Gold trading

Trade CFDs on gold with the tools and pricing that give you control.

Why trade gold CFDs?

Gold stands strong when markets don't. It's a go-to during inflation, volatility, or economic shocks.

Go both waysExpecting a rally? Buy. Forecasting a dip? Sell. Trade rising or falling prices.

Diversification made easyAdd shine to your portfolio without the baggage of physical ownership.

How to start trading CFDs on gold

With gold CFDs, you’re speculating on price. No pickaxe required. Here’s how it plays out:

Open your gold trading account

Fast setup. No complicated forms. Get started in just a matter of minutes.

Why choose ThinkMarkets?

We give you more than just access to the gold market

Trade CFDs on gold with

ThinkTrader

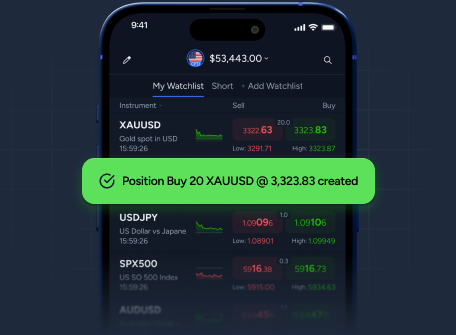

ThinkTrader is a new-age technology platform, designed to give you speed, insight, and control across global markets.

All-in-one access

Trade gold alongside up to 4,000 instruments including forex, indices, crypto, and more - on mobile, tablet, or desktop.

Powerful charting

Get advanced TradingView charts with 100+ indicators and drawing tools, right inside the platform.

Real-time market edge

Set up to 200 cloud-based alerts and get notified instantly when gold hits your key levels.

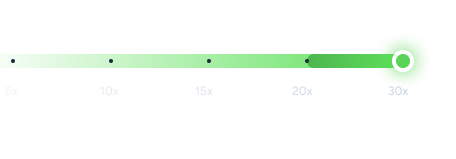

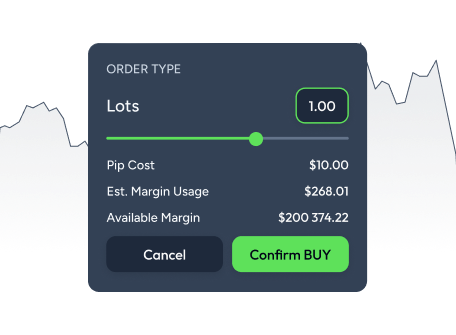

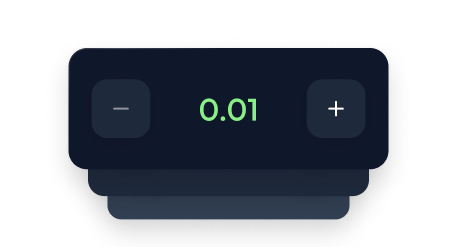

Precision order control

Place up to 6 pending order types - plan trades with stop loss, take profit, and more.

Multi-screen mode

Track up to 8 charts at once so you never miss a breakout, reversal, or shift in trend.

No risk strategy testing

Use Traders’ Gym to backtest gold strategies on real historical data - no capital required.

Always in sync

Seamless experience across devices, plus one-click trading, market calendars, and custom watchlists.