Bitcoin’s make-or-break moment: bear market or a bullish rebound?

Is the bear market finally here for Bitcoin, or is this an opportunity to turn bullish? Let us unpack the pros and cons in this article.

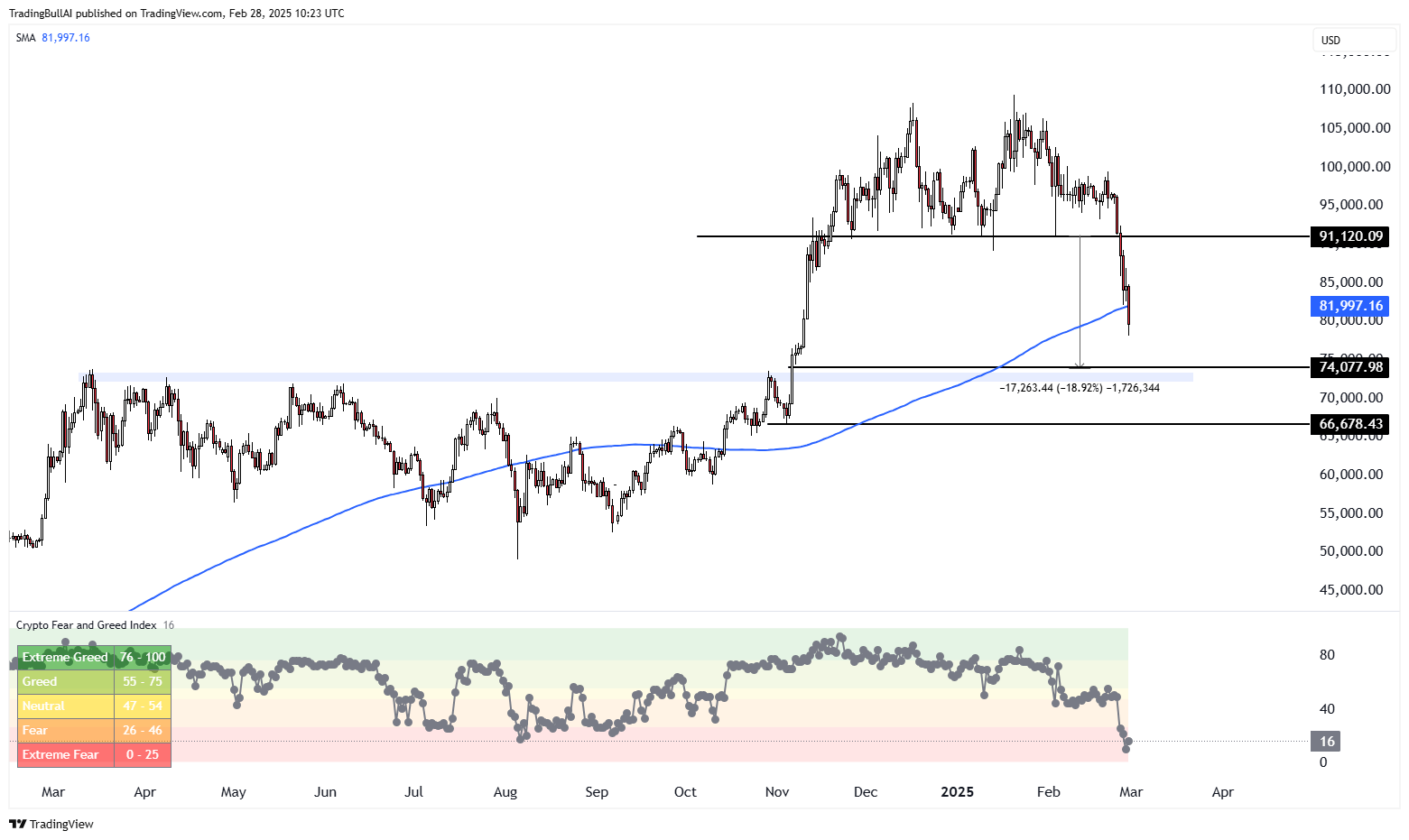

Traders have been scratching their heads recently, as the altcoin bear market has been in full swing for the last 2 months, with some meme coins losing up to 85% of their value. Yet BTCUSD remained trapped in a range for 95 days until this week when BTC slid below the 91,200 level and started to catch up with altcoins.

Short-term outlook

Ahead of the slide, I pointed out that Bitcoin was stuck in a rectangle-like range and that a break below $91K could push the price toward $73K. It dropped as low as $78K. Yet in patterns like this, the price does not always reach the entire target. Moreover anyone short on the break, can’t complain about the quick returns generated, both factors hinting that a low may be near.

There are more reasons why the probability of BTCUSD could soon start to find support.

- The price is below the psychological $80K level, which many a few months ago believed unlikely, and the same players now forecast that we can trade lower, a bullish sign.

- We are approaching the $74K support level, which capped BTC in March, May, and October 2024. This important resistance is now expected to act as support.

- Bitcoin is slightly below its 200-day moving average, which has often been a signal for bullish reversals or the start of a bear market, meaning that the risk-to-reward ratio favours the upside.

- Bitcoin is currently down around 28% from its all-time high, which is slightly less than the 33% decline we saw between March and August 2024, and these types of drawdowns are common in bull markets.

- The Fear and Greed index dropped to 10 yesterday, lower than the lows seen in the summer of 2024, just before BTC turned higher. But it is also as low as when the 2021 bear market started hence, we are at a make it or break it level, offering a very good risk to reward.

Daily chart

Long term factors to remain bullish

Long term factors to remain bullish

- Trump’s stance on crypto is also worth considering. He has his meme coin, showing support for the industry.

- The US government assembled a task force that has 180 days to propose regulatory improvements for crypto in the US. About 36 days have passed, meaning we have roughly 144 days left before they present their conclusions. We could see a major positive shake-up given Trump’s tendency to adopt bold policies.

- Bitcoin’s halving cycle: Historically, Bitcoin tends to be bullish from six months before the halving to about 18 months after. This suggests we still have several bullish months ahead until October 2025.

Fundamental factors to consider, and a risk to the bullish outlook

Last week, the US Flash PMI slowed sharply in February, and consumer sentiment declined as well. This triggered selloffs in both stock indices and crypto, with crypto taking an even bigger hit. This is likely linked to the firing of many federal employees but also Trump’s negotiation style, which has strained the US’s relationship with Canada, Mexico, and Europe, even though full-scale trade wars have not yet begun. While the weak economic data could be a one off, if we see persistent weakness in the economic data, this could turn into a recession, though unlikely in the short term.

Conclusion

Several fundamental and technical factors point to the upside, and the risk-to-reward ratio favours the upside positive between the 69K – 78K levels, with the 69K level being low on the US presidential election vote day. On the other hand, bad economic data has started to crop up, possibly sending markets lower if they persist.

What is your take on the BTC and altcoins in general? Trade your view with ThinkMarkets.