Articles (1)

ThinkTrader Introduces Trailing Stop Loss Feature for Advanced Risk Management

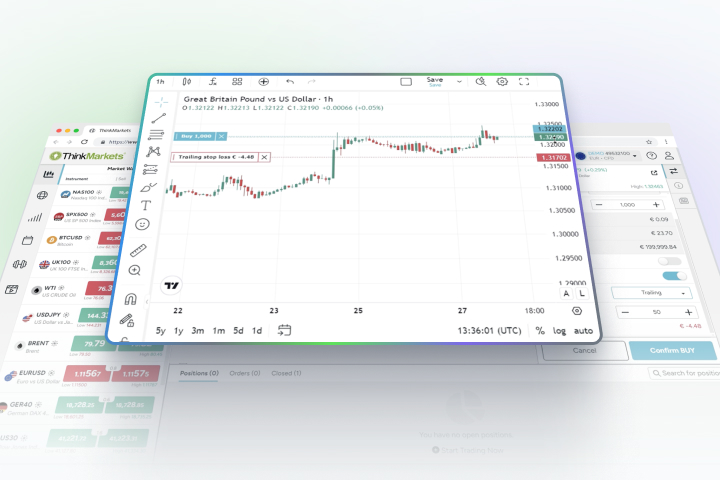

<p>In online trading, effective risk management is crucial for minimising potential losses and safeguarding potential gains. ThinkMarkets, committed to providing traders with the tools they need to manage risk effectively, is pleased to introduce Trailing Stop Loss as the latest feature of its next-gen trading platform, ThinkTrader.</p> <h2>What is a Trailing Stop Loss Order?</h2> <p>A trailing stop loss order is a sophisticated risk management tool that allows traders to protect their potential profits by automatically adjusting the stop-loss level as the market price moves in a favourable direction.</p> <p>Unlike the traditional stop loss which stays fixed at a specific price point, a trailing stop loss dynamically follows the price movement at a set distance.</p> <p>This means that as the price of an instrument rises, the stop loss moves up in tandem, securing potential gains and providing protection against sudden market reversals.</p> <h2>What are the Benefits of Using Trailing Stop Loss?</h2> <h3>Limits Your Potential Losses</h3> <p>The primary advantage of using a trailing stop is its ability to limit the potential losses during a market reversal by closing the position at the last adjusted stop level, thus preventing further losses and protecting your gains.</p> <h3>Improves Your Efficiency</h3> <p>Trailing stop orders improve trading efficiency by automating the adjustment process. You no longer need to manually adjust your stop loss levels as the market price changes.</p> <p>This not only saves time but also allows you to focus on finding new potential trading opportunities instead of having to constantly watch your positions.</p> <h3>Reduces Emotional Trading Decisions</h3> <p>Emotions can often cloud judgment and lead to poor trading decisions. The automatic adjustment of stop-loss levels helps mitigate this risk by reducing the temptation to make impulsive decisions based on short-term market fluctuations.</p> <p>Like all other tools on ThinkTrader, it was designed to support a rational and objective trading process, helping you stay on track even in volatile markets.</p> <h2>How to Use Trailing Stop Loss on ThinkTrader</h2> <h3>Setting Up Trailing Stop Loss on ThinkTrader</h3> <p>ThinkMarkets has made it incredibly straightforward to set up a trailing stop loss on ThinkTrader. </p> <p>After selecting which instrument you wish to trade, you can easily set your trailing stop loss directly within the order screen.</p> <p>This user-friendly setup ensures that you can quickly implement this advanced risk management tool into your trading strategy.</p> <p>For detailed instructions on setting up and using this feature, refer to the how-to video <a href="https://www.youtube.com/watch?v=yErzUQHzRHc" target="_blank">here</a>.</p> <h3>Customising Your Trailing Stop Loss</h3> <p>ThinkTrader offers a range of customisation options for your trailing stop loss orders. Whether you are a short-term trader looking to protect small gains or a long-term investor aiming to lock in larger profits, ThinkTrader allows you to adjust your trailing stop loss settings to match your specific trading style.</p> <p>These customisation features ensure that your trailing stop loss works in harmony with your overall trading strategy, providing a tailored approach to risk management.</p> <h3>Combining Trailing Stop Loss with Other ThinkTrader Features</h3> <p>ThinkTrader isn’t just another trading platform; it’s a powerhouse of advanced tools and features designed to give traders an edge in today’s hectic markets. It offers a comprehensive suite of tools that can be combined with trailing stop loss to optimise your trading performance.</p> <p>One of the standout features of ThinkTrader is its advanced charting capabilities, powered by TradingView, offering a robust suite of technical indicators, including Moving Averages, RSI, MACD, and Bollinger Bands, among others. These indicators are important in identifying market trends, potential reversal points, and optimal entry and exit positions. By combining these technical indicators with a trailing stop loss, you can make more precise trading decisions.</p> <p>ThinkTrader’s real-time alerts are another essential feature that complements the use of a trailing stop loss. These alerts can be set to notify you of significant market movements, news events, or specific price levels that could impact your trades. With these alerts you are always in tune with the markets, allowing you to adjust your trailing stop loss settings accordingly.</p> <p>ThinkTrader’s advanced charting tools are fully customisable to suit your trading style. You can overlay multiple indicators, adjust time frames, and use drawing tools to identify support and resistance levels. When setting a trailing stop loss, you can analyse your charts in real time to ensure that your levels are aligned with the market’s landscape by visually tracking what’s necessary.</p> <p>ThinkTrader’s Signal Centre provides AI-enhanced trading signals that are FCA-regulated, offering another layer of analysis that can be used alongside your trailing stop loss strategy. These signals help you spot high-probability trading opportunities, which, when paired with a trailing stop, can improve your chances of maximising profits and effectively managing your risk.</p> <p>Additionally, ThinkTrader’s Traders’ Gym allows you to backtest your strategies in a risk-free simulated environment. By applying your trading strategies on historical market data, you can refine them without risking actual capital.</p> <p>ThinkTrader is designed for traders on the go, offering seamless cross-device functionality. Whether you are trading from web or from a mobile device, your trailing stop loss settings are synchronised across all devices. This means you can monitor and adjust your traders no matter where you are, ensuring that you never miss an opportunity.</p> <h3>Empower Your Trading Strategy with ThinkTrader’s Trailing Stop Loss</h3> <p>The introduction of trailing stop loss on ThinkTrader is a significant enhancement that can potentially help you minimise your losses, maximise your profits, and improve your overall trading performance.</p> <p>By integrating this powerful tool into your trading, in combination with the full suite of ThinkTrader tools, you can create an effective well-rounded trading strategy that can protect your investments while allowing you to stay focused on rising opportunities.</p> <p>Explore ThinkTrader’s trailing stop loss feature and its suite of advanced tools today and see for yourself how they can take your trading strategy to new heights.</p>