Obliteration Day: why the selloff may only be starting

What we knew yesterday no longer holds today. Trump called it Liberation Day. Some people call it Obliteration Day. It is indeed a major break from the trading system we have known for decades. But similar to what the USA tried 95 years ago. At that time, world trade collapsed, and the world economy was in ruins; 10 years later, World War 2 started.

As for today, the initial reaction from countries has been muted. But many are considering their next steps. We are already seeing signs of this. Even the UK, despite its low 10 per cent tariffs and its “special relationship” with the US, is now looking to implement countermeasures against US goods. The EU has also warned that it is preparing a response. What is most concerning is that the US has turned on nearly the entire world, apart from Mexico and Canada. This raises the risk of coordinated retaliation, which could be devastating for global trade.

Why Trump’s plan is brilliant and mad at the same time

Trump’s idea makes some sense in theory. The world economy would likely see a major boost if all countries lowered their tariffs. Allow people to trade freely, and the majority wins. Thus if 1-2 major countries decide to cut trade barriers and the USA does the same, then more might join the move, and this could prove to be a multi-year low in stock indices.

The problem is that the new US tariffs appear designed to reduce the US trade balance with the rest of the world to zero. In other words, every product the US imports is expected to export something of equal value. Something that is almost impossible to accomplish.

As we have discussed before, there are valid reasons for trade barriers. However, some are not trade barriers, such as wage differences. Take Nike as an example. Instead of producing sneakers and apparel in the US, they manufacture them in places like Vietnam. If production returned to the US, the cost of shoes would rise significantly. This would hurt American consumers and make Nike a far less profitable company. A zero-trade balance goal does not make economic sense.

There is a high risk that countries respond with their own tariffs. As things stand, stock indices are likely to keep drifting lower, and crypto may follow.

In the world of currencies, the situation is more complex; it looks like people are selling their stocks and dumping dollars. This will raise US inflation on top of the tariffs. Could the world be giving up on the USA?

Technical outlook

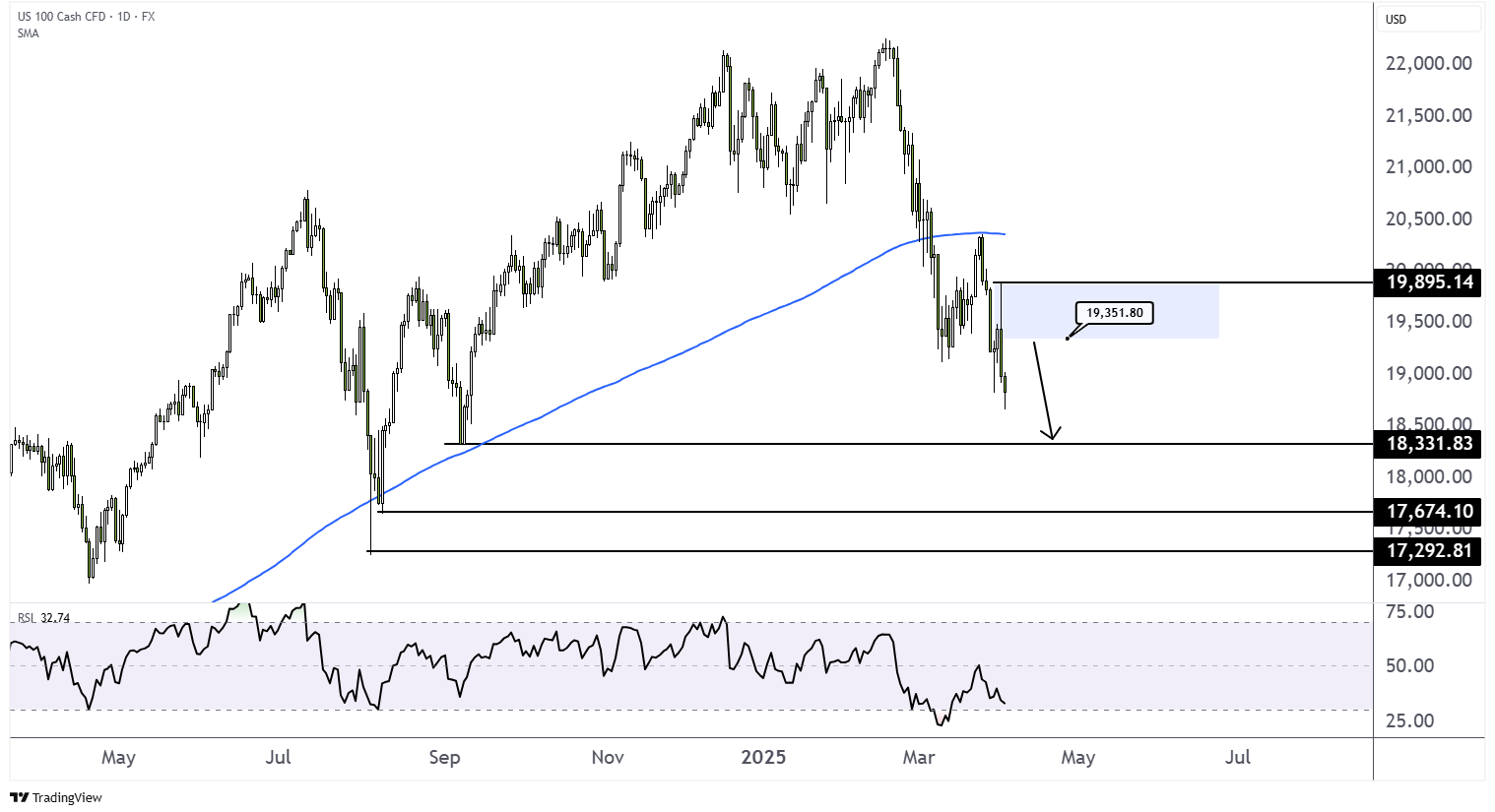

The Nasdaq 100 is trading below its 200-day moving average and remains clearly bearish below yesterday’s high of 19,895. While a bounce is possible, traders are likely to turn bearish between 19,351 and 19,895.

Brent crude oil prices have declined as expected and will remain bearish below yesterday’s high of $75.18. A break below the 2025 low, which also aligns with the 2024 low, is likely to trigger a major bearish pattern, with the first target at $64.88.

Bitcoin remains bearish below yesterday’s high of 88,814 and is likely heading toward the 2025 low of 76,453.

EURUSD is moving slightly lower following today’s strong surge. A dip toward 1.10 is possible before the price attempts to take out last year’s high of 1.1218. The next level beyond that is 1.1491. The trend remains upward as long as the price stays above 1.08.

Open a position today

Trade the increased volatility and seize opportunities across a wide range of markets now. Log in to ThinkTrader, or open an account here.