Academy

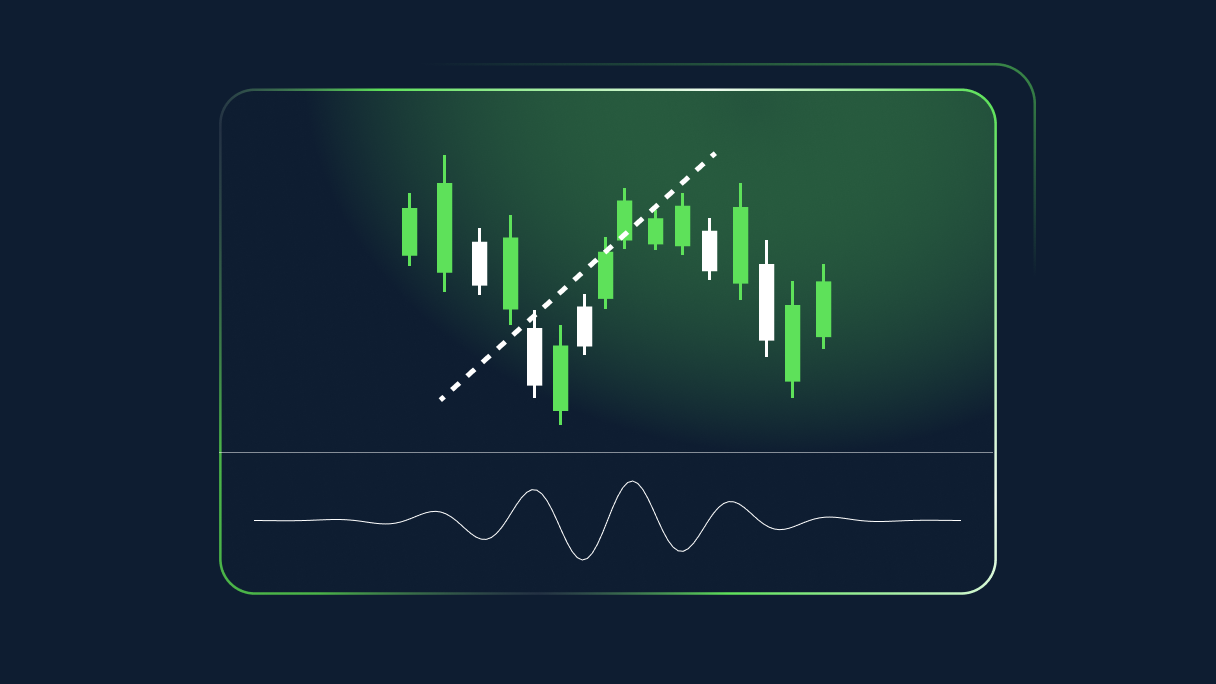

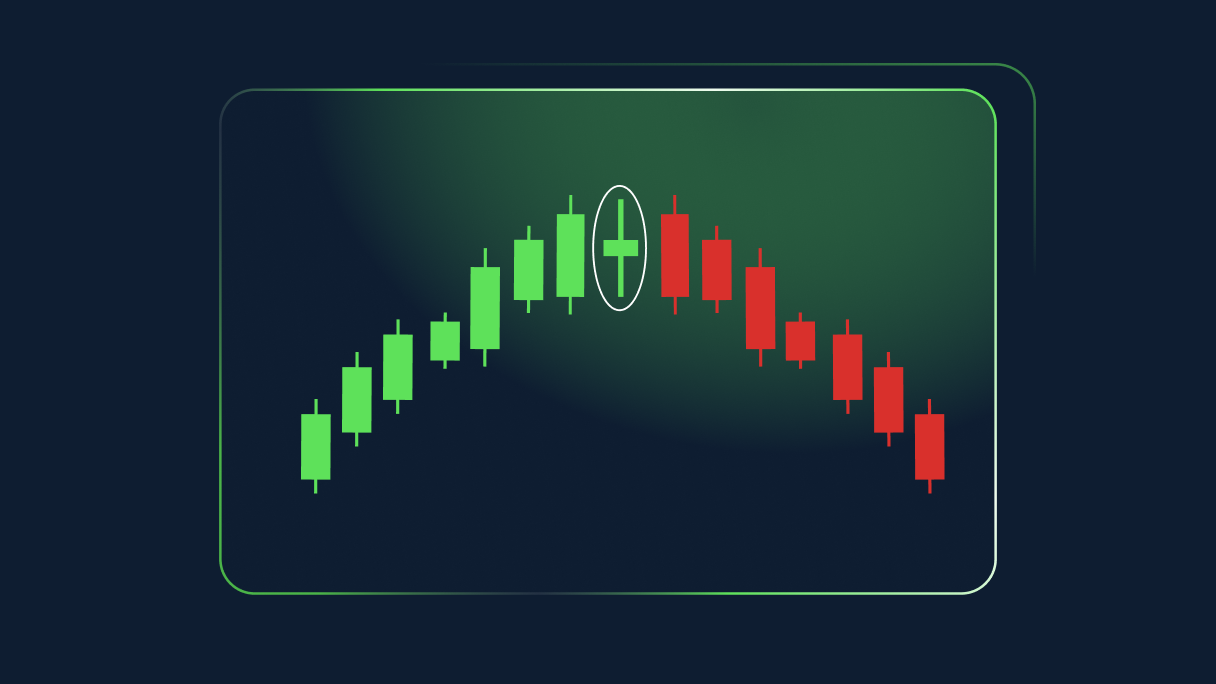

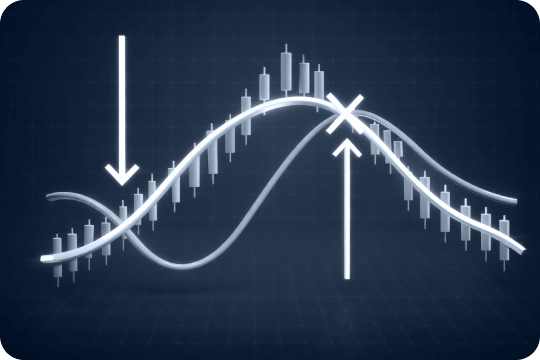

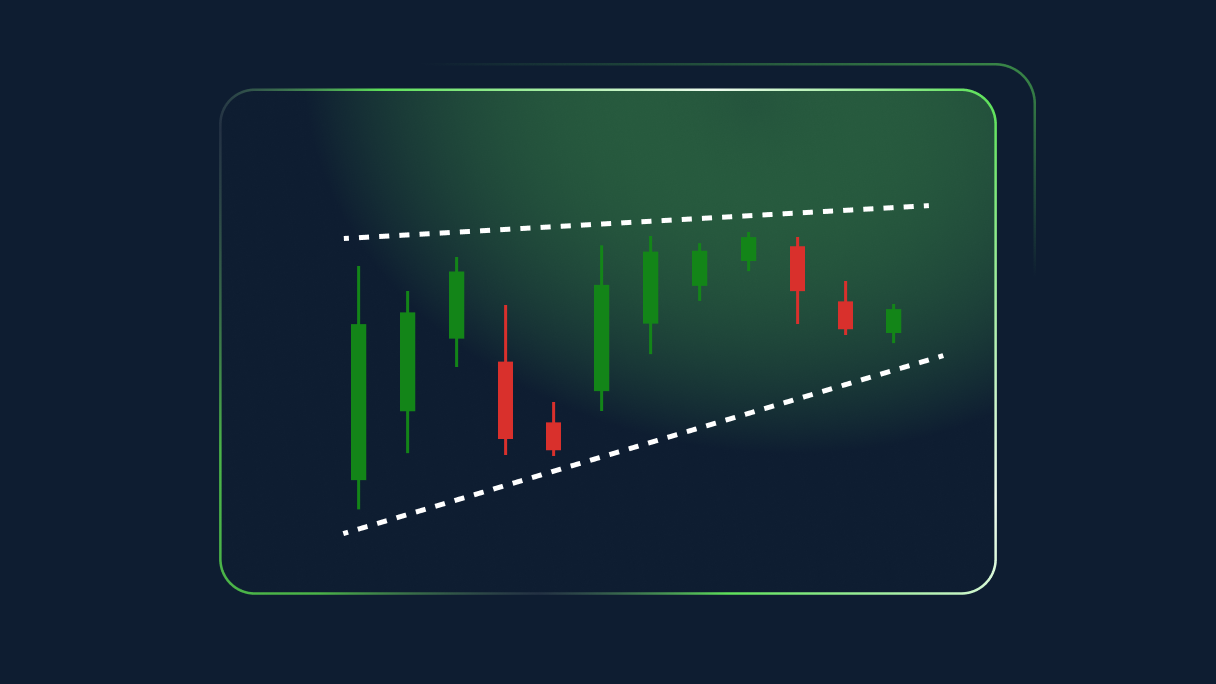

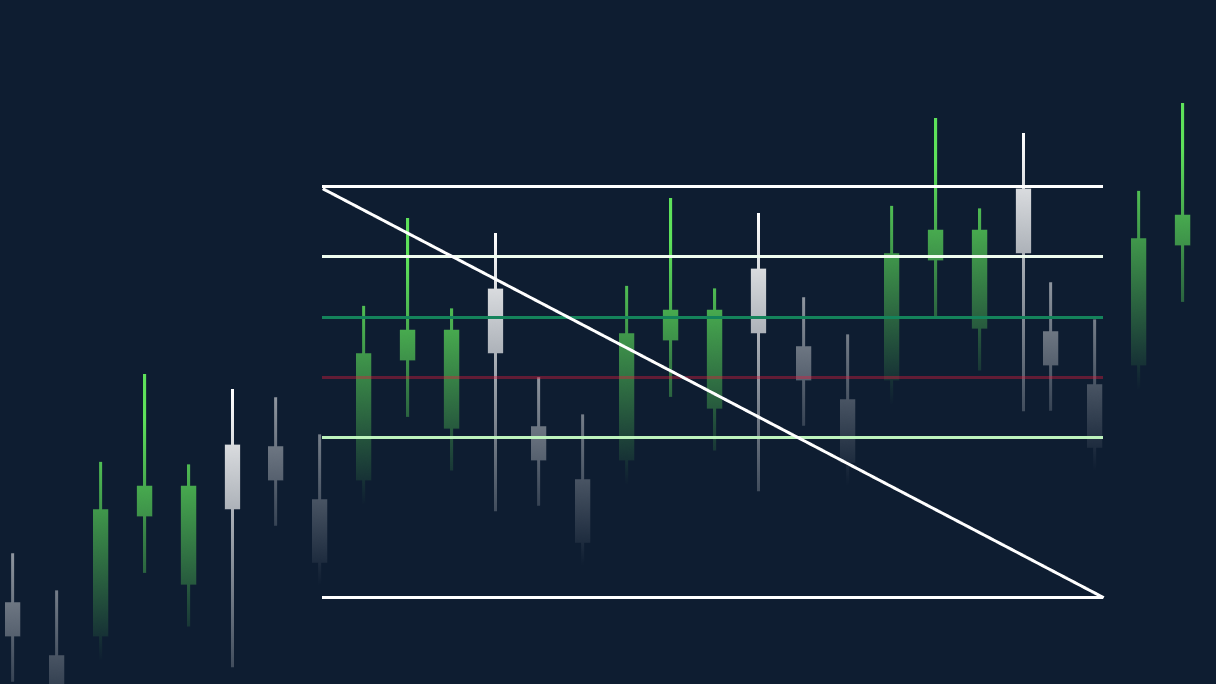

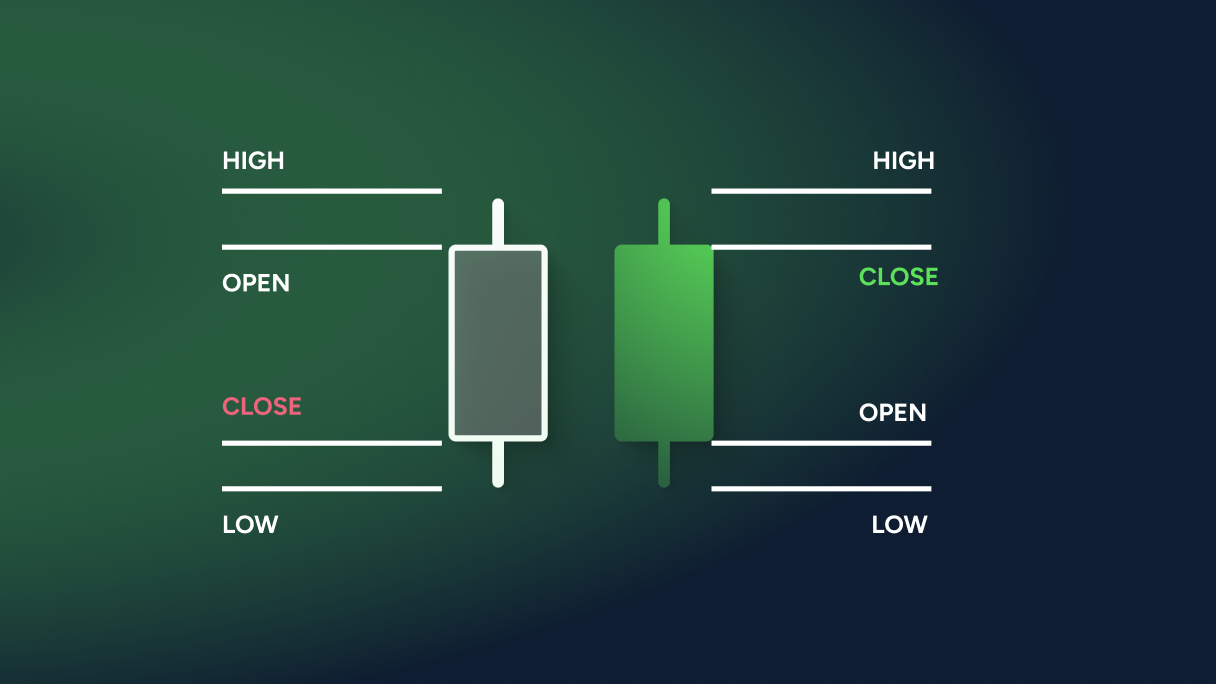

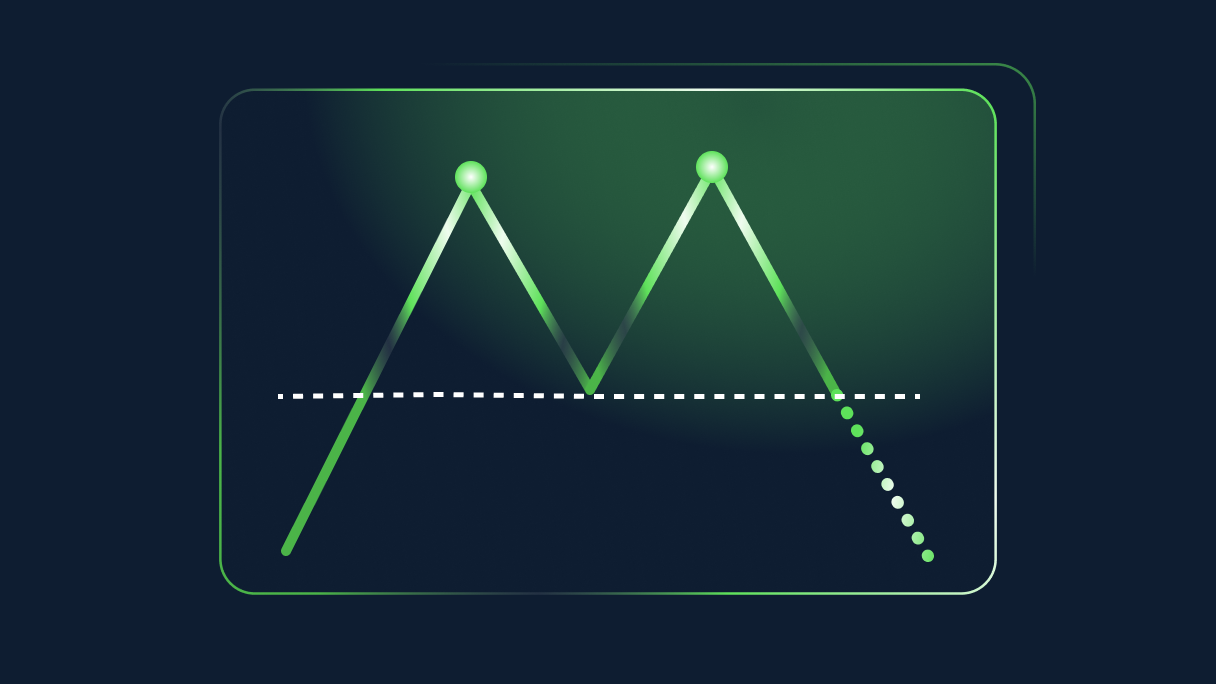

Indicators and patterns

Indicators and patterns

Discover how to identify potential trading opportunities by reading and analysing charts effectively.

Articles (45)

All

Beginners

Experienced

Indicators and patterns

Discover how to identify potential trading opportunities by reading and analysing charts effectively.

-indicator.png?ext=.png)