The week's not over: Bank of Japan decision looms

Risk appetite is on the up following yesterday's 50 bps rate cut by the Federal Reserve, which also lifted the USD/JPY. Traders' tempers will be tested tomorrow morning as the Bank of Japan concludes its September interest rate meeting.

A CNBC poll of 32 analysts suggests they will leave interest rates unchanged. But there are still reasons to be on alert. First, inflation is running hotter than expected. Earlier in the month, Tokyo consumer prices rose to 2.6% YoY from 2.2% in July, and much higher than the 2.3% expected. At the same time, Core CPI rose unexpectedly to 2.4% vs 2.2% in July and expected. Industrial production, which has been suffering in recent months, turned positive, with gains broadly shared across the economy.

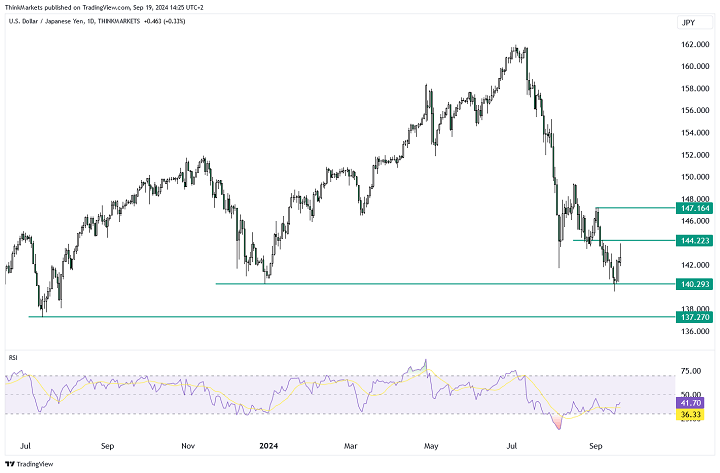

Is that enough to increase interest rates tomorrow? We will need to wait to find out, but BOJ Governor Kazuo Ueda said clearly last month that the bank would hike rates if inflation stayed on course while also monitoring financial market conditions. Regarding this, we note that the Nikkei 225 index has recuperated 61.8% of its 28.5% drop from its July high and is currently just 11% below this high. We also note that the USD/JPY could have dropped much more yesterday following the Fed rate cut, but looking at the charts, the price dropped below the important December 2023 low, and the exchange rate is now above this level, making it look like a false breakdown, trapping bears.

The stability in the market might be enough to prompt a rate cut, or at least a strong hint about a rate cut in October or December. December is also the month in which the Japanese bank Nomura predicts the next rate hike. They also project 2 more hikes for 2025 as they see higher economic growth from Q2 and wage increases being much higher than last year, leading to persistent inflation.

The technical outlook is turning USD/JPY positive. The RSI suggests that the market is oversold and that we have bullish divergence. The break to the December and 2024 low at 140.29 proved to be a false move, which on its own is bullish. If the price manages to remain above Monday's low of 139.58, we might see further gains. Resistance levels to watch are 144.22 and 147.16.

At the same time, a breach of Monday’s low of 139.57 might send USD/JPY to the July low of 137.27.