Articles (40)

Forex Fundamental Analysis: Definition, Drivers & Trading Methodology

<p>Forex fundamental analysis is a type of analysis used in trading to gain a deeper understanding of the factors that move the foreign exchange market. Unlike technical analysis, which tells you "what" is happening, fundamental analysis in forex reveals "why" it's happening, giving you an edge in an increasingly competitive forex market.</p> <p>Did you know that 85% of chief forex dealers in London rely more on trading fundamentals than technical analysis? According to the Bank of England's study, "Charts and Fundamentals in the Foreign Exchange Market," these professional traders understand that while charts may show where the price has been, it's fundamentals that truly drive where it's going.</p> <p>Forex fundamental analysis can give you the power to see beyond <a href="/en/trading-academy/technical-analysis/day-trading-chart-patterns/">price patterns</a> by examining the underlying aspects that make up the intrinsic value of a country's currency, including economic, monetary, and capital flow factors.</p> <p>In this article, we will go through:</p> <ul> <li>The three pillars of fundamental analysis that drive the majority of significant currency movements</li> <li>How to interpret like a pro major economic indicators that affect forex markets, focusing on what truly matters</li> <li>Why do different currency types, from reserve to commodity currencies, respond to fundamentals and affect various currency groups in different ways</li> <li>Catalysts and a step-by-step methodology to transform fundamental data into forex fundamental trading strategies</li> </ul> <p>Whether you're struggling to understand sudden market moves or looking to build more conviction in your trades, mastering fundamental analysis may transform how you approach the forex market forever.</p> <div> <style type="text/css">.didyouknow { display: block; background: #F1FDf0; width: 600px; border-radius: 20px; gap: 20px; padding-top: 48px; padding-right: 40px; padding-bottom: 48px; padding-left: 40px; font-family: Figtree; font-weight: 600; font-size: 22px; line-height: 140%; letter-spacing: 0%; } </style> </div> <div style="text-align: center;"> <style type="text/css">.btn { font: Figtree; justify-content: center; align-items: center; text-align: center; gap: 7px; font-style: normal; font-size: 18px; line-height: 24px; padding: 13px 20px; border: 1px solid #ddd; border-radius: 38px; background: #5EE15A; } </style> </div> <div class="didyouknow">Ready to Dive Into Forex Fundamental Analysis?<br /> <br /> <a class="btn" href="https://portal.thinkmarkets.com/account/individual/demo/" style="text-decoration: none; font-weight: 500; color: #000000; background: 5EE15A;" target="_blank">Open a Demo and Start Testing Today!</a></div> <h2>What is Fundamental Analysis in Forex</h2> <p>A fundamental analysis definition in <a href="/en/trading-academy/forex/what-is-forex-trading/">forex</a> sees the type of analysis as the systematic evaluation of economic, financial, political, and social factors that influence currency valuations across global markets. Unlike chart analysis, fundamental analysis in forex focuses on causal relationships between economic variables and exchange rates.</p> <p>At its core, this forward-looking method examines:</p> <ol> <li><strong>Economic strength indicators:</strong> GDP growth, employment figures, inflation rates, and productivity metrics</li> <li><strong>Monetary policy dynamics:</strong> Interest rate trajectories, quantitative measures, and central bank decisions/communications</li> <li><strong>Political stability of a country:</strong> Governance quality, regulatory environment, international relations, and geopolitical positioning*</li> <li><strong>Market sentiment:</strong> Risk appetite, positioning extremes, market volatility metrics, and carry trade dynamics</li> </ol> <p>*For a deeper understanding of how geopolitics work in forex, visit our article Impact of Geopolitical Events on Forex Markets.</p> <p><img alt="Fundamentals in Forex Trading (ThinkMarkets)" src="/getmedia/6fc7f504-8e95-4b8e-a305-b24d6bbb195c/Academy-Forex-Fundamental-Analysis-4-Core-Fundamental-Analysis-Elements-in-Forex-Markets.png" /></p> <p style="text-align: center;">4 Core Fundamental Analysis Elements in Forex Markets</p> <p>Note that market sentiment is not as much a fundamental element as it is based on market psychology. It often bridges both technical and fundamental analysis, as traders often use both to form a complete market view. While fundamentals provide the underlying narrative, sentiment reflects how market participants interpret and act on this information.</p> <h3>Technical vs Fundamental Analysis</h3> <p>The key differences between fundamental and technical analysis include:</p> <ul> <li>Focuses on the "why" behind price movements rather than just "how" prices move</li> <li>Utilises macroeconomic data rather than price patterns and chart formations</li> <li>Operates across multiple timeframes with emphasis on longer-term economic cycles</li> <li>Considers inter-market relationships and global capital flows</li> </ul> <p>To learn more about technical analysis, go to our article: Technical Analysis in Forex: Definition, Charts & Strategy Method.</p> <h2>Why is Fundamental Analysis Important for Forex Traders</h2> <p>Forex fundamental analysis can help traders really understand current market conditions and spot potential trading opportunities. However, it can also assist them in various other ways. In particular, it enables forex traders:</p> <h3>1. Understand Economic Indicators and Market Catalysts</h3> <p>When changes in economic data and policy are major, they often trigger market moves so large that technical analysis alone cannot predict them. And when these major economic shifts happen, knowing the underlying economic factors driving them prevents forex traders from being blindsided by sudden price movements.</p> <h3>2. Improve Decision-Making in Trading</h3> <p>Knowledge of forex fundamentals can help traders build stronger conviction in their trading decisions and may even allow them to hold positions through market noise. By learning fundamental relationships, they can better differentiate between brief fluctuations and real trend reversals. In turn, this allows them to scale position sizes with greater confidence.</p> <h3>3. Manage Risk More Effectively</h3> <p>Forex traders can anticipate potential volatility catalysts in advance as well as identify key risk events. This helps them assess how vulnerable the market might be to surprises and protect their positions during fundamental changes.</p> <p>Knowledge of fundamental relationships enables traders to make more informed trading decisions about currency pricing in response to changing conditions.</p> <h2>The Three Pillars of Forex Fundamental Analysis</h2> <p>To start employing fundamental analysis in forex, one must first understand the three interconnected pillars that can drive the value of a currency:</p> <p><img alt="Pillars of Forex Fundamental Analysis (ThinkMarkets)" src="/getmedia/ba8486bd-6010-4415-9a3e-9d530d471633/Academy-Forex-Fundamental-Analysis-Three-Pillars-of-Fundamental-Analysis-Forex.png" /></p> <p style="text-align: center;">Three Pillars of Fundamental Analysis, Forex</p> <h3>1. Macroeconomic Performance Differentials</h3> <p>When comparing a country's economy to another, relative performance matters more than absolute values. Strong currencies typically arise from economies showing:</p> <ul> <li>Higher GDP growth rates compared to trading partners (differential of 1%+ sustained over quarters)</li> <li>Positive productivity trends signalling sustainable expansion potential</li> <li>Strong employment data showing labour market health beyond headline unemployment figures</li> <li>Stable inflation within target bands indicates economic balance</li> </ul> <p>Key economic indicators within this pillar include:</p> <ul> <li><strong>Growth differentials:</strong> Affect long-term capital allocations</li> <li><strong>Inflation differentials:</strong> Impact of currency competitiveness and long-term value</li> <li><strong>Employment trends:</strong> Signal economic health and potential policy shifts</li> <li><strong>Productivity metrics:</strong> Indicate sustainable growth potential</li> </ul> <p>For a deep dive into these indicators, refer to our previous article on <a href="/en/trading-academy/indicators-and-patterns/what-are-forex-economic-indicators-and-how-they-impact-forex/">What Are Forex Economic Indicators and How They Impact Forex Trading</a>.</p> <h3>2. Monetary Policy Divergence</h3> <p>Interest rate decisions explain much of the differential movement in developed market currencies. This pillar examines:</p> <ul> <li>Real yield differentials (nominal yields minus inflation) between currency pairs</li> <li>Central bank cutting and raising interest rates (easing/tightening) and their relative positioning</li> <li>Balance sheet policies (quantitative easing/tightening) affecting liquidity</li> <li>Forward guidance disparities signalling future policy intentions</li> </ul> <p>The central bank policy framework includes:</p> <ul> <li><strong>Reaction Function Parameters:</strong> Define policy responses to economic conditions</li> <li><strong>Dual vs. Single Mandate Prioritisation:</strong> Influences predictability of policy responses</li> <li><strong>Forward Guidance Credibility:</strong> Affects market response to communications</li> <li><strong>Quantitative Policy Impact:</strong> Influences both currency values and economic activity</li> </ul> <p><strong>Tip:</strong> The 2-year government bond yield spread between economies shows a particularly strong correlation with exchange rate movements, serving as a proxy for expected monetary policy divergence—for example, USD/JPY currency correlation with US-Japan 2-year yield spread.</p> <p><img alt="Currency Correlation (ThinkMarkets)" src="/getmedia/c6a59974-f340-4f6d-ae7e-4c0600f4bdf0/Academy-Forex-Fundamental-Analysis-High-Importance-Forex-Economic-Events-G7-ThinkMarkets-Trader-Platform-Calendar.png" /></p> <p style="text-align: center;">USD/JPY vs US-Japan 2-year spread</p> <h3>3. Capital Flow Analysis</h3> <p>This pillar examines capital movements that drive currency demand:</p> <p><strong>Capital Flow Components:</strong></p> <ul> <li>Current account balances as a percentage of GDP (surplus currencies tend to appreciate)</li> <li>Foreign direct investment patterns indicate long-term economic confidence</li> <li>Portfolio investment flows into equity and debt markets</li> <li>Foreign ownership percentages of local debt markets (early warning for EM currencies)</li> </ul> <p><strong>Key capital flow indicators within this pillar include:</strong></p> <ul> <li><strong>Current Account/GDP Ratio:</strong> Indicates fundamental currency pressure</li> <li><strong>Foreign Direct Investment Trends: </strong>Shows long-term confidence</li> <li><strong>Portfolio Flow Patterns:</strong> Reveals short-term market sentiment</li> <li><strong>External Debt Metrics</strong>: Highlights potential vulnerability to outflows</li> </ul> <p>However, specific fundamentals do not exert the same influence on currency pricing.</p> <h2>How Do Fundamentals Transmit to Currency Prices</h2> <p>The transmission from fundamentals to currency prices operates through multiple channels working simultaneously but at different velocities:</p> <p><img alt="Fundamental Drivers of Currency Pricing (ThinkMarkets)" src="/getmedia/b8e1df9c-0ff2-4e30-8c6c-0d2b56317faa/Academy-Forex-Fundamental-Analysis-Key-Transmission-Channels-of-Fundamentals-into-Currency-Prices.png" /></p> <p style="text-align: center;">Key Transmission Channels of Fundamentals into Currency Prices</p> <p><strong>Interest Rate and Capital Flow Differentials:</strong> Currencies with higher interest rates (real rates) tend to attract capital inflows, creating upward pressure on their exchange rates. Similarly, strong economic growth attracts foreign investment.</p> <p><strong>Risk Appetite Dynamics:</strong> Global uncertainty drives capital toward currencies perceived as stable stores of value, particularly the US dollar, the Swiss franc, and the Japanese yen, during market stress.</p> <p><strong>Market Expectations and Forward Pricing:</strong> Markets price currencies based on anticipated future conditions rather than current data, which explains why expected policy shifts often impact prices before they are implemented.</p> <p>These transmission mechanisms can operate across distinct timeframes:</p> <ul> <li><strong>Short-term (intraday to weekly):</strong> Data releases, central bank communications</li> <li><strong>Medium-term (weekly to monthly):</strong> Monetary policy cycles, inflation trends</li> <li><strong>Long-term (monthly to yearly):</strong> Growth differentials, structural economic changes</li> </ul> <p>Understanding these timeframes helps forex traders align their analysis horizon with their fundamental trading strategy, from news trading strategies to position trading.</p> <h3>Currency-Specific Transmission Patterns</h3> <p>Currencies are not created equal, as their pricing reflects different fundamental factors. Different currency types respond to these transmission mechanisms in distinct ways, requiring traders to tailor their analysis accordingly. There are three different types of currencies, each with its own transmission channels.</p> <h4>Reserve Currencies (USD, EUR, GBP, CHF, JPY)</h4> <p>To trade forex, one must assess global situations alongside domestic market fundamentals when it comes to reserve currencies, i.e., major currency pairs.</p> <h4>Primary Transmission Channels</h4> <ul> <li><strong>Monetary Policy:</strong> Federal Reserve decisions and Treasury yields drive USD</li> <li><strong>Safe-Haven Flows:</strong> Risk-off periods strengthen CHF and JPY</li> <li><strong>Institutional Capital Flows:</strong> Deep markets enable fast transmission</li> </ul> <p>The US dollar holds a dominant <a href="https://data.imf.org/en/news/4225global+fx+reserves+decreased+by+3+percent+in+2024q4" target="_blank">reserve status</a> (approx 60% according to the IMF), which strengthens its response to Fed policy, while the euro reflects ECB decisions across a fragmented eurozone. The Swiss franc and Japanese yen often move counter to their domestic fundamentals during periods of market stress, displaying <a href="/en/trading-academy/commodities/what-is-gold-trading-why-trade-gold/">safe-haven</a> characteristics.</p> <p>These major currencies are highly liquid and see their relative market values refreshed around the clock by constant data releases <a href="/en/trading-academy/forex/sessions/">from Sydney to New York</a>. Traders may focus on inflation and employment figures, notably the US non-farm payrolls, to mould their views on each currency’s fundamentals.</p> <h4>Commodity Currencies (AUD, NZD, CAD, NOK, RUB)</h4> <p>Analysing these currencies requires following both domestic conditions and commodity prices. For example, copper and iron ore take a significant chunk of Australia’s exports, and their prices tend to weigh on the currency.</p> <h4>Primary Transmission Channels</h4> <ul> <li><strong>Terms of Trade:</strong> Commodity price movements</li> <li><strong>Global Growth Cycles:</strong> Trade volume impact</li> <li><strong>Risk Appetite:</strong> Pro-cyclical behaviour</li> </ul> <p>These currencies show a strong correlation with their key export commodities: copper and iron ore for AUD, dairy for NZD, and oil for CAD, NOK, and RUB. Chinese economic data often drives AUD and NZD moves through its impact on commodity demand.</p> <h4>Emerging Market Currencies (CNH, CZK, HUF, PLN, ZAR)</h4> <p>They display increased sensitivity to global risk appetite and the strength of the US dollar.</p> <h4>Primary Transmission Channels</h4> <ul> <li><strong>Global Risk Sentiment:</strong> Quick transmission through capital flows</li> <li><strong>External Vulnerability Metrics:</strong> Current account and debt levels</li> <li><strong>Political Risk Premium:</strong> Institutional stability impact</li> </ul> <p>These currencies show increased sensitivity to the strength of the USD and global risk appetite, with political developments often triggering rapid capital flow responses. Central banks generally lack credibility, and let inflation run out of control, which makes these currencies particularly volatile.</p> <h2>How to Use Fundamental Analysis in Forex Trading</h2> <p>Successful fundamental analysis trading requires a systematic method for translating fundamental insights into tradeable opportunities. The following step-by-step framework may help traders and investors move from analysis to execution while maintaining disciplined risk management.</p> <h3>Step 1 - Implement Analysis Driven by Fundamental Data</h3> <p>To trade forex using fundamental analysis, one has to be able to:</p> <ul style="list-style: none;"> <li>A. Understand market reactions</li> <li>B. Implement data hierarchy</li> <li>C. Verify fundamental signals</li> </ul> <h4>A. Understand Market Reactions</h4> <p>Skilled fundamental traders who do fundamental trading know that market reactions to data releases depend more on deviations from expectations than on absolute values or technicals for that matter.</p> <p>As markets show different sensitivity to economic indicator surprises, data that exceeds certain thresholds is more meaningful in terms of risk and opportunity. Some of the thresholds that may drive outsized market repositioning are seen in the table below.</p> <p><img alt="Major Economic Reports Deviations and Impact on Currencies (ThinkMarkets)" src="/getmedia/c90fa025-a69d-4e63-b136-ce0ad39ddca7/Academy-Forex-Fundamental-Analysis-Major-Economic-Reports-Deviations-and-Impact-on-Currencies-ThinkMarkets.png" /></p> <p style="text-align: center;">Economic Release Numbers Threshold and Impact</p> <p>Note that at times, revisions may have a greater market impact than their initial releases, but novice investors and traders often overlook them.</p> <h4>B. Implement Data Hierarchy</h4> <p>Hard economic data from government statistics, including GDP, employment, inflation and trade balance, provide the most authoritative readings as they may influence central bank decisions.</p> <p>Survey data like business confidence and purchasing manager surveys offer secondary insights, while composite indices help with broader economic trends.</p> <p>Market-based fundamental indicators, such as risk reversals and institutional positioning reports, complete the hierarchy, providing real-time sentiment feedback.</p> <p>Here’s a table with what economic report data is most reliable and examples of what they can change:</p> <p><img alt="Major Forex Economic Data Reliability (ThinkMarkets)" src="/getmedia/afdd1c70-a43b-40bf-8784-9166bd404059/Academy-Forex-Fundamental-Analysis-Major-Forex-Economic-Data-Reliability-ThinkMarkets.png" /></p> <p style="text-align: center;">Which Economic Data Category is Most Reliable in Forex</p> <p>Understanding this hierarchy can help forex traders to weigh information appropriately when building positions.</p> <h4>C. Verify Fundamental Signals</h4> <p>In an attempt to raise the odds of success, fundamental analysts employ multiple verification methods in trading fundamental analysis:</p> <ul> <li>Data triangulation compares primary statistics with secondary confirmation</li> <li>Cross-verification analyses aim to align with leading economic indicators</li> <li>Cross-asset verification ensures fundamental alignment in broader financial markets</li> </ul> <h3>Step 2 - Align Fundamental and Technical Analysis</h3> <p>The alignment method helps with entry and risk management, with the fundamental part identifying the directional bias and the technical part timing entries for favourable risk-reward.</p> <p>Key support and resistance provide natural entry points when fundamental catalysts fuel volatility, and momentum indicators could confirm this narrative. Fundamental traders may prefer to pay special attention to technical breakouts that support fundamental drivers, as they may lead to sustained market trends.</p> <p>A divergence between expectations and price action may signal trend changes. When fundamentals fail to produce the expected breakouts, the market positioning may be incorrect or signal a turn.</p> <h3>Step 3 - Plan Entries based on Fundamental Catalysts</h3> <p>Catalyst-driven entries are based on specific events or data. Proper identification and execution are essential to capture alpha while managing risk.</p> <p>Clearly defined fundamental triggers set specific conditions to open a position. High-probability setups stem from large deviations from market expectations, so thresholds ensure that trades are opened only when an event is of significant importance.</p> <p>Pre-established execution parameters define exact entries ahead of events, which helps eliminate emotional decision-making in the heat of the moment. They include execution timeframes (e.g. 5 minutes post-release) and confirmation signals such as breakout candles.</p> <p>Risk-adjusted position sizing accounts for increased volatility and uncertainty surrounding trade execution. Traders may reduce their usual ticket sizes by half to offset wider spreads, slippage, and gaps.</p> <p>Liquidity considerations require traders to be aware of the market depth surrounding data releases. Spreads can widen a lot in the first minutes, and traders might want to wait for them to normalise before going in.</p> <h3>Step 4 - Determine Position Size from Fundamental Conviction</h3> <p><a href="/en/trading-academy/forex/position-sizing-guide/">Trade sizes</a> should reflect the conviction that a trader has in the fundamental narrative. Strong divergence suggests that larger positions may be opened when economic data show heavy deviations from consensus, as the market response could unwind previous positioning.</p> <p>Confirmation with multiple indicators increases the odds of a solid trade, and in turn, validates the corresponding position size. On the one hand, this prevents over-sizing on a single data point, while on the other hand, it helps with gains from the previously mentioned fundamental alignment.</p> <p>Existing market positioning should also be taken into account when adjusting the trade size, based on whether the fundamental view aligns with the prevailing market trend. If so, positions may be reduced, as favourable developments may already be reflected in the price.</p> <p>As a rule of thumb, a systematic method would set capital allocation as follows:</p> <ul> <li>0.5% risk for weak and mid-strength fundamental divergence</li> <li>1% risk for fundamental-technical alignment setups</li> <li>Up to 2% for fundamental signals confirmed by several indicators</li> </ul> <h3>Step 5 - Work Out a Fundamental Stop Loss</h3> <p>These are triggered when the underlying story becomes invalid. Traders must monitor a country's <a href="/en/trading-academy/market-events/how-to-use-the-thinkmarkets-economic-calendar/">economic calendar</a> for data, policy developments, and market conditions to determine whether fundamental assumptions remain valid. For example, a long USD position based on Fed tightening should be closed if the central bank signals a dovish stance, regardless of the price action.</p> <p>Invalidation usually takes shape gradually through several data points, and traders can set their checkpoints accordingly to spot when the tide turns. This prevents holding onto losers when the underlying condition evolves while avoiding premature exits due to market noise.</p> <h3>Step 6 - Project Target based on Fundamental Model</h3> <p>Traders can set their profit objectives based on fundamental developments, by looking at historical price data or forward-looking models.</p> <ul> <li><strong>Historical Reactions:</strong> Similar market fundamentals have set expectations based on previous events. These deja vu patterns help traders focus on targets with historical precedent.</li> <li><strong>Interest Rate Differential Trajectory:</strong> It acts as a projection of forex movements from monetary policy divergence. Forward rate curve reveals expectations for each country’s interest rate path, and an increased differential would justify larger targets.</li> </ul> <p>Using multi-timeframe analysis, traders can set targets whenever there is alignment between technical indicators and fundamental data. Short-term targets may serve as support and resistance for partial profit-taking, while longer-term targets would be part of overall position management.</p> <div> <style type="text/css">.didyouknow { display: block; background: #F1FDf0; width: 600px; border-radius: 20px; gap: 20px; padding-top: 48px; padding-right: 40px; padding-bottom: 48px; padding-left: 40px; font-family: Figtree; font-weight: 600; font-size: 22px; line-height: 140%; letter-spacing: 0%; } </style> </div> <div style="text-align: center;"> <style type="text/css">.btn { font: Figtree; justify-content: center; align-items: center; text-align: center; gap: 7px; font-style: normal; font-size: 18px; line-height: 24px; padding: 13px 20px; border: 1px solid #ddd; border-radius: 38px; background: #5EE15A; } </style> </div> <div class="didyouknow">Want to Apply this Framework in Real-Time? Open a Risk-Free Demo Account and Practice with virtual funds.<br /> <br /> <a class="btn" href="https://portal.thinkmarkets.com/account/individual/demo/" style="text-decoration: none; font-weight: 500; color: #000000; background: 5EE15A;" target="_blank">Start Demo Trading Here!</a></div> <h2>Trading Fundamentals on EURUSD: Central Bank & Interest Rate Idea</h2> <p>Below, we present a fundamental <a href="/en/trading-academy/forex/popular-forex-trading-strategies/">trading strategy</a> on EURUSD, along with a brief analysis of the step-by-step methodology.</p> <p><strong>Initial Market Context</strong></p> <ul> <li>European Central Bank (ECB) expected to deliver 4 rate cuts vs the Fed's 2 cuts in 2025</li> <li>Eurozone showing improved economic outlook</li> <li>Business activity returning to growth trajectory</li> <li>Euro finding bottom near the 1.0200 round support as market sentiment shifts</li> </ul> <p><img alt="EURUSD Fundamental Trade (ThinkMarkets)" src="/getmedia/857bb98f-f1be-4524-8c90-24af146abf6d/Academy-Forex-Fundamental-Analysis-EURUSD-Trade-based-on-ECB-Rhetoric-Shift-Fundamental-Conviction.jpg" /></p> <p style="text-align: center;">EURUSD Trade based on ECB Rhetoric Shift, Fundamental Conviction</p> <h3>Step-by-Step Fundamental Trading</h3> <h4>Step 1 - Central Bank Policy & Data Analysis</h4> <p><strong>Policy Divergence:</strong></p> <ul> <li>Market repositioning ahead of the 6 March meeting</li> <li>ECB March meeting strikes hawkish tone</li> <li>Data-dependent approach signals fewer rate cuts</li> <li>Oil and gas price peaks removing headwinds</li> </ul> <p><strong>Market Validation:</strong></p> <ul> <li>Rally sustained post-meeting</li> <li>Smart money showing conviction in euro recovery</li> <li>Cross-verification with economic indicators is positive</li> </ul> <h4>Step 2 - Technical-Fundamental Alignment</h4> <p><strong>Key Technical Signals:</strong></p> <ul> <li>Double bottom formation in February</li> <li>Breakout above 1.0950 resistance <ul> <li>Earlier short squeeze amplifying upward momentum</li> </ul> </li> <li>Price action confirming hawkish narrative</li> </ul> <h4>Step 3 - Entry Strategy</h4> <p><strong>Fundamental Catalysts:</strong></p> <ul> <li>ECB's shift to 'data-dependent' approach</li> <li>Slowdown in economy; higher rates hurt economy</li> <li>Moderation in wage growth</li> <li>Drop in inflation to 2.2%</li> </ul> <p><strong>Technical Conviction:</strong></p> <ul> <li>Three consecutive bullish candles (<a href="/en/trading-academy/technical-analysis/guide-to-day-trading-triple-candlestick-patterns/">Three White Soldiers</a>)</li> <li>No reversal pattern following post-ECB peak at 1.0950</li> <li>Shallow pullback opportunity end-of-month</li> </ul> <h4>Step 4 - Position Size</h4> <p><strong>High Conviction Setup:</strong></p> <ul> <li>Strong deviation from expectations of more cuts</li> <li>Technical breakout confirmation with a <a href="/en/trading-academy/technical-analysis/single-candlestick-patterns-a-guide-for-day-trading/">Marubozu candle</a></li> <li>Fundamental alignment with growth, wage and inflation</li> <li>Suggested allocation: Up to 2% of capital</li> </ul> <h4>Step 5 - Risk Management</h4> <p><strong>Fundamental Invalidation Points:</strong></p> <ul> <li>Disappointing growth below expectations</li> <li>Rise in wage growth or inflation data</li> <li>ECB policy or member stance reversal</li> <li>Significant geopolitical disruption affecting inflation</li> <li>Institutional positioning shift in the COT report</li> </ul> <h4>Step 6 - Profit Target</h4> <p><strong>Technical Levels:</strong></p> <ul> <li>Partial take-profit at 1.1210</li> <li>Full target at 1.1400</li> </ul> <p><strong>Fundamental Exit Signals:</strong></p> <ul> <li>Deteriorating growth outlook (2 consecutive months)</li> <li>ECB dropping 'data-dependent' language</li> <li>Forward rate curve showing increased ECB accommodation</li> </ul> <p>With an entry at the first breakout candle above 1.0950 at 1.1055, a stop loss 30 pips below the EOM swing low at 1.0700 and a first take-profit mirroring the 1.0178-1.0950 leg, the trade returned 1.88x at 1.1722.</p> <h2>Conclusion</h2> <p>Fundamental analysis is one of the building blocks for trading forex, providing the economic rationale behind prevailing trends. More specifically, macroeconomic differentials, monetary policy divergence and capital flow dictate market fluctuations.</p> <p>Success in trading fundamentals in forex requires understanding that market reactions depend more on deviations from expectations than on absolute values. Savvy traders focus on:</p> <ul> <li>Systematic evaluation of economic data relative to consensus expectations</li> <li>Cross-verification of signals across multiple data sources</li> <li>Integration of fundamental catalysts with technical confirmation</li> <li>Position sizing based on fundamental conviction strength</li> </ul> <p>Remember that forex fundamental analysis isn't as much about collecting economic data or trading economic events. It’s more about understanding the relationships between all fundamental forces and currency valuations. When combined with disciplined execution and proper risk management, this can create a sustainable edge in the forex market.</p>

ZigZag Indicator Signals, Strategies and Integration

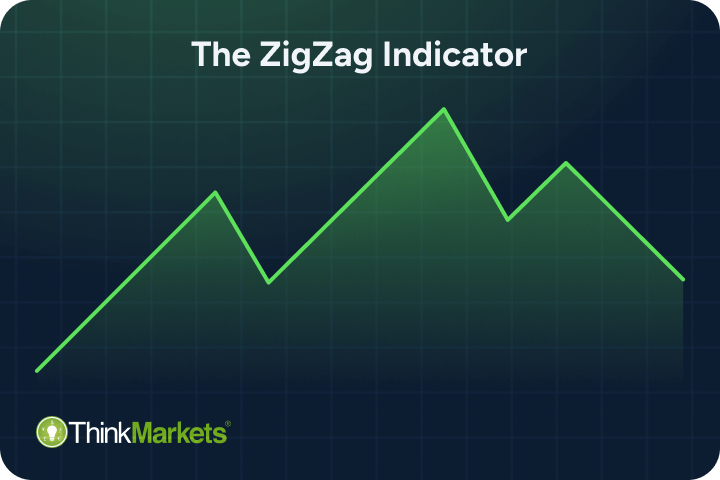

<p>The ZigZag indicator is a technical tool used by forex traders to spot chart patterns that may have been otherwise hidden by minor price movements known as “market noise.”</p> <p>By connecting major swing highs and swing lows with trend lines, the ZigZag tool provides a clearer visual context for identifying major turning points and trend continuations. Its graphical clarity reduces trend analysis time and helps navigate through market volatility.</p> <p>Focusing only on meaningful price movements, the Zig Zag indicator is a popular trading tool among swing traders and trend traders. Incorporating the technical indicator into a ZigZag trading strategy can simplify trading analysis and help cut through market noise.</p> <p>In this short trading guide, traders will learn:</p> <ul> <li>What the ZigZag trading indicator is</li> <li>The trading signals provided by the market indicator</li> <li>Different trading strategies to use with the ZigZag</li> <li>Integrating the forex indicator with existing strategies</li> <li>Risk management and best practices</li> </ul> <p>Whether you are looking to trade trends, identify price reversals, or improve your market structure analysis, understanding the Zig Zag indicator can improve your technical trading approach and help you build a proper ZigZag trading strategy.</p> <div> <style type="text/css">.didyouknow { display: block; background: #F1FDf0; width: 600px; border-radius: 20px; gap: 20px; padding-top: 48px; padding-right: 40px; padding-bottom: 48px; padding-left: 40px; font-family: Figtree; font-weight: 600; font-size: 22px; line-height: 140%; letter-spacing: 0%; } </style> </div> <div style="text-align: center;"> <style type="text/css">.btn { font: Figtree; justify-content: center; align-items: center; text-align: center; gap: 7px; font-style: normal; font-size: 18px; line-height: 24px; padding: 13px 20px; border: 1px solid #ddd; border-radius: 38px; background: #5EE15A; } </style> </div> <div class="didyouknow">Ready to Test Your Own ZigZag Trading Strategy?<br /> <br /> <a class="btn" href="https://portal.thinkmarkets.com/account/individual/demo" style="text-decoration: none; font-weight: 500; color: #000000; background: 5EE15A;" target="_blank">Try Here!</a> <br /> <br /> No Strategy? Read Along.</div> <h2>What is the ZigZag Indicator</h2> <p>The ZigZag indicator is a technical analysis tool that connects swing highs and swing lows with straight lines to filter out price moves that exceed a certain threshold.</p> <p><img alt="ZigZag Indicator - ThinkMarkets" src="/getmedia/91bf11cd-9ff2-42d2-8eea-683b68778ef3/Academy-indicators-and-patterns-zigzag-indicator-Formation-of-ZigZag-Straight-Lines.png" /></p> <p style="text-align: center;">Formation of ZigZag Straight Lines</p> <p>While primarily a lagging indicator due to plotting Ziz Zag lines after price action exceeds this threshold, when these pivot points are confirmed (i.e. when the Zig Zag line is plotted), they serve as a powerful leading trend indicator of potential future price continuation.</p> <p>Besides allowing traders to anticipate trend continuation as well as reversal patterns, it boasts advantages over similar trader tools like the Parabolic SAR or the Renko charts:</p> <ul> <li>It focuses on the magnitude of price changes, not on time intervals, which makes it more <strong>effective at identifying major market shifts</strong></li> <li>It maintains the visual context and <a href="/en/trading-academy/technical-analysis/single-candlestick-patterns-a-guide-for-day-trading/">candlestick information</a> of price charts while still filtering noise, which <strong>allows concurrent chart pattern analysis</strong></li> </ul> <p>The Zig Zag indicator helps <a href="/en/trading-academy/forex/">forex traders</a> in several other ways, starting with decluttering their view by highlighting cleaner price patterns while also revealing the underlying market structure and the direction of the trend.</p> <p>Notably, the Zig Zag indicator can assist with recognising parts of harmonics, Elliott waves and several geometry-based <a href="/en/trading-academy/technical-analysis/day-trading-chart-patterns/">chart patterns</a> due to how it marks pivot points. The term ‘Zig Zag’ itself is used extensively with the Elliott Wave Theory to pinpoint corrective wave structures.</p> <p>This combination creates a strong framework for both forex trend analysis and tactical trade execution, which brings us to the importance of understanding how the Zig Zag tool works.</p> <h2>How the Zig Zag Indicator Works</h2> <p>The Zig Zag indicator works by identifying major swing highs or swing lows on price charts based on a defined percentage threshold or deviation set by the user.</p> <p>Once the price movement exceeds this threshold from the previous turning point, the forex <a href="/en/trading-academy/indicators-and-patterns/technical-indicators-beginners-guide/">technical indicator</a> draws a straight trendline connecting these two points. This process continues with each new qualifying pivot point.</p> <p>Here is how this looks on ThinkMarkets GBPUSD 1-day chart on TradingView:</p> <p><img alt="Zig Zag Indicator (ThinkMarkets)" src="/getmedia/5a49526d-cfce-459b-9308-8d96ec70df07/Academy-indicators-and-patterns-zigzag-indicator-on-GBPUSD-1D-chart-ThinkMarkets-TradingView.jpg" /></p> <p style="text-align: center;">Zig Zag Indicator on GBPUSD 1D chart, ThinkMarkets TradingView</p> <p>Naturally, as a technical indicator in trading, the ZigZag can achieve this by a mathematical function - i.e. a formula.</p> <h3>Zig Zag Indicator Highs and Lows Formula</h3> <p>Below is the formula of how the ZigZag indicator calculates when to plot its lines:</p> <p style="text-align: center;"><strong>ZigZag (HL, %change=X, retrace=FALSE, LastExtreme=TRUE)</strong></p> <p style="text-align: center;"><strong>If %change>=X,plot ZigZag</strong></p> <p><strong>Where,</strong></p> <ul> <li><strong>HL</strong> = High/Low price series or closing price series</li> <li><strong>%change</strong> = Minimum price movement, in percentage</li> <li><strong>Retrace</strong> = Answers if change is a retracement of the previous move or an absolute change from peak to trough</li> <li><strong>Last Extreme</strong> = Answers if the extreme price is the same over multiple periods, is the extreme price the first or last observation</li> </ul> <p>The user has control of how the indicator plots ZigZag lines through its settings.</p> <h3>Zig Zag Indicator Settings</h3> <p>The ZigZag indicator has three primary settings:</p> <ol> <li><strong>Depth:</strong> Ensures swing points are major by setting a minimum number of candles</li> <li><strong>Deviation:</strong> Controls the magnitude of price movement required to plot a ZigZag</li> <li><strong>Backstep:</strong> Prevents successive pivot points from being plotted too close together</li> </ol> <p><img alt="ZigZag Indicator Default Settings (ThinkMarkets)" src="/getmedia/a0493442-2995-4046-9d8f-715a37fefbc7/Academy-indicators-and-patterns-zigzag-indicator-Settings-on-GBPUSD-1D-chart-ThinkMarkets-TradingView.jpg" /></p> <p style="text-align: center;">Zig Zag Indicator Settings on GBPUSD 1D chart, ThinkMarkets TradingView</p> <p>Each component of the ZigZag trading indicator functions differently, implying a particular impact during trading.</p> <p>Next is a summary of the ZigZag settings, what each component does and how changing settings can impact trading.</p> <p><img alt="Zig Zag Indicator Trading Signals (ThinkMarkets)" src="/getmedia/6913c198-8c6b-4534-b770-eef0099e6fb8/Academy-indicators-and-patterns-zigzag-indicator-Trading-Signals-ThinkMarkets.png" /></p> <p style="text-align: center;">Zig Zag Indicator Components and How They Function</p> <p>The deviation is a key parameter in the Zig Zag indicator's formula, as it is mainly responsible for how sensitive the indicator is. Generally, the accepted range is 5-15%, where the higher the figure is, the less sensitive the indicator is, which results in filtering out more noise.</p> <p>As a point of reference, scalpers and day traders could aim for 3-5%; in swing trading, traders may target 5-8%; long-term or position traders may opt for 10-15%. However, slight adjustments should be considered in the dynamic forex markets based on the trading session and the forex pair one trades.</p> <h2>What Are the Main Trading Signals of the ZigZag Indicator</h2> <p>The ZigZag indicator provides traders with objective signals by identifying significant price movements and filtering out minor fluctuations. These signals are not direct buy or sell recommendations but rather tools to interpret market structure and plan trades.</p> <p>The Zigzag trading indicator generates three actionable signals (with insights), acting as a trend reversal and trend trading indicator:</p> <ol> <li><strong>Trend reversals</strong> at major swing highs and lows</li> <li><strong>Trend continuations</strong> based on the direction of the ZigZag lines</li> <li><strong>Trend momentum</strong> gauged by length and angle of the ZigZag lines (used when trend trading)</li> </ol> <p>Let us take a closer look at each one separately.</p> <h3>1. Zig-Zag Indicator Trend Reversal</h3> <p>The ZigZag pivot points mark significant reversal points, often aligning with key support and resistance levels. Traders can use pivot points to set stop-loss or profit-taking levels below swing lows (for long trades) or above swing highs (for short trades).</p> <p><img alt="ZigZag Trend Reversal Trade (ThinkMarkets)" src="/getmedia/fc2af4e6-e8e7-40bc-ba03-45a385c4da74/Academy-indicators-and-patterns-zigzag-indicator-Major-Trend-Reversal-Example-GBPUSD-1D-Chart-1.jpg" /></p> <p style="text-align: center;">Major Trend Reversal Example, GBPUSD 1D Chart</p> <p>For intermediate traders, the structures that form at swing highs and lows can be used to make Elliott wave patterns or harmonic patterns easier to identify.</p> <p>On the advanced patterns front, when similar Zig Zag patterns appear, it suggests market rhythm or symmetry, which can be used to inform speculation about future price movements.</p> <h3>2. Zig-Zag Indicator Trend Continuation</h3> <p>The ZigZag reveals a clear market structure by showing higher highs and higher lows in uptrends or lower highs and lower lows in downtrends, confirming the prevailing trend direction. This implies it can be used as a trend following indicator.</p> <p>Notably, when a new ZigZag pivot forms, it signals that the price has reversed by the specified percentage threshold, which can be used as a trend confirmation signal at early turning points. Naturally, the pivot points act as breakout zones in trend continuations.</p> <p><img alt="ZigZag Trend Continuation Trade (ThinkMarkets)" src="/getmedia/c9bede24-f5f0-4457-9622-7e87915be309/Academy-indicators-and-patterns-zigzag-indicator-Trend-Reversal-Turns-into-Trend-Continuation-GBPUSD-1D-Chart-1.jpg" /></p> <p style="text-align: center;">Trend Reversal Turns into Trend Continuation, GBPUSD 1D Chart</p> <h3>3. Zig-Zag Indicator Trend Momentum</h3> <p>Longer ZigZag lines indicate stronger momentum, and shorter consolidation or trend exhaustion. On the other hand, steeper angles suggest strong momentum, while flatter angles may indicate trend exhaustion or reversal potential.</p> <p>In the GBPUSD 1D example below, an angle of 70.68 produced a 420 pips whereas an angle of 73.12 produced 727 pips, nearly twice.</p> <p><img alt="ZigZag Trend Momentum (ThinkMarkets)" src="/getmedia/e91552df-fd77-4a35-8cb0-f28fa3dda957/Academy-indicators-and-patterns-zigzag-indicator-Steeper-Angle-Produces-More-Gains-GBPUSD-1D-Chart-1.jpg" /></p> <p style="text-align: center;">ZigZag Steeper Angle Produces More Gains, GBPUSD 1D Chart</p> <p>The ZigZag length and angle also simplify the process of measuring the required Fibonacci retracement and extension levels. This aids in timing trades.</p> <p>For example, a 10% ZigZag pattern on a weekly chart can reveal the overall trend, while smaller settings, such as 5% on daily charts or 3% on 4-hour charts, may help traders identify shorter-term moves and refine entries.</p> <h2>Examples of ZigZag Trading Strategies</h2> <p>Building on our understanding of the ZigZag trading indicator signals, let us explore two practical trading strategies designed to capitalise on reversals and continuations (with momentum confirmation).</p> <h3>Swing Reversal ZigZag Trading Strategy</h3> <p>Here, traders use the indicator to clearly identify swing highs and swing lows, then trade reversals at those points when confirmed by other indicators or <a href="/en/trading-academy/forex/using-candlestick-patterns-in-forex-day-trading/">candlestick patterns</a>.</p> <p>This ZigZag strategy works best in ranging markets or at the potential end of extended trends, where a reversal is more likely.</p> <p><strong>How It Works:</strong></p> <ul> <li><strong>Identify a Significant Pivot Point:</strong> Wait for the ZigZag to mark a swing low or swing high (visible V-shape and inverted V-shape patterns that often appear in <a href="/en/trading-academy/technical-analysis/what-is-the-dead-cat-bounce-pattern-and-how-to-identify-it/">Dead Cat Bounces</a>).</li> <li><strong>Confirm the Reversal:</strong> Look for confirmation signals such as: <ul> <li>Bullish candlestick patterns (hammer, <a href="/en/trading-academy/technical-analysis/using-double-candlestick-patterns-in-day-trading/">engulfing</a>) at swing lows</li> <li>Bearish candlestick patterns (shooting star, engulfing) at swing highs</li> <li>RSI showing oversold conditions (below 30) at swing lows or overbought (above 70) at swing highs</li> </ul> </li> <li><strong>Execute the Trade:</strong> <ul> <li><strong>For long trades:</strong> Enter after confirmation near the swing low</li> <li><strong>For short trades:</strong> Enter after confirmation near the swing high</li> <li>Set stop-loss just below the recent swing low (for longs) or above the swing high (for shorts)</li> <li>Initially, target the previous swing point, the RSI overbought/oversold</li> </ul> </li> <li><strong>Manage the Position:</strong> <ul> <li>Consider partial profit-taking at the halfway point to the target</li> <li>Trail stops as price moves favorably to lock in profits</li> </ul> </li> </ul> <p>In the GBPUSD 1D long example below, using this method resulted in a gain with a risk-reward ratio of approximately 2x:</p> <ul> <li><strong>Take Profit:</strong> when the RSI closes in the overbought region near 1.29</li> <li><strong>Stop loss:</strong> 30 pips below the last ZigZag swing, measured near 1.22</li> </ul> <p><img alt="ZigZag Trend Trade (ThinkMarkets)" src="/getmedia/beb3f04d-0907-4a03-8569-99fd5f525102/Academy-indicators-and-patterns-zigzag-indicator-RSI-Reversal-Long-Trade-with-Trend-Confirmation-GBPUSD-1D-Chart-1.jpg" /></p> <p style="text-align: center;">ZigZag RSI Reversal (Long) Trade with Trend Confirmation, GBPUSD 1D Chart</p> <h3>Trend Following ZigZag Trading Strategy</h3> <p>This strategy combines the ZigZag's trend signal with trendline analysis to capture continuation moves after pullbacks. It works best in trending markets with regular pullbacks, particularly effective on daily and 4-hour charts.</p> <p><strong>How It Works:</strong></p> <ul> <li><strong>Identify the Dominant Trend:</strong> Use this indicator to confirm higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).</li> <li><strong>Draw Trendlines:</strong> Connect consecutive ZigZag swing highs (for downtrends) or swing lows (for uptrends).</li> <li><strong>Wait for a Pullback:</strong> Look for a counter-trend move that pulls back to the ZigZag lines or forms a new ZigZag leg against the trend.</li> <li><strong>Enter on Continuation Confirmation:</strong> <ul> <li><strong>For uptrends:</strong> Enter long when price bounces off trendline support or breaks above a minor high</li> <li><strong>For downtrends:</strong> Enter short when price rejects from trendline resistance or breaks below a minor low</li> <li>Confirm with volume increase or momentum indicator alignment (MACD crossover)</li> <li>Place a stop-loss beyond the most recent counter-trend ZigZag pivot</li> </ul> </li> <li><strong>Monitor Zigzag Momentum Signals:</strong> <ul> <li>Watch for ZigZag line characteristics during the trade</li> <li><strong>Strong momentum:</strong> long ZigZag legs with steep angles in trend direction</li> <li><strong>Weakening momentum:</strong> shorter ZigZag legs with flatter angles</li> <li><strong>Warning sign:</strong> counter-trend ZigZag moves deepening beyond 50% retracement</li> </ul> </li> <li><strong>Take Profit Approaches:</strong> <ul> <li>Use Fibonacci extensions (127.2% or 161.8%) of the pullback move</li> <li>Target the length of the previous ZigZag leg in the trend direction</li> <li>Implement a trailing stop based on subsequent ZigZag pivots</li> <li>Consider scaling out when ZigZag momentum shows signs of weakening</li> </ul> </li> </ul> <p>In the GBPUSD 1D short example below, using this method resulted in a gain with a risk-reward ratio of approximately 2x:</p> <ul> <li><strong>Take Profit:</strong> at 161.8% of the prior major Zig Zag near 1.21</li> <li><strong>Stop loss:</strong> 30 pips above the last ZigZag swing, measured near 1.3070</li> </ul> <p><img alt="Zig Zag Trend Trade (ThinkMarkets)" src="/getmedia/2ee9b913-9226-4886-809f-50ca2c4203cb/Academy-indicators-and-patterns-zigzag-indicator-Trend-Continuation-Short-Trade-with-MACD-Confirmation-GBPUSD-1D-Chart-1.jpg" /></p> <p style="text-align: center;">Zig Zag Trend Continuation (Short) Trade with MACD Confirmation, GBPUSD 1D Chart</p> <p>By keeping a close eye on the length, angle, and pattern of ZigZag lines throughout a trade, traders can manage their positions more effectively, hold through periods of strong momentum and reduce exposure when momentum begins to wane.</p> <h3>Additional ZigZag Trading Strategies</h3> <p>Beyond these three core strategies, traders often implement several other ZigZag-based approaches:</p> <ol> <li><strong>Fibonacci Confluence Strategy:</strong> Uses ZigZag pivot points as anchors for Fibonacci retracement and extension levels to identify precise entry and exit points during trends.</li> <li><strong>ZigZag Channel Trading:</strong> Forms price channels by connecting consecutive ZigZag swing highs and lows, then trades bounces within the channel or breakouts from it.</li> <li><strong>Pattern Recognition Strategy:</strong> Uses the ZigZag to more clearly visualise classic chart patterns like double top and double bottom patterns, head and shoulders, or <a href="/en/trading-academy/technical-analysis/using-double-candlestick-patterns-in-day-trading/">triangles</a> that might be obscured in noisy price action.</li> <li><strong>Elliott Wave Analysis:</strong> Leverages the ZigZag's filtering capability to more accurately count waves and identify potential market reversals.</li> </ol> <p>Each of those ZigZag trading strategies can be adjusted based on trading style, risk tolerance, and the markets one trades.</p> <h2>How to Use the Zig Zag Indicator In A Strategy</h2> <p>The process of integrating the ZigZag trading indicator into a trading strategy involves the following steps:</p> <p><strong>Step 1 - Select the Indicator:</strong> Add the Zigzag from the indicator list.</p> <p><strong>Step 2 - Set Initial Parameters:</strong> Set the deviation at a 5% threshold for a balanced view (or use trading platform default settings).</p> <p><strong>Step 3 - Adjust Visual Properties:</strong> Adjust visuals; line colour, thickness, and style for clear chart reading.</p> <p><strong>Step 4 - Fine-Tune Settings:</strong> Adjust depth, deviation, and backstep parameters according to your target market and timeframe.</p> <p><strong>Step 5 - Analyse Price Structure:</strong> Monitor how the indicator connects recent highs and lows, focus on swing patterns, trend direction and potential reversal zones, and pay attention to ZigZag characteristics (length, angle, pattern) that may suggest trend continuation or exhaustion.</p> <p><strong>Step 6 - Plan Your Trade:</strong> Align entries with additional confirmation tools, such as support/resistance levels, momentum indicators, or candlestick patterns. Set logical stop-loss levels near recent ZigZag pivots and determine take-profit targets based on previous ZigZag waves or Fibonacci levels.</p> <p>A part of integrating the ZigZag into a trading strategy, as revealed in step 4, is adjusting its settings based on the forex pair one trades.</p> <h2>Adjusting Settings for Different Forex Markets</h2> <p>This allows traders to align the forex trading indicator with their own volatility levels and price behaviour.</p> <p>Here are examples of settings to use for all three pair types (of course, one can create their own), along with the rationale behind the changes:</p> <p><img alt="ZigZag Indicator Forex Settings (ThinkMarkets)" src="/getmedia/96d3bde3-890c-4b60-967d-5aa7fd952d45/Academy-indicators-and-patterns-zigzag-indicator-Forex-Settings-ThinkMarkets.png" /></p> <p style="text-align: center;">Adjusting ZigZag Indicator Settings for Forex</p> <p><strong>Major pairs:</strong> Less volatile, highly liquid markets require moderate settings to identify meaningful swings without excessive filtering. The backstep ensures the indicator doesn’t plot two swing highs or lows too close together, which keeps the structure of the ZigZag lines clear and readable.</p> <p><strong>Cross pairs:</strong> Higher volatility needs slightly increased thresholds to filter minor price fluctuations. Slightly higher settings smooth out market noise while maintaining responsiveness.</p> <p><strong>Exotic pairs:</strong> Extreme volatility requires more aggressive filtering to identify truly significant price movements. Wider ZigZag parameters help the indicator identify only significant turning points in these unpredictable markets.</p> <p>Naturally, another consideration for integrating the ZigZag into a strategy is the timeframes.</p> <h3>Timeframe Considerations</h3> <p>Different timeframes serve distinct trading objectives when using the ZigZag indicator:</p> <ul> <li><strong>Lower timeframes (15M-1H):</strong> The indicator can be used with tighter settings for intraday trading, though they contain more noise</li> <li><strong>4-Hour charts:</strong> Provide frequent trading opportunities while maintaining reasonable signal reliability</li> <li><strong>Daily charts:</strong> Offer excellent balance between signal quality and timeliness for most ZigZag strategies</li> <li><strong>Weekly charts:</strong> Ideal for identifying major trend changes and suited for position trading</li> </ul> <p>Swing traders typically find the 4H and daily timeframes most effective, while position traders benefit from weekly chart analysis. For a comprehensive approach, consider using multiple timeframes with coordinated ZigZag settings to confirm reversal and trend signals across different time perspectives.</p> <div> <style type="text/css">.didyouknow { display: block; background: #F1FDf0; width: 600px; border-radius: 20px; gap: 20px; padding-top: 48px; padding-right: 40px; padding-bottom: 48px; padding-left: 40px; font-family: Figtree; font-weight: 600; font-size: 22px; line-height: 140%; letter-spacing: 0%; } </style> </div> <div style="text-align: center;"> <style type="text/css">.btn { font: Figtree; justify-content: center; align-items: center; text-align: center; gap: 7px; font-style: normal; font-size: 18px; line-height: 24px; padding: 13px 20px; border: 1px solid #ddd; border-radius: 38px; background: #5EE15A; } </style> </div> <div class="didyouknow">Test Your Forex ZigZag Strategy on ThinkMarkets TradingView<br /> <br /> <a class="btn" href="https://portal.thinkmarkets.com/account/individual/demo" style="text-decoration: none; font-weight: 500; color: #000000; background: 5EE15A;" target="_blank">Here!</a></div> <h2>Integrating the ZigZag Trading Indicator into Your Strategy</h2> <p>To demonstrate how to integrate the ZigZag trading indicator into your trading strategy effectively, let us examine a couple of key application scenarios.</p> <h3>Trend-Following ZigZag Strategy with EMA and RSI Technical Indicators</h3> <p>This example shows how to use the ZigZag indicator to improve a classic trend following strategy on the USDCAD 1D chart, using the <a href="/en/trading-academy/indicators-and-patterns/rsi-indicator/">Relative Strength Index</a> (RSI) and the Exponential Moving Average (EMA).</p> <p>Setup: ZigZag (14 depth, 5% deviation, 5 backsteps) + 100 EMA + RSI (14)</p> <p><img alt="ZigZag Trading Strategy (ThinkMarkets)" src="/getmedia/4ebea59f-47e0-40c6-92ae-5b4aeafb314c/Academy-indicators-and-patterns-zigzag-indicator-Strategy-with-EMA-and-RSI-Confirmation-USDCAD-1D-Chart-1.jpg" /></p> <p style="text-align: center;">Zig Zag Strategy with EMA and RSI Confirmation, USDCAD 1D Chart</p> <p><strong>Signal:</strong></p> <ul> <li>ZigZag confirmed a higher high and higher low, validating the uptrend</li> <li>Price pulled back and held the 100 EMA dynamic support zone at 1.35, forming a ZigZag low</li> <li>RSI dipped below 50 and then reversed, showing a momentum shift</li> </ul> <p><strong>Trade Execution:</strong></p> <ul> <li><strong>Entry:</strong> After ZigZag marked a higher low, entry on the first bullish candle that aligned with the RSI momentum shift (1.3570)</li> <li><strong>Stop-loss:</strong> Placed 30 pips below the most recent swing low (1.3385)</li> <li><strong>Take-profit:</strong> Price closing in RSI overbought region (1.3880)</li> </ul> <p>Using this method resulted in a gain with a risk-reward ratio of approximately 1.7x.</p> <p>This ZigZag strategy combined trend structure (from ZigZag), dynamic support (from EMA), and momentum confirmation (from RSI) to create a high-probability entry.</p> <h3>Reversal ZigZag Strategy with EMA and MACD Technical Indicators</h3> <p>This reversal trading strategy example demonstrates how to identify potential turns at major points, using CAD/JPY, which formed a double top on the daily chart.</p> <p><strong>Setup:</strong> ZigZag (20 depth, 8 deviation, 7% backsteps) + MACD</p> <p><img alt="Zig Zag Trading Strategy (ThinkMarkets)" src="/getmedia/67cebbb7-063c-4c3a-a580-2a16bdd4901b/Academy-indicators-and-patterns-zigzag-indicator-Strategy-with-EMA-and-MACD-Confirmation-CADJPY-1D-Chart-1.jpg" /></p> <p style="text-align: center;">ZigZag Strategy with EMA and MACD Confirmation, CADJPY 1D Chart</p> <p><strong>Signal:</strong></p> <ul> <li>ZigZag clearly delineated a double top formation (M pattern)</li> <li>The MACD histogram and lines turned negative, confirming a momentum shift</li> <li>The market slid below the 100 EMA to confirm a trend change from bullish to bearish</li> </ul> <p><strong>Trade Execution:</strong></p> <ul> <li><strong>Entry:</strong> Short position when the price broke below the recent ZigZag low (104.70)</li> <li><strong>Stop-loss:</strong> Placed 30 pips above the 100 EMA (106.15)</li> <li><strong>Take-profit:</strong> The height of the double top pattern projected downward from the breakout point (length of 110.50 to 104.70 from breakout point -> 98.90)</li> </ul> <p>As with the previous example, this position combined the ZigZag's ability to outline patterns, an EMA trend change and MACD momentum confirmation, resulting in a trade that offered a nearly 4x risk:reward.</p> <h2>Risk Management and Best Practices to Use ZigZag</h2> <p>While the Zig Zag indicator is often used as a trading analysis tool, it has its drawbacks.</p> <p>For starters, the indicator lags. This means that ZigZags appear some time after the price has exceeded the threshold. Relying solely on it would result in trends that have already moved substantially, which supports the idea of confirming trends.</p> <p>Another downside is how susceptible the trading tool can be to false signals or whipsaws, especially in volatile forex markets. To mitigate these effects:</p> <ul> <li><strong>Adjust Settings:</strong> Increase the deviation percentage threshold to reduce sensitivity to minor price fluctuations</li> <li><strong>Combine with Other Indicators:</strong> Use the ZigZag trading indicator with other complementary forex tools like the RSI or the MACD for confirmation</li> <li><strong>Confirm with Volume:</strong> Analyse real trading volume to confirm the strength of a trend</li> <li><strong>Use Whipsaw Filters:</strong> Use other types of indicators that help identify and filter out whipsaw patterns</li> </ul> <p>Due to these drawbacks, prudent position sizing is crucial. Traders should risk a small percentage (ideally 1-2%) of their trading capital for every position to ensure a minimal and manageable drawdown.</p> <h2>Common Trader Mistakes with the Zig Zag Indicators</h2> <p>Traders should be aware of the following mistakes when using the ZigZag indicator:</p> <ul> <li><strong>Ignoring the broader market context:</strong> Focusing exclusively on ZigZag patterns without considering the overall market trend can result in misguided trades. Always analyse the prevailing market direction alongside ZigZag signals.</li> <li><strong>Using inappropriate settings for different timeframes:</strong> Applying uniform settings across different timeframes or assets leads to inaccurate representations. Higher timeframes generally require larger deviation settings.</li> <li><strong>Failing to wait for pattern confirmation:</strong> The ZigZag indicator can redraw its lines as new price data becomes available. Acting on a pattern before it is fully formed can lead to trades based on incomplete information.</li> <li><strong>Neglecting to adjust for market conditions:</strong> Market volatility varies across different assets and timeframes. Using static ZigZag settings without adjusting for these variations can result in missed opportunities or false signals.</li> </ul> <p>Understanding the importance of avoiding these actions can help many traders make more informed live trading decisions when using the tool.</p> <h2>Conclusion</h2> <p>The Zig Zag indicator is a tool used by many traders to filter out market noise by highlighting major turning points and potential continuations in trend direction. Its visual clarity allows forex traders to analyse market structures more easily and aid in technical nature decisions.</p> <p>When applying a ZigZag trading strategy, remember these key principles:</p> <ul> <li>Use the tool as part of a complete trading system, not in isolation</li> <li>Combine its signals with momentum analysis and breakout patterns for confirmation</li> <li>Adjust settings as market conditions and volatility change</li> <li>Apply proper risk management with appropriate stops near ZigZag points</li> </ul> <p>However, whether you use the ZigZag indicator as a reversal or trend tool, or count Elliott waves, to integrate it into your trading toolbox properly, you must master both its strengths and limitations. The Zig Zag indicator does not predict the future after all.</p> <div> </div>

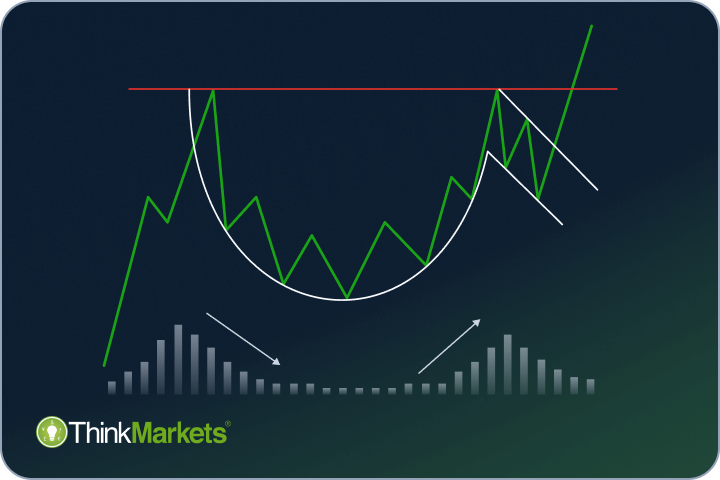

Trading Cup and Handle Patterns in Forex Markets