Save time

Avoid having to set and adjust your leverage manually.

Reduce exposure

Manage your risk more effectively during volatile market conditions.

Improve potential returns

Dynamic leverage adapts, optimising risk, and boosting potential returns.

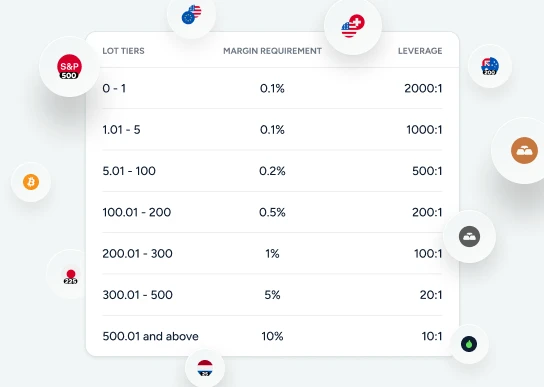

Dynamic leverage tiers

Learn more about how your leverage automatically adjusts based on asset class and trade size.