broker and a platform. Next, you need to choose a forex pair to trade. Check out our How to trade forex article for more details and tips.

What controls the forex market?

Forex is a decentralised market. No entity can single-handedly control or manipulate the price. We discuss it in detail in our What is forex? article.

How to predict forex price movement?

To predict price movements on forex, you can use two methods – fundamental and technical analysis. Fundamental analysis includes studying macro and microeconomic factors discussed in this article, and technical analysis is based on studying charts and identifying patterns.