Another day, another blow for EUR/USD — is the 2023 low next?

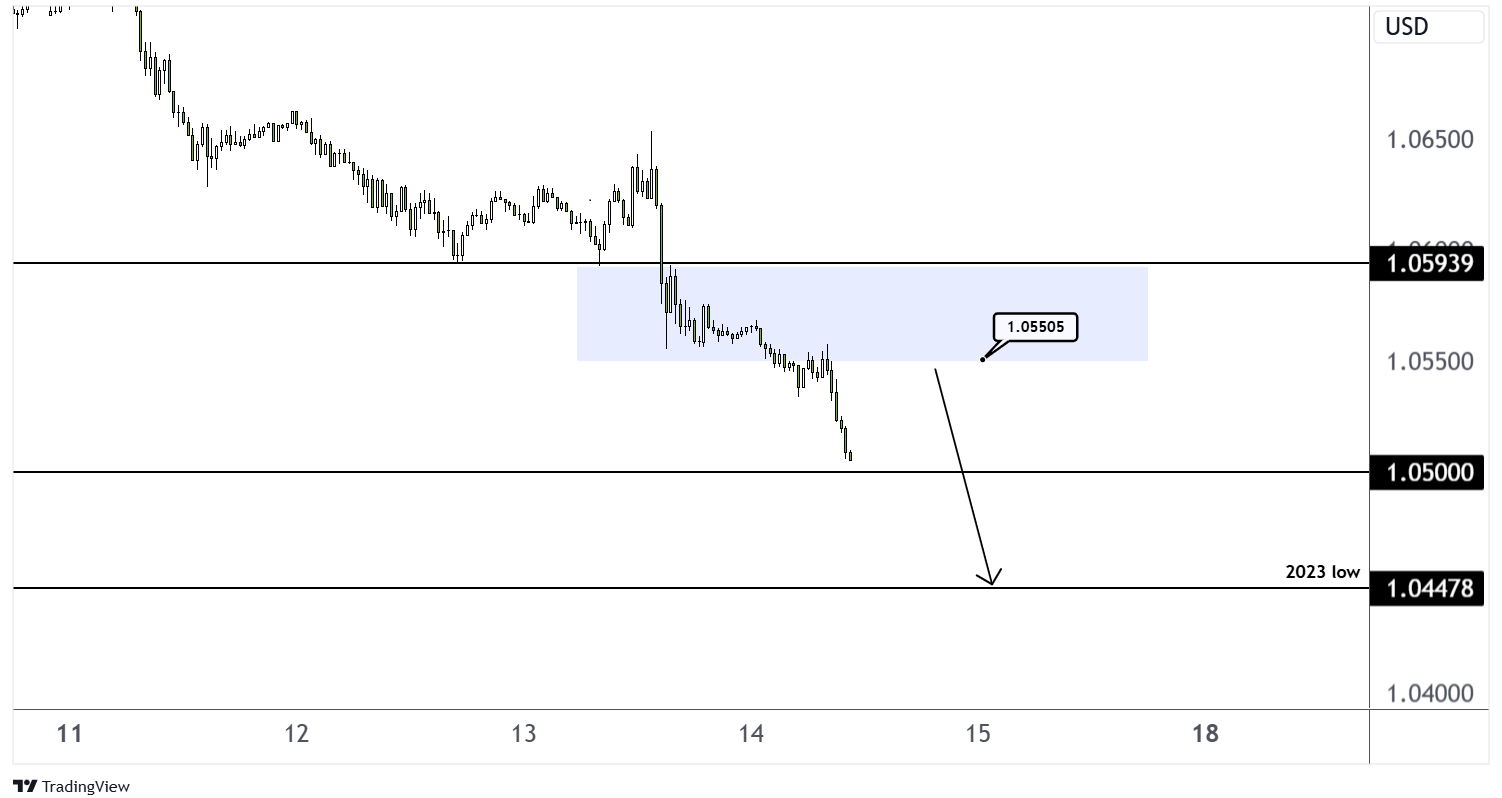

EUR/USD has reached a 2024 low of 1.0508, with traders eyeing the 2023 low of 1.0447 as the next significant level. The previous 2024 low of 1.0602, set in April, was breached two days ago, with the downward movement accelerating yesterday. This acceleration followed the release of U.S. inflation data showing annual headline inflation rising to 2.6% from 2.4%, and core inflation increasing to 3.3%, the same pace as last month. These higher inflation rates reduce the likelihood of aggressive Federal Reserve rate cuts in the new year. For the upcoming December 18 meeting, there is a 20.9% probability of rates remaining unchanged in the 4.50–4.75% range and a 79.1% chance of a 25 basis point cut to the 4.25–4.50% range.

The markets are adjusting to Trump's recent win, with significant moves across FX, gold, and cryptocurrencies. As highlighted on ThinkMarkets' election page and in recent webinars, Trump's GDP-boosting policies are likely to exacerbate inflation in the U.S. The reasoning is straightforward: with the unemployment rate already at 4.1%, cutting taxes and deregulating to create jobs may face challenges due to a lack of available workers in the short term. Mass deportations will further exacerbate the situation. Considering that some banks have even projected EUR/USD could reach 0.95 by next year, this scenario is becoming increasingly plausible.

From a trading perspective, while EUR/USD may be short-term oversold, this does not preclude further declines. Traders are currently watching the 1.0593 level, with the short-term bearish trend holding below this point. A correction toward 1.0550 is likely to encounter sellers targeting 1.0500, followed by the 2023 low at 1.0447.

The next important date to watch is US retail sales, due tomorrow at 13:30 London time.

30-minute chart